Mississippi Substituted Agreement

Description

How to fill out Substituted Agreement?

If you require thorough, obtain, or produce legal document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Make use of the site’s straightforward and efficient search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you’ve found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Mississippi Substituted Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Mississippi Substituted Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

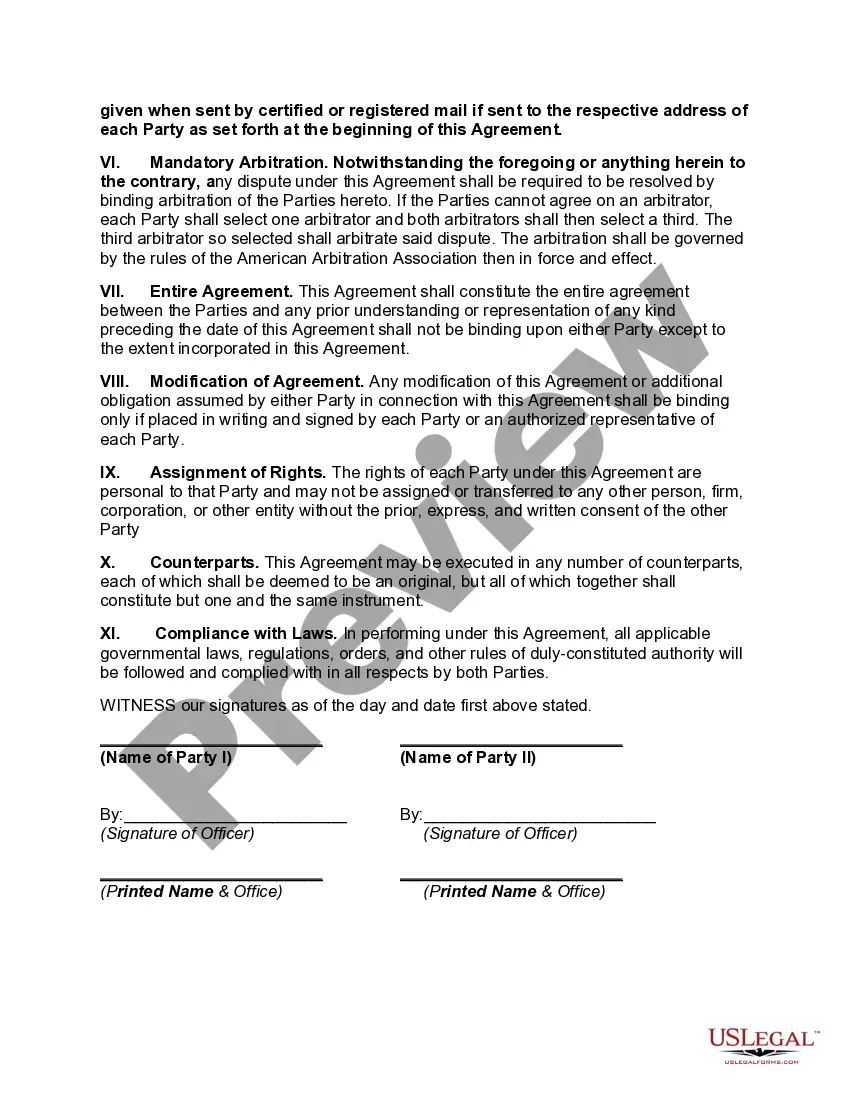

- Step 2. Use the Preview feature to review the form’s content. Remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Rule 81 in Mississippi refers to the rules governing various aspects of civil procedure, especially relating to the service of process. This typically includes guidelines for how legal notices must be delivered in certain legal proceedings. Understanding Rule 81 is important for business owners who want to ensure compliance when utilizing legal documents, including the Mississippi Substituted Agreement.

To exit a teaching contract in Mississippi, first, review the terms and conditions outlined in your agreement. Generally, you may need to provide written notice to your school district and state your reasons clearly. Understanding the implications of your Mississippi Substituted Agreement is crucial, as it may outline specific obligations before you can terminate the contract. Consulting a legal expert can provide you with tailored advice for your situation.

Rule 8.06 addresses the necessary contents of a pleading in Mississippi. This rule ensures that all parties have a clear understanding of the claims being made. For anyone preparing a Mississippi Substituted Agreement, it's crucial to ensure that all relevant information is included in line with this rule to avoid legal complications.

Hence, under the original wording of Rule 81(c), where a case is filed less than 20 days before the term and is removed within a few days but before answer, it is possible for the defendant to delay interposing his answer or presenting his defenses by motion for six months or more.

(A) A summons and complaint may be served upon a defendant of any class referred to in paragraph (1) or (4) of subdivision (d) of this rule by mailing a copy of the summons and of the complaint (by first-class mail, postage prepaid) to the person to be served, together with two copies of a notice and acknowledgment

Make sure service by mail is allowed before you use this method to serve your papers. For service by mail: The server mails the papers to the party being served. If the party being served is a person, the papers can be mailed to his or her home or mailing address.

2. In circuit court a memorandum of authorities in support of any motion to dismiss or for summary judgment shall be mailed to the judge presiding over the action at the time that the motion is filed. Respondent shall reply within ten (10) days after service of movant's memorandum.

Rule 81 requires use of a special summons which commands that the defendant appear and defend at a specific time and place set by order of the court and informs him or her that no answer is necessary.

They can be served by: Personal delivery: by handing a copy of the summons to you, or by leaving it at your last known address or your place of work, or with your spouse, child or another relative.

Requirements to Become a Process Server in Mississippi A summons and complaint shall be served by any person who is not a party and is not less than 18 years of age.