Title: Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business — A Comprehensive Overview Introduction: In Mississippi, an LLC (Limited Liability Company) may choose to acquire assets of a business by passing a resolution during a meeting of LLC members. This resolution serves as a legally binding document that outlines the decision-making process and details regarding the asset acquisition. In this article, we will delve into the intricacies of the Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business, providing an informative guide for interested parties. Key Topics: 1. Purpose of the Resolution: The Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business is designed to establish a formal mechanism by which LLC members can approve the acquisition of assets of a business. It ensures that the acquisition adheres to the legal framework governing LCS in the state of Mississippi. 2. Types of Mississippi Resolutions of Meeting of LLC Members to Acquire Assets of a Business: a. General Resolution: This type of resolution encompasses the acquisition of any assets related to the business in question. It provides a broad scope for asset acquisition decisions and is commonly used for routine acquisitions. b. Specific Resolution: This resolution focuses on a particular asset or a specific group of assets that the LLC intends to acquire. It narrows down the scope of the acquisition, providing detailed information about the assets in question. 3. Legal Considerations: a. Quorum: The resolution can be deemed valid only if a sufficient number of LLC members are present during the meeting. Quorum requirements must be met according to the LLC's operating agreement or state laws. b. Voting: The resolution typically requires a majority or super majority vote of the LLC members for approval, depending on the respective operating agreement and the nature of the asset acquisition. 4. Contents of the Resolution: a. Title: A descriptive title indicating the purpose of the resolution, e.g., "Resolution to Acquire Assets of a Business." b. Recitals: An introduction section mentioning the background and context surrounding the proposed asset acquisition. c. Approval: The LLC members' acknowledgment and approval of the acquisition, including the specific assets involved, their value, and any pertinent financial details. d. Signatures: Signature lines for LLC members to express their consent, followed by the date and the LLC's official seal if applicable. 5. Record-Keeping and Filing: Once the resolution is passed, it is crucial to maintain a record of the resolution in the LLC's books and records. While there may not be a legal requirement for filing the resolution with state authorities, it is advisable to consult an attorney for accurate guidance and compliance with relevant regulations. Conclusion: The Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business offers a structured decision-making process for LLC members when acquiring assets. By understanding its different types, legal considerations, and key content elements, LCS can ensure that the asset acquisition is conducted in a transparent, compliant, and legally sound manner. Consulting an attorney experienced in Mississippi LLC regulations is beneficial during the creation and execution of such a resolution.

Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business

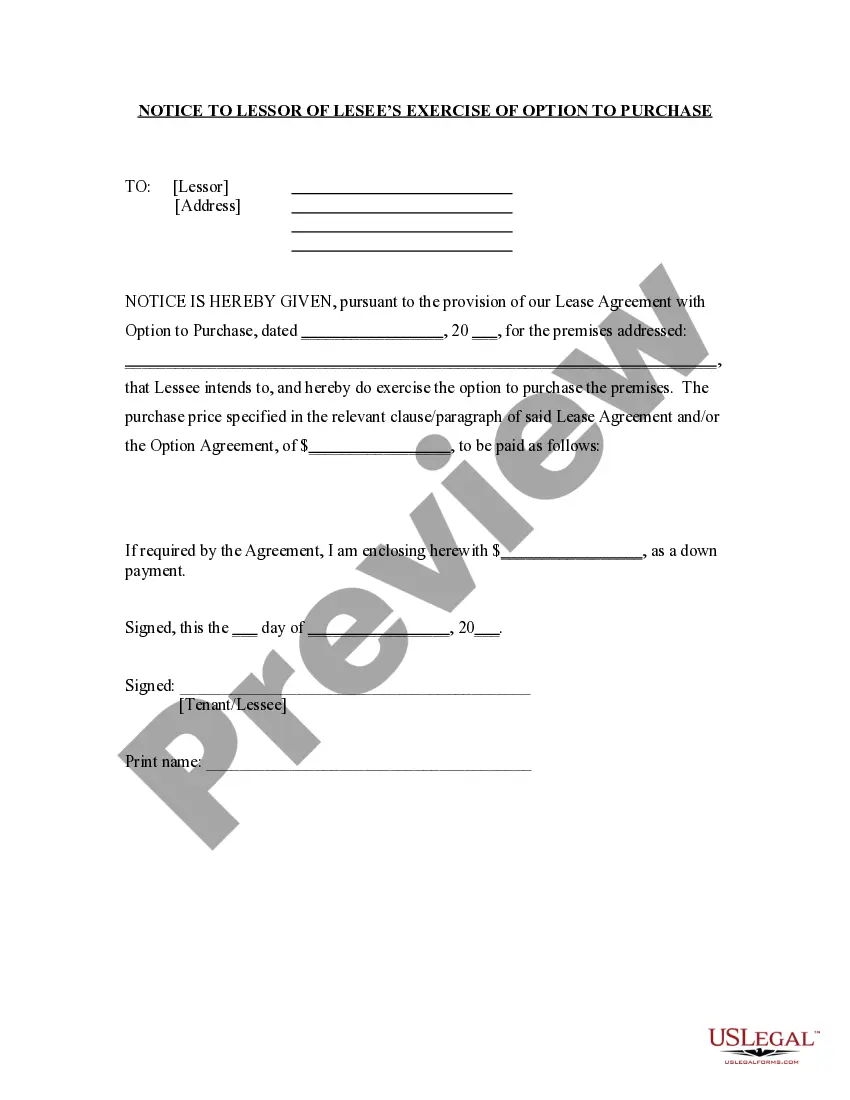

Description

How to fill out Mississippi Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

If you wish to total, acquire, or print out authorized record layouts, use US Legal Forms, the greatest variety of authorized types, that can be found on the Internet. Use the site`s simple and easy hassle-free lookup to find the documents you will need. Numerous layouts for company and person purposes are sorted by groups and says, or search phrases. Use US Legal Forms to find the Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business with a few click throughs.

In case you are already a US Legal Forms customer, log in for your profile and then click the Acquire button to have the Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business. You can also accessibility types you previously downloaded within the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form to the correct city/nation.

- Step 2. Take advantage of the Review choice to look over the form`s content material. Never forget about to read through the outline.

- Step 3. In case you are unsatisfied with all the form, use the Research area on top of the screen to discover other versions in the authorized form format.

- Step 4. Upon having found the form you will need, click on the Get now button. Choose the costs prepare you favor and add your qualifications to sign up for an profile.

- Step 5. Method the deal. You should use your bank card or PayPal profile to accomplish the deal.

- Step 6. Select the formatting in the authorized form and acquire it on your own gadget.

- Step 7. Comprehensive, revise and print out or indicator the Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business.

Each and every authorized record format you acquire is the one you have for a long time. You might have acces to each and every form you downloaded inside your acccount. Select the My Forms section and pick a form to print out or acquire again.

Be competitive and acquire, and print out the Mississippi Resolution of Meeting of LLC Members to Acquire Assets of a Business with US Legal Forms. There are millions of specialist and status-particular types you can utilize for the company or person needs.

Form popularity

FAQ

Asset Protection.A single-member LLC may act as a shield to protect your personal assets from the liabilities associated with the business conducted by the LLC.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

When you set up an LLC, the LLC is a distinct legal entity. Generally, creditors can go after only the assets of the LLC, not the assets of its individual owners or members. That means that if your LLC fails, you are risking only the money you invested in it, not your home, vehicle, personal accounts, etc.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Law ? 203(d), 202. Since an LLC is a legal person, the property it owns is the property of the LLC, not of the members.

The LLC owns the business and all its assets. The LLC membersthe owners of the LLCrun the LLC. The LLC members ordinarily are not personally liable for LLC debts and lawsuits. For more details, see "Sole Proprietorships vs.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.