Mississippi Notice of Unpaid Invoice

Description

How to fill out Notice Of Unpaid Invoice?

If you want to finalize, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of authentic forms available online.

Utilize the website's straightforward and convenient search to locate the documents you require.

Numerous templates for business and personal uses are categorized by sections and claims, or keywords and phrases.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to create an account.

- Utilize US Legal Forms to retrieve the Mississippi Notice of Unpaid Invoice in just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and press the Obtain button to find the Mississippi Notice of Unpaid Invoice.

- You can also find forms you have previously uploaded under the My documents tab in your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure that you have selected the form for your correct region/country.

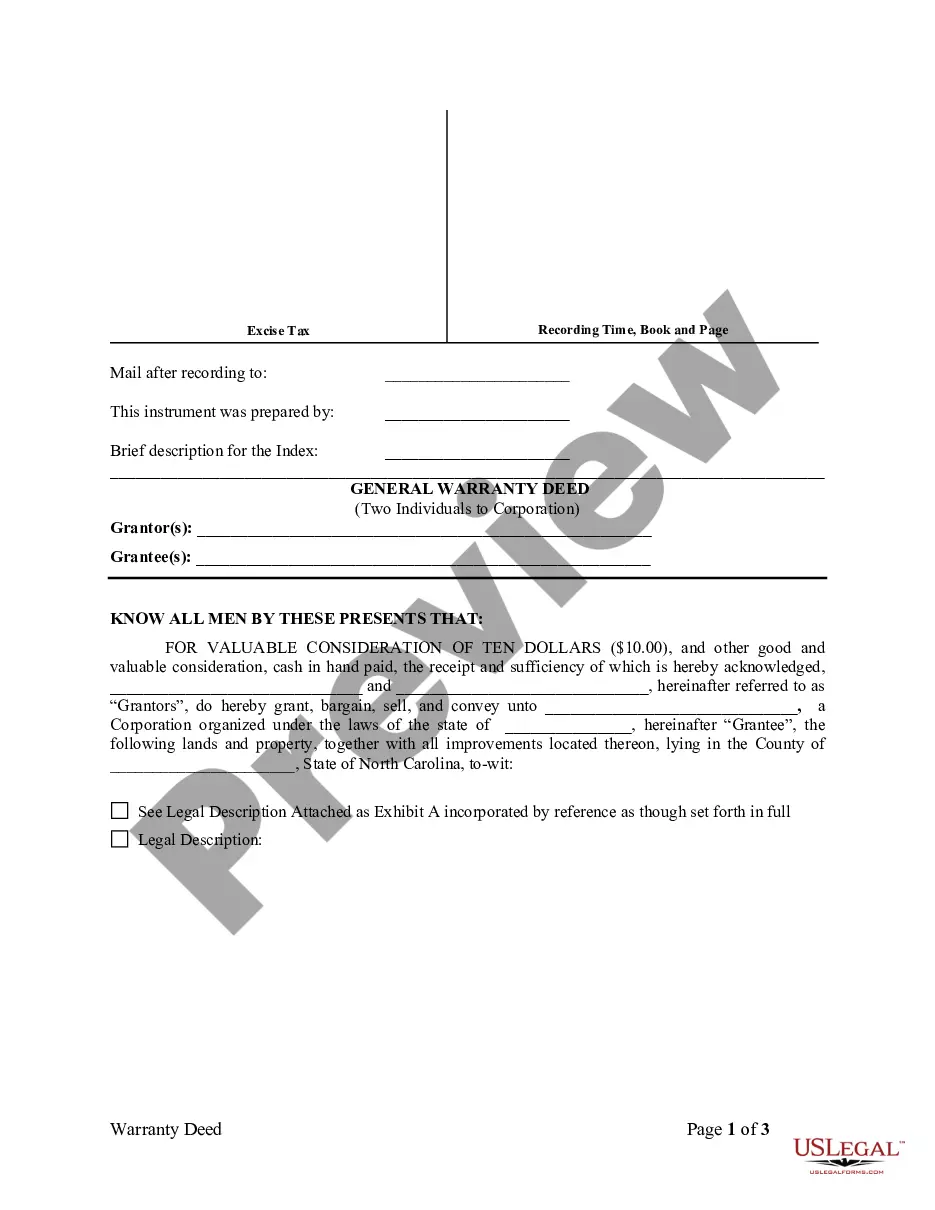

- Step 2. Use the Preview feature to review the form's information. Don't forget to read the description.

Form popularity

FAQ

Here are some steps you should follow:Send a written reminder promptly when you don't receive payment by the due date. Resend the invoice with a message that you haven't received payment.Send a debt collection letter.Make personal contact with the client by phone or a face-to-face meeting.Send a final demand letter.

How to collect overdue paymentsDiscuss all costs and payment terms before you begin a project.Bill for work upfront.Send invoices right away.Be persistent with late customers.Charge late fees.Set up a payment plan.Hire an attorney.Take clients to small claims court.

7 Steps for Collecting Unpaid InvoicesStep 1 Identify Overdue Invoices.Step 2 Send a Friendly Reminder Email.Step 3 Reach Out via Text or Social Media.Step 4 Send a Final Reminder Email.Step 5 Place a Final Reminder Phone Call.Step 6 Force the Issue.Step 7 Drop the Hammer.

How to Sue for Non-Payment of ServicesSend a Final Demand for Payment. Before taking any formal legal action, it's a good idea to send a final demand for payment to the client.Assess How Much You're Owed.Get Legal Advice.Consider Small Claims Court.Consider A Civil Lawsuit.

You can start by having sent a legal notice, wherein, you call upon the party to pay in 15 days or 7 days'. In case if he does not pay you may Institute a summary suit which is a legal faster proceeding.

What Makes A Document Legally Binding?Both Parties Must Agree: A client and supplier must agree on the offer put forth by one party and approved by the other party.A Transaction Must Occur: Suppliers should offer goods or services in exchange for payment made.

Legal action for non payment is common in contract disputes.Legal Action for Non Payment.Determine Your Damages.Analyze the Other Party's Finances.Make a Formal Demand.Filing a Lawsuit.Obtaining Judgment.

You can start by having sent a legal notice, wherein, you call upon the party to pay in 15 days or 7 days'. In case if he does not pay you may Institute a summary suit which is a legal faster proceeding.

Here are some steps you should follow:Send a written reminder promptly when you don't receive payment by the due date. Resend the invoice with a message that you haven't received payment.Send a debt collection letter.Make personal contact with the client by phone or a face-to-face meeting.Send a final demand letter.

If you decide to take legal action for non-payment of invoices, you initiate the process with a formal demand letter to the defendant, whether it be an individual or a business, or both. If the defendant is a business, but an individual signed a personal guaranty, you can make the demand on both.