The Mississippi Nonexempt Employee Time Report is a crucial document used by employers in Mississippi to keep track of the working hours and related details of nonexempt employees. This comprehensive report aids in proper documentation, payroll processing, and compliance with labor laws. The Mississippi Nonexempt Employee Time Report provides an organized structure to record important information such as employee's name, job title, department, and employee identification number. It also includes details about the payroll period or pay period, which may be weekly, bi-weekly, semimonthly, or monthly, depending on the employer's chosen pay frequency. The report consists of multiple sections to accurately record employee working hours. The first section typically includes the date of each day worked, while the subsequent sections are segregated into daily columns for this purpose. Within each day's column, the report allows employers to record relevant information, such as the start and end times of each shift, including the lunch or meal breaks, if applicable. The Mississippi Nonexempt Employee Time Report may provide additional columns to record details related to overtime hours, paid time off, or any leaves taken during the specified pay period. These additional columns enable employers to accurately calculate overtime pay and ensure compliance with state and federal laws governing working hours and compensation. Different variations of the Mississippi Nonexempt Employee Time Report may exist based on the employer's specific requirements. These variations could include customized sections for recording different types of leave, whether paid or unpaid, as well as tracking employee's attendance, tardiness, and incidences of absence. Furthermore, employers may opt to use electronic or software-based timekeeping systems to streamline the process of employee time reporting. These systems can automatically calculate hours worked, overtime, and leave accruals, reducing the potential for errors and providing a more efficient solution. In summary, the Mississippi Nonexempt Employee Time Report is a vital tool for employers to document the working hours and related details of nonexempt employees accurately. It ensures compliance with labor laws, aids in payroll processing, and facilitates a comprehensive record-keeping system. Employers may customize this report to suit their specific needs and may also utilize electronic timekeeping systems for enhanced efficiency.

Mississippi Nonexempt Employee Time Report

Description

How to fill out Mississippi Nonexempt Employee Time Report?

Have you been in the place where you require documents for possibly company or specific functions virtually every working day? There are a variety of authorized document templates available on the Internet, but getting ones you can depend on is not easy. US Legal Forms offers a huge number of kind templates, such as the Mississippi Nonexempt Employee Time Report, that are created to fulfill state and federal needs.

If you are already knowledgeable about US Legal Forms internet site and also have your account, simply log in. Following that, it is possible to download the Mississippi Nonexempt Employee Time Report web template.

Unless you come with an profile and wish to start using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for your proper metropolis/county.

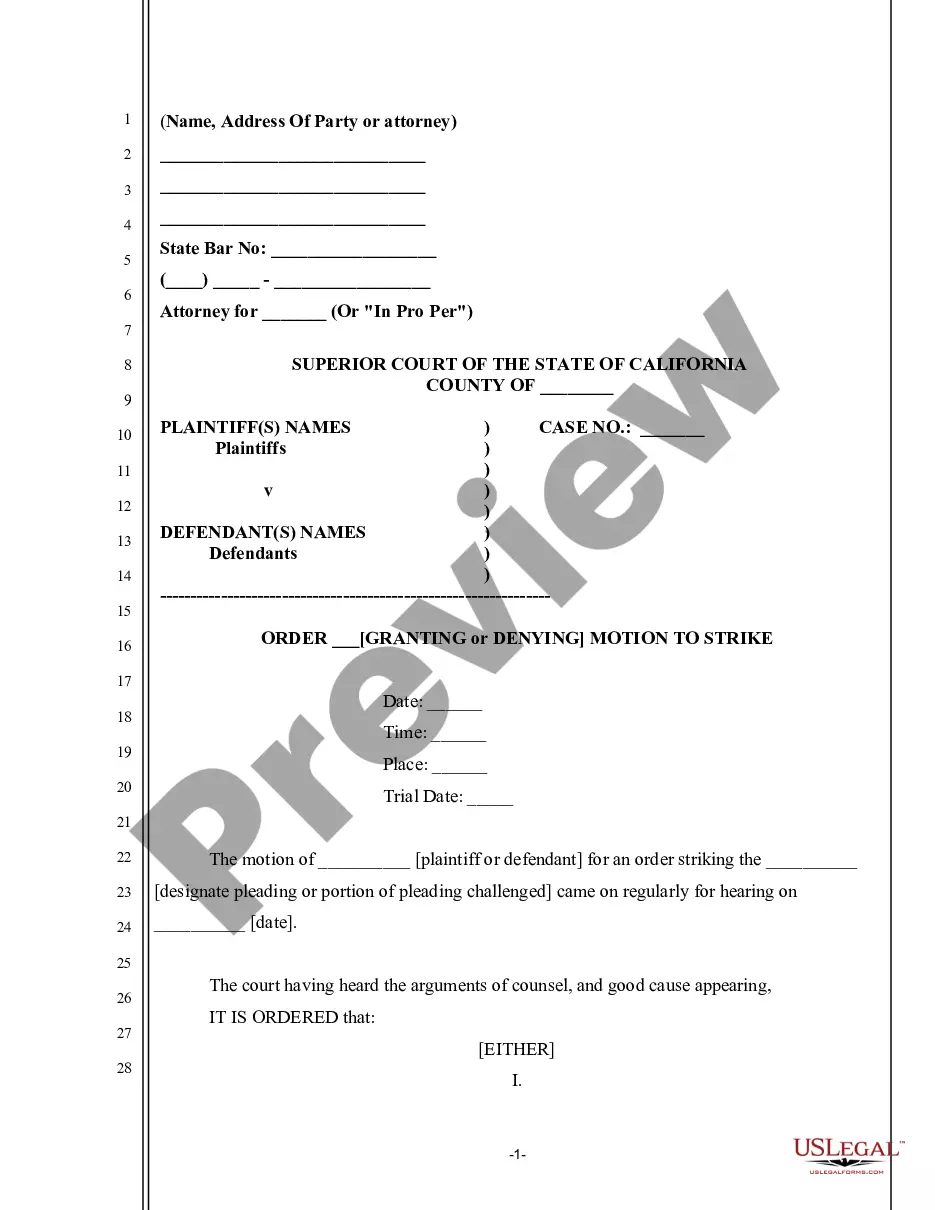

- Take advantage of the Review key to examine the shape.

- See the outline to actually have selected the appropriate kind.

- When the kind is not what you`re trying to find, utilize the Research field to get the kind that meets your needs and needs.

- When you obtain the proper kind, simply click Get now.

- Opt for the costs strategy you would like, submit the specified information and facts to produce your money, and pay for an order using your PayPal or bank card.

- Select a convenient data file structure and download your backup.

Get all of the document templates you possess bought in the My Forms menus. You can aquire a additional backup of Mississippi Nonexempt Employee Time Report whenever, if required. Just click on the required kind to download or print out the document web template.

Use US Legal Forms, by far the most comprehensive selection of authorized types, to save lots of some time and prevent blunders. The service offers expertly created authorized document templates that can be used for an array of functions. Create your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

Exempt employees are not regulated under the Fair Labor and Standards Act, which sets the federal requirements for overtime pay and minimum wage. Exempt employees must meet the Department of Labor's salary level, salary base and duties criteria.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Fair Labor Standards Act (FLSA) exempt and nonexempt testsEmployees who meet the thresholds of both the Duties and Salary tests are considered exempt from overtime pay or salaried. All other employees, with some exceptions listed below, are considered nonexempt, or eligible for overtime wages.

Exempt workers are exempt from overtime payso even if they work more than 40 hours in a workweek, they're not eligible for overtime pay. So, whether a salaried employee has to fill out a timesheet will come down to whether they're considered exempt or non-exempt.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Related Content. Under the federal Fair Labor Standards Act (FLSA), employees who are not exempt from the FLSA's minimum wage or overtime pay protections.

An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

Exempt Employees must meet basic salary threshold of $913/week $47,476/year) and meet applicable Department of Labor Tests for executive exemption, administrative exemption, professional exemption, or computer exemption. Exempt employees are paid a salary that covers the amount of time required to perform the job.

Partial Exempted Personnel from Overtime Pay.Executive Exemption.Administrative Exemption.Computer Professionals Exemption.Professional Exemption.Outside Sales Exemption.Highly Compensated Employees.