Mississippi Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

It is feasible to dedicate numerous hours online attempting to locate the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms provides an extensive selection of legal documents that have been reviewed by experts.

You can easily download or print the Mississippi Liquidation of Partnership with Sale and Proportional Distribution of Assets from my service.

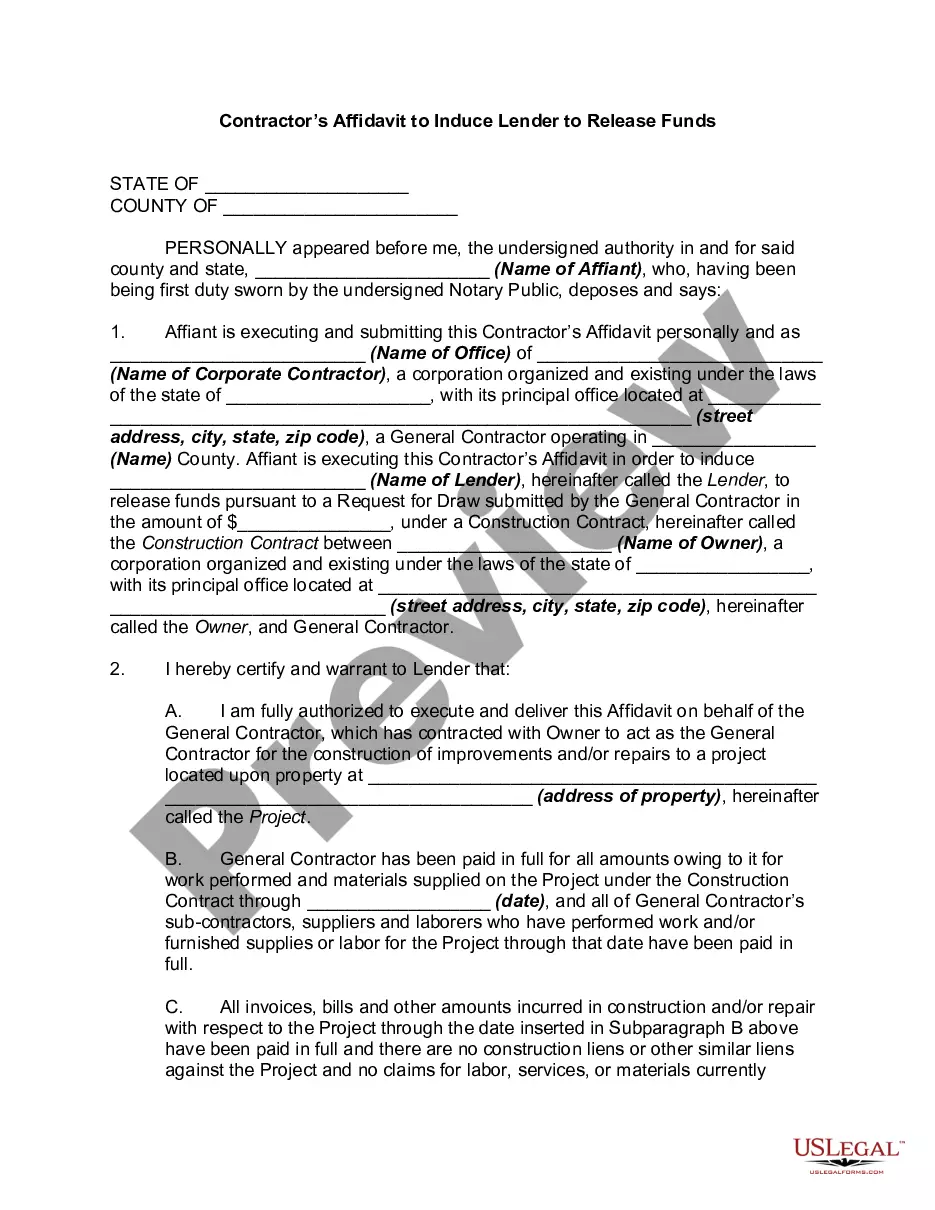

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Mississippi Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for your chosen county/town.

- Review the document outline to confirm you have selected the accurate form.

Form popularity

FAQ

A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner's interest in partnership capital or income. Distributions do not include loans to partners or amounts paid to partners for services or the use of property, such as rent, or guaranteed payments.

What Role Does Basis Play In A Partnership Liquidation? basis equal to the amount of money on hand plus the level at which any business-related assets will be contributed, ie, what they will cost.

Maintaining basis is important because it determines how much you may withdraw or deduct from the partnership without recognizing additional gain or without being limited on the allowable pass-through of partnership losses. It's the owners responsibility, not that of the partnership, to keep track of basis.

Partnership withdrawalsPartners withdrawing from the partnership are not taxed to the extent the withdrawal is a return of the partner's investment. In other words, any return or withdrawal paid to the partner up to and including the partner's capital investment will be non-taxable for the partner.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Both the distributee partner and the partnership can recognize taxable gain or loss in these distributions. The partnership will recognize gain or loss if its property involved in the deemed exchange of Section 751 property has unrealized appreciation or depreciation.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Allocation of Income and Loss Credit each expense account and debit the income section account for total expenses. If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.