Mississippi Exempt Survey

Description

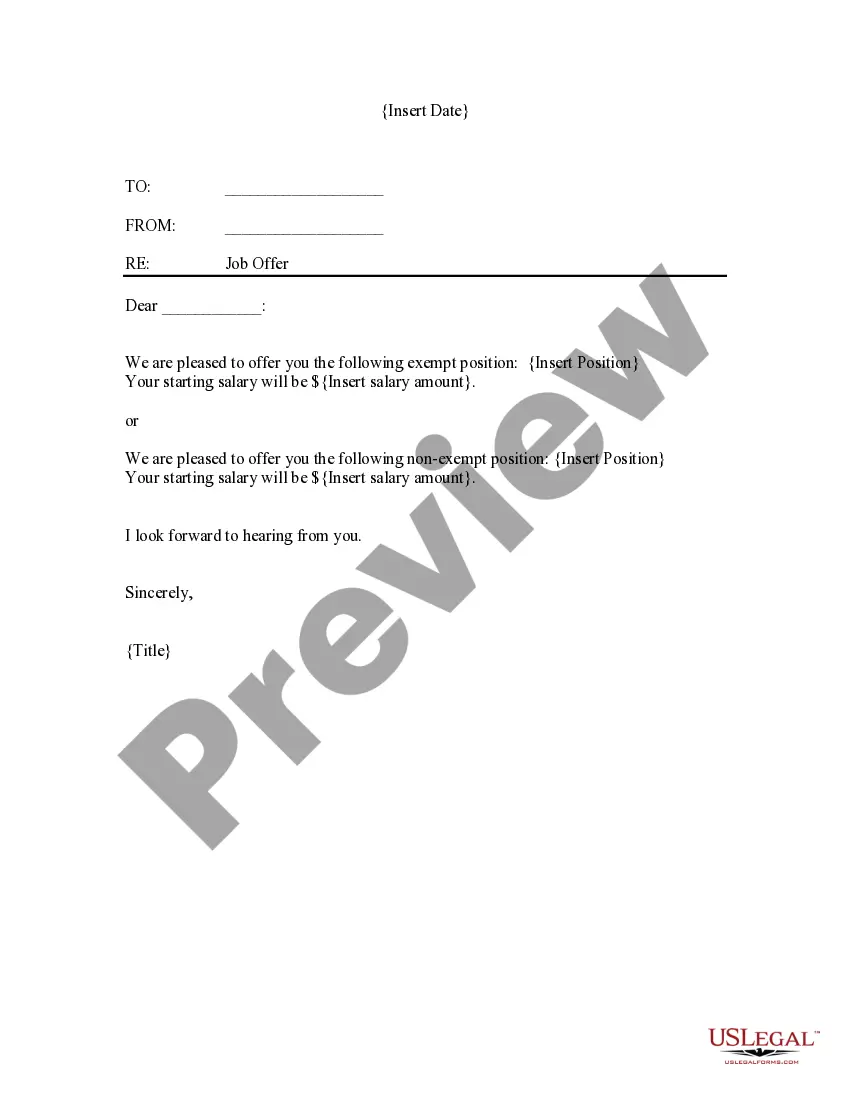

How to fill out Exempt Survey?

Selecting the ideal legal document template can be challenging.

Indeed, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Mississippi Exempt Survey, which you can use for business and personal purposes.

If the form does not meet your expectations, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Purchase now button to acquire the document. Select the pricing option you want and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Mississippi Exempt Survey. US Legal Forms is the largest repository of legal documents where you can find various file templates. Use the service to download professionally crafted documents that meet state requirements.

- All templates are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Mississippi Exempt Survey.

- Use your account to browse through the legal documents you have purchased before.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to make sure it meets your requirements.

Form popularity

FAQ

(5) Any nonresident who fishes without the required license is guilty of a misdemeanor and, upon conviction, shall be fined in an amount not less than One Hundred Dollars ($100.00) nor more than Two Hundred Fifty Dollars ($250.00) for the first offense.

Human subjects research that is classified as exempt means that the research qualifies as no risk or minimal risk to subjects and is exempt from most of the requirements of the Federal Policy for the Protection of Human Subjects, but is still considered research requiring an IRB review for an exemption determination.

Resident - Each resident of the State of Mississippi ages sixteen (16) through sixty-four (64), fishing in the fresh or marine waters of Mississippi, including lakes and reservoirs but NOT to include privately owned ponds and streams, shall be required to buy a fishing license.

Mississippi Fishing LicensesAny person sixty-five (65) or older, or any person otherwise exempted from obtaining a freshwater fishing license, must have documentation with him/her at all times while fishing. Residents 65 years of age or older are required to purchase a lifetime recreational saltwater fishing license.

Mississippi Department of Marine Resources requires Mississippi residents, 65+, to purchase a lifetime recreational Saltwater Fishing License for a one time fee of $7.29.

Resident - Each resident of the State of Mississippi ages sixteen (16) through sixty-four (64), fishing in the fresh or marine waters of Mississippi, including lakes and reservoirs but NOT to include privately owned ponds and streams, shall be required to buy a fishing license.

According to the Federal regulations (45 CFR 46.101(b)), survey research may be exempt from the regulations unless "the information obtained is recorded in such a manner that the human subjects can be identified, directly or through identifiers linked to the subjects" or if "federal statute(s) require(s) without

Educational tests, surveys, interviews, or observations research involving the use of educational tests (cognitive, diagnostic, aptitude, achievement), survey procedures, interview procedures, or observations of public behavior meets the definition of human subjects research and requires IRB review.

Mississippi Fishing LicensesAny person sixty-five (65) or older, or any person otherwise exempted from obtaining a freshwater fishing license, must have documentation with him/her at all times while fishing. Residents 65 years of age or older are required to purchase a lifetime recreational saltwater fishing license.

Residents who are blind, paraplegic, a multiple-amputee, adjudged 100% disabled by the Social Security Administration, or 100% service-connected disabled by the Veterans Administration or Railroad Retirement Board are NOT required to purchase a hunting or fishing license MS.