Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legally binding agreement between an employer and employee in the state of Mississippi. This agreement establishes the terms and conditions for providing a nonqualified retirement plan funded with life insurance to the employee. Keywords: Mississippi, employment agreement, nonqualified retirement plan, life insurance Nonqualified retirement plans are often offered by employers to provide additional benefits to employees beyond their regular retirement plan. These plans are not subject to the same rules and regulations as qualified retirement plans, such as 401(k) plans, but they still provide attractive benefits to employees. One type of Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is the Defined Benefit Plan. This plan promises a specific benefit amount upon retirement, usually based on the employee's years of service and salary history. The employer funds this plan by purchasing life insurance policies on the employee, with the death benefit being used to fund the promised retirement benefits. Another type is the Executive Bonus Plan, where the employer provides cash bonuses to selected employees. These bonuses are used by the employees to purchase life insurance policies, with the death benefit being used to fund retirement benefits. This agreement ensures that the employer and employee are on the same page regarding the terms, contribution amounts, and expected benefits of the plan. A Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance should include key provisions such as the effective date of the agreement, the term of the agreement, the eligibility criteria for participation in the plan, the employer's contribution schedule, investment options for the life insurance policy, and any vesting requirements. Additionally, the agreement should specify how the plan will be administered, including the named beneficiaries and the process for updating beneficiary designations. It should also outline any potential withdrawal or loan options available to the employee. Overall, a Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a detailed contract that ensures both the employer and employee are aware of their rights and obligations regarding the nonqualified retirement plan. The agreement provides a clear framework for the administration of the plan and helps protect both parties' interests. In conclusion, Mississippi Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance offer attractive retirement benefits to employees. With different types such as Defined Benefit Plans and Executive Bonus Plans, employers have the flexibility to design plans that best suit the needs of their workforce. These agreements establish the rules and expectations for administering the plan and provide a framework for employer-employee collaboration in securing the employee's financial future.

Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

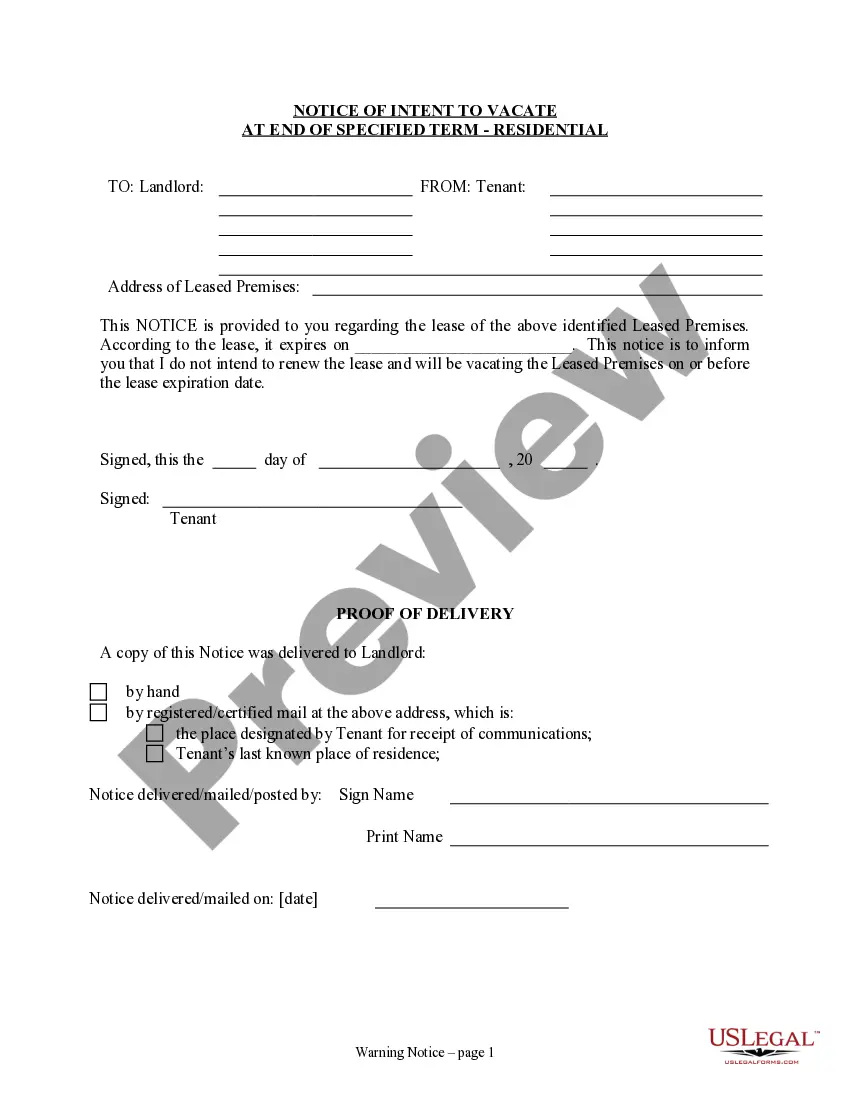

How to fill out Mississippi Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

US Legal Forms - one of many largest libraries of lawful kinds in America - gives a variety of lawful record templates it is possible to obtain or produce. Utilizing the internet site, you will get a large number of kinds for business and person purposes, categorized by categories, states, or key phrases.You can find the most up-to-date variations of kinds much like the Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance within minutes.

If you already have a subscription, log in and obtain Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance in the US Legal Forms catalogue. The Down load option will show up on each and every type you perspective. You have access to all earlier delivered electronically kinds from the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, listed here are basic guidelines to get you started off:

- Ensure you have chosen the correct type for your personal metropolis/state. Select the Preview option to review the form`s information. Look at the type information to ensure that you have chosen the correct type.

- If the type doesn`t satisfy your specifications, use the Lookup industry at the top of the screen to obtain the one which does.

- Should you be satisfied with the form, confirm your option by simply clicking the Purchase now option. Then, pick the rates plan you favor and give your qualifications to register to have an profile.

- Process the purchase. Use your credit card or PayPal profile to accomplish the purchase.

- Choose the format and obtain the form on your own device.

- Make alterations. Load, edit and produce and indicator the delivered electronically Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Each template you put into your account does not have an expiry time and is also the one you have forever. So, if you would like obtain or produce one more copy, just check out the My Forms area and click around the type you want.

Get access to the Mississippi Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance with US Legal Forms, probably the most comprehensive catalogue of lawful record templates. Use a large number of professional and condition-specific templates that meet your company or person demands and specifications.

Form popularity

FAQ

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

A nonqualified deferred compensation arrangement subject to Section 409A is defined as any plan, including any agreement or arrangement, that provides for the deferral of compensation other than a qualified employer plan and any bona fide vacation leave, sick leave, compensatory time, disability pay, or death benefit

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

Nonqualified plans are retirement savings plans. They are called nonqualified because unlike qualified plans they do not adhere to Employee Retirement Income Security Act (ERISA) guidelines. Nonqualified plans are generally used to provide high-paid executives with an additional retirement savings option.

200bMississippi Deferred Compensation (MDC) MDC is a voluntary supplemental tax-deferred retirement savings plan offered through PERS to all state employees, elected officials, employees of participating political subdivisions, and independent contractors of the state or participating political subdivisions.

"Deferring this income provides one tax advantage: You don't pay federal or state income tax on that portion of your compensation in the year you defer it (you pay only Social Security and Medicare taxes), so it has the potential to grow tax-deferred until you receive it."

A 409A is used to determine the fair market value (FMV) of your company's common stock and is typically determined by a third-party valuation provider. 409As set the strike price for options issued to employees, contractors, advisors, and anyone else who gets common stock.

A nonqualified deferred compensation arrangement subject to Section 409A is defined as any plan, including any agreement or arrangement, that provides for the deferral of compensation other than a qualified employer plan and any bona fide vacation leave, sick leave, compensatory time, disability pay, or death benefit

NQDC plans (sometimes known as deferred compensation programs, or DCPs, or elective deferral programs, or EDPs) allow executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid.

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.