The Mississippi Self-Employed Independent Contractor Questionnaire is a form utilized by the state of Mississippi to determine the classification and status of individuals working as independent contractors within the state. This questionnaire is designed to gather detailed information about the nature of the business relationship between the self-employed individual and the client or company they work with. Keywords: Mississippi, self-employed, independent contractor, questionnaire, classification, status, business relationship, client, company. The Mississippi Self-Employed Independent Contractor Questionnaire helps the Mississippi Department of Revenue ensure that individuals are correctly classified as independent contractors rather than employees for tax and legal purposes. It plays a crucial role in determining the tax obligations, withholding requirements, and potential benefits of these workers. There may be different types or variations of the Mississippi Self-Employed Independent Contractor Questionnaire, depending on specific circumstances. Some potential variations could include: 1. Initial Classification Questionnaire: Used when a person first starts working as an independent contractor in Mississippi, this questionnaire focuses on gathering essential information about the individual's business structure, services provided, and relationship with clients or companies. 2. Annual Recertification Questionnaire: Required on an annual basis, this questionnaire aims to verify the ongoing status of an individual as a self-employed independent contractor. It ensures that the worker's classification remains accurate over time and identifies any changes in their business operation. 3. Financial and Tax Information Questionnaire: This type of questionnaire delves deeper into the financial aspects of the self-employed individual's business. It may require the individual to report their income, expenses, deductions, and other relevant financial details to facilitate tax reporting and compliance. 4. Worker Classification Audit Questionnaire: When there is a suspicion of misclassification, the Mississippi Department of Revenue may use this questionnaire during an audit or investigation. It is a comprehensive form intended to gather extensive information about the working relationship between the individual and their clients or companies to assess the true nature of the worker's employment status. In conclusion, the Mississippi Self-Employed Independent Contractor Questionnaire is a vital tool used by the state to properly classify workers and ensure compliance with tax and legal requirements. It serves to establish the business relationship between self-employed individuals and their clients or companies while determining the appropriate tax obligations and benefits. Employing different types and variations of this questionnaire enables Mississippi to conduct thorough assessments in various scenarios, establishing accurate classification and maintaining compliance.

Mississippi Self-Employed Independent Contractor Questionnaire

Description

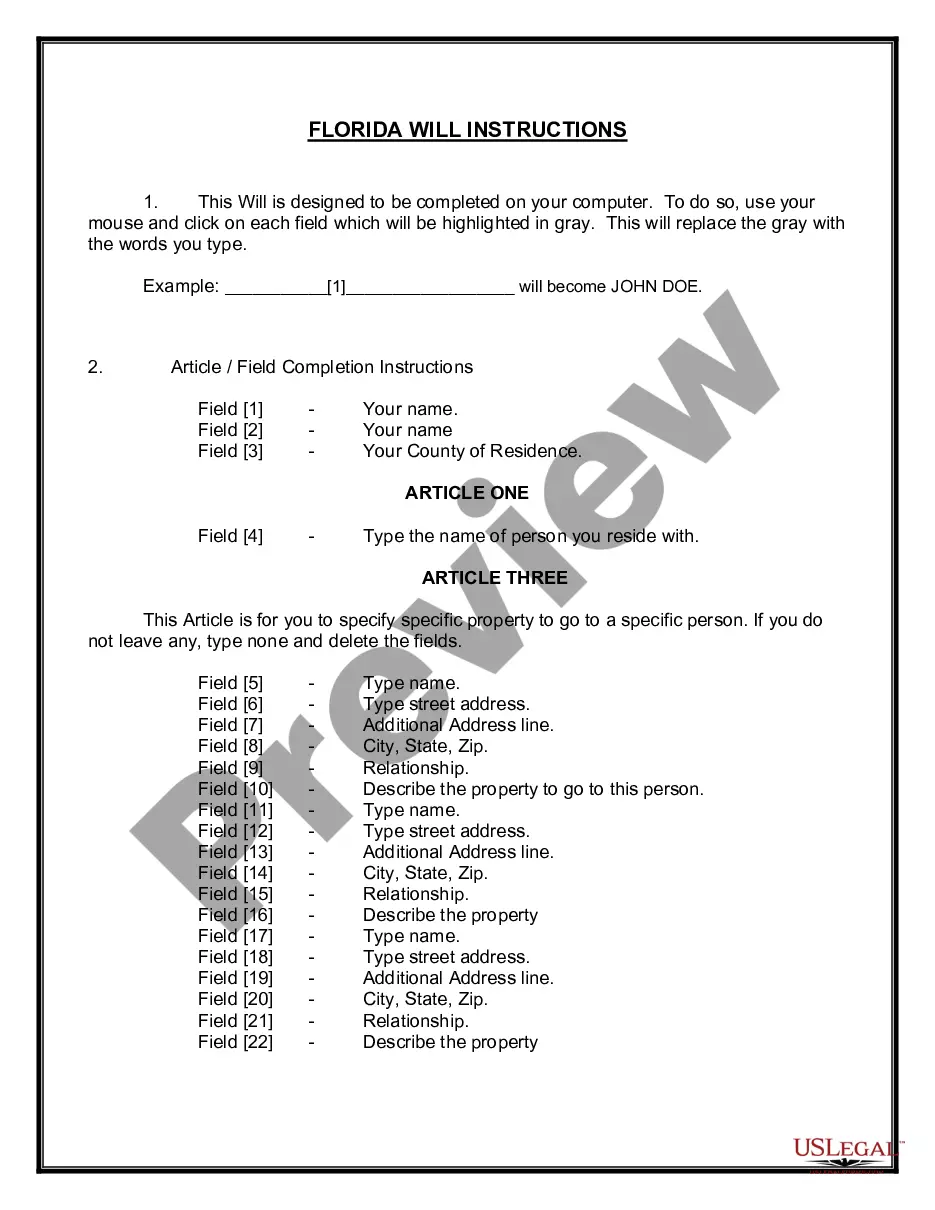

How to fill out Mississippi Self-Employed Independent Contractor Questionnaire?

Choosing the best lawful document web template can be quite a have difficulties. Naturally, there are tons of themes accessible on the Internet, but how would you find the lawful kind you require? Use the US Legal Forms website. The service delivers 1000s of themes, including the Mississippi Self-Employed Independent Contractor Questionnaire, that you can use for company and private demands. Every one of the types are examined by specialists and satisfy federal and state demands.

Should you be previously authorized, log in to your profile and click the Obtain option to find the Mississippi Self-Employed Independent Contractor Questionnaire. Use your profile to look with the lawful types you may have bought formerly. Go to the My Forms tab of your own profile and acquire an additional copy from the document you require.

Should you be a new user of US Legal Forms, listed below are straightforward directions for you to adhere to:

- Initially, make sure you have selected the proper kind to your city/region. You may look through the form making use of the Review option and read the form outline to guarantee it will be the best for you.

- In case the kind does not satisfy your preferences, use the Seach field to get the proper kind.

- Once you are sure that the form is proper, go through the Purchase now option to find the kind.

- Opt for the prices program you desire and enter the necessary information. Make your profile and pay money for the transaction using your PayPal profile or charge card.

- Choose the data file structure and down load the lawful document web template to your device.

- Full, modify and print and signal the received Mississippi Self-Employed Independent Contractor Questionnaire.

US Legal Forms is the greatest library of lawful types that you will find numerous document themes. Use the service to down load professionally-produced documents that adhere to condition demands.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.