The Mississippi Certificate of Borrower regarding Commercial Loan is a legal document that pertains to the borrowing entity seeking a commercial loan in the state of Mississippi. This certificate is typically required by lenders as part of the loan application process to ensure transparency and protect their interests during the loan term. It serves as a declaration by the borrower, providing vital information about their entity, financial status, and collateral. When dealing with the Mississippi Certificate of Borrower regarding Commercial Loan, there are two main types that can be distinguished: 1. Mississippi Individual Borrower Certificate: This type of certificate is applicable when the borrower is an individual seeking a commercial loan in Mississippi. It requires the individual borrower to disclose their personal information, such as full name, address, Social Security number, and other relevant identification details. Additionally, the individual will often need to provide information on their employment, income, and personal assets, which may serve as collateral for the loan. 2. Mississippi Entity Borrower Certificate: In the case where the borrower is an entity, such as a corporation, partnership, or limited liability company (LLC), the Mississippi Entity Borrower Certificate is relevant. This certificate requires the borrower entity to provide comprehensive details about their legal structure, including the entity's name, registered address, and identification numbers (such as EIN or tax ID). Moreover, the entity borrower must provide financial statements, such as balance sheets and profit/loss statements, to showcase their financial stability and repayment capability. Additional information may also be required, depending on the specific requirements of the lender or loan program. Both types of Mississippi Certificate of Borrower regarding Commercial Loan aim to ensure that lenders have accurate and up-to-date information about the borrower before approving the loan. It establishes a legally binding agreement between the borrower and lender, enabling the lender to verify the borrower's identity, assess their creditworthiness, and evaluate the collateral offered, thereby minimizing potential risks associated with the loan. In summary, the Mississippi Certificate of Borrower regarding Commercial Loan is an essential component of the loan application process. It varies slightly depending on whether the borrower is an individual or entity seeking a commercial loan. By providing accurate information, borrowers can demonstrate their creditworthiness and increase their chances of obtaining a commercial loan in Mississippi.

Mississippi Certificate of Borrower regarding Commercial Loan

Description

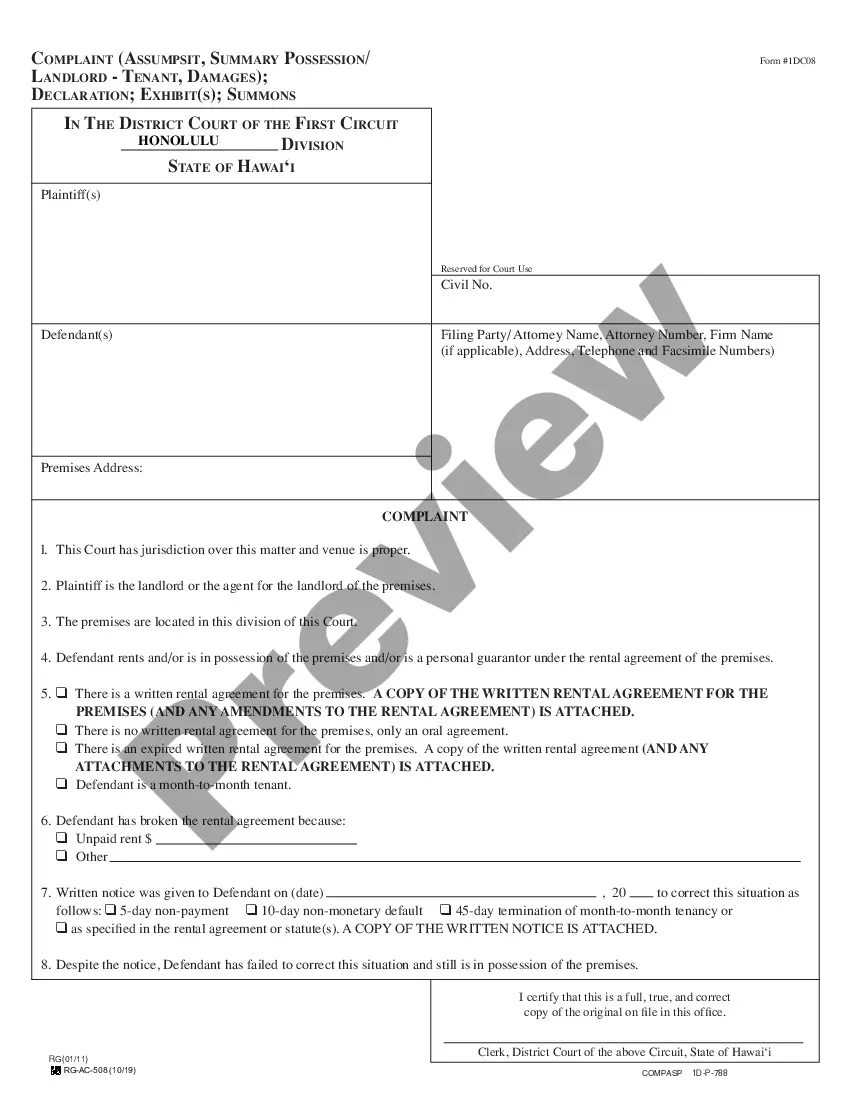

How to fill out Mississippi Certificate Of Borrower Regarding Commercial Loan?

Choosing the right lawful record design can be a struggle. Obviously, there are tons of web templates available on the Internet, but how can you obtain the lawful kind you will need? Make use of the US Legal Forms website. The services gives a large number of web templates, for example the Mississippi Certificate of Borrower regarding Commercial Loan, which can be used for company and private requires. Every one of the kinds are checked out by specialists and satisfy state and federal needs.

If you are already listed, log in to your account and click on the Obtain option to obtain the Mississippi Certificate of Borrower regarding Commercial Loan. Make use of account to search with the lawful kinds you might have purchased formerly. Check out the My Forms tab of your account and have another copy from the record you will need.

If you are a brand new customer of US Legal Forms, listed here are basic recommendations for you to follow:

- Initial, be sure you have chosen the correct kind for the city/county. You are able to check out the form making use of the Review option and look at the form description to guarantee this is the right one for you.

- When the kind fails to satisfy your requirements, use the Seach industry to find the correct kind.

- When you are certain the form is proper, go through the Buy now option to obtain the kind.

- Opt for the pricing strategy you want and type in the required details. Create your account and purchase an order with your PayPal account or credit card.

- Select the data file formatting and acquire the lawful record design to your gadget.

- Comprehensive, revise and print and indicator the acquired Mississippi Certificate of Borrower regarding Commercial Loan.

US Legal Forms will be the biggest catalogue of lawful kinds for which you will find numerous record web templates. Make use of the service to acquire skillfully-produced papers that follow status needs.

Form popularity

FAQ

A third party authorization form says to your mortgage company that you allow a third party to receive information about you and your mortgage. It may allow the third party to take actions for you. There is no single form used by every mortgage company.

The first is that you certify that all information you have given ? on the application, and in subsequent paperwork ? is true and complete. Secondly, you are authoring the release of credit, employment, and other information as needed to process and close your home loan.

§ 81-18-35 - Journal of mortgage transactions for Mississippi residential loans that licensee originates and/or funds; journal of serviced loans for Mississippi residential loans that licensee owns and/or services [Repealed effective July 1, 2016]

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.

Mississippi does not require mortgage lenders to purchase any form of liability insurance as a prerequisite to obtaining a business license. Mortgage lenders must purchase and maintain a $150,000 surety bond.

The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

The Truth in Lending Act (TILA) was signed into law in 1968 as a means to protect consumers from unfair and predatory lending practices. It requires lenders and creditors to supply borrowers with clear and visible key information about the credit extended.

The borrower authorization form is a standard form that is signed by a loan applicant authorizing the lender to verify his/her information from a third party.