Mississippi Guardianship Current Assets

Description

How to fill out Guardianship Current Assets?

Are you presently in a placement the place you will need paperwork for either enterprise or specific uses virtually every day time? There are a variety of authorized document templates available on the Internet, but locating versions you can rely is not simple. US Legal Forms gives thousands of form templates, like the Mississippi Guardianship Current Assets, which can be composed to meet state and federal demands.

Should you be presently knowledgeable about US Legal Forms site and possess your account, merely log in. After that, you are able to acquire the Mississippi Guardianship Current Assets format.

Should you not provide an profile and need to begin using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for that proper city/state.

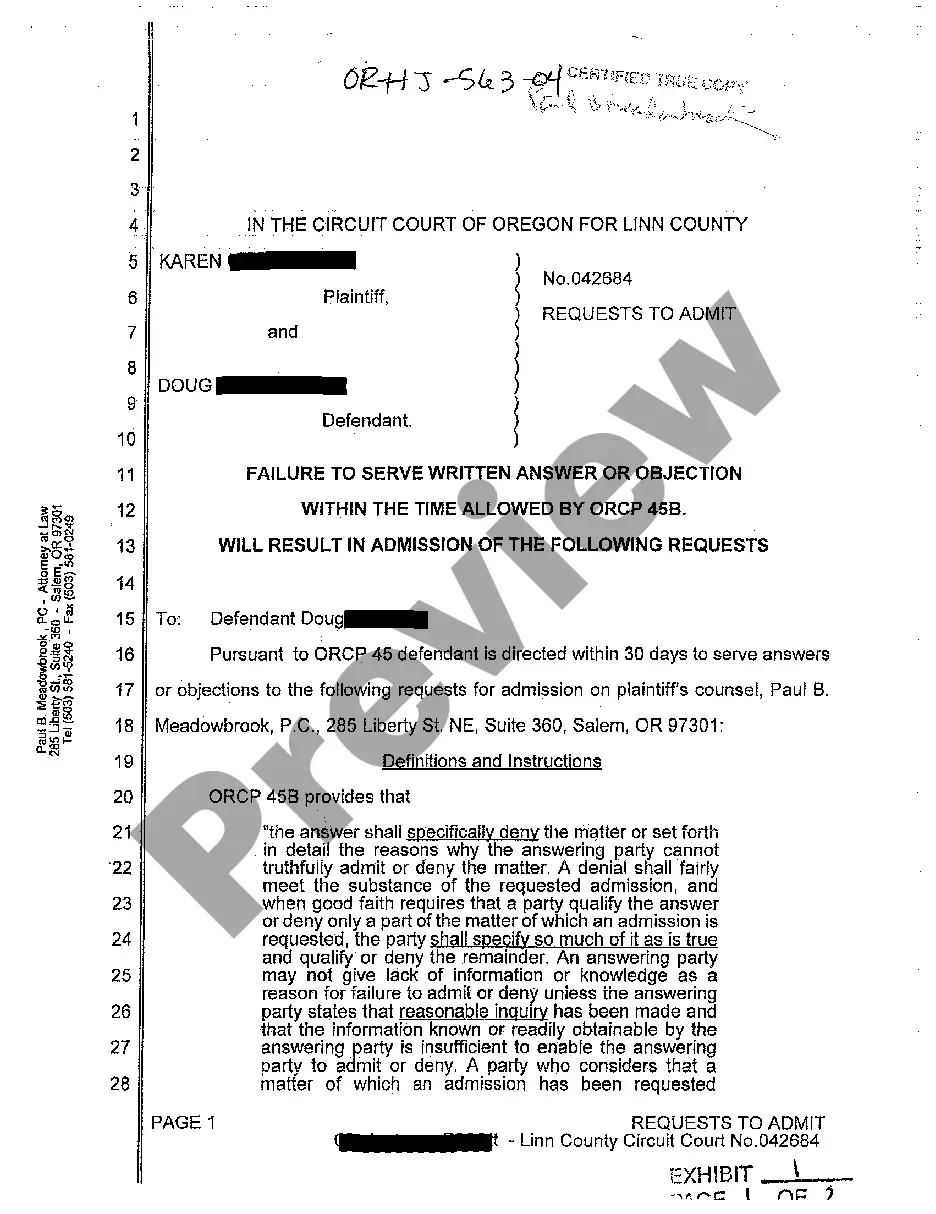

- Make use of the Review option to analyze the form.

- Browse the description to ensure that you have chosen the appropriate form.

- In the event the form is not what you are searching for, utilize the Search area to get the form that meets your requirements and demands.

- Whenever you find the proper form, click on Get now.

- Pick the pricing plan you need, submit the required details to produce your bank account, and purchase your order with your PayPal or credit card.

- Select a convenient file structure and acquire your duplicate.

Locate all the document templates you possess bought in the My Forms menu. You can obtain a additional duplicate of Mississippi Guardianship Current Assets anytime, if needed. Just select the essential form to acquire or print the document format.

Use US Legal Forms, the most considerable collection of authorized kinds, in order to save time and stay away from mistakes. The support gives skillfully produced authorized document templates that you can use for a range of uses. Create your account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

A related but distinct arrangement is what is known as ?conservatorship.? While a guardian is legally responsible for the individual (called a ?ward?) and his or her physical well-being and physical care, a conservatorship only gives the conservator control and responsibility for the ward's money, property, and ...

A legal guardian is someone who is appointed by the court to take responsibility for another person, known as a "ward." A ward can be either a child or an adult who for some reason cannot manage his own affairs. Although you can appoint a guardian in your will, the probate court is not obligated to accept your choice.

An interested person may file petition for emergency guardian/conservator and court may appoint if it so finds that appointment is likely to prevent substantial and irreparable harm; no one else has authority or willingness to act in the circumstances; and there is reason to believe a guardian/conservator is necessary.

Who may be guardian for adult. Appointment of a guardian for an adult will be at the discretion of the court and in the best interest of the respondent.

Ask the Court to End the Guardianship If a guardianship is no longer needed for any reason, a person can file a petition asking the court to terminate the guardianship. If granted, the guardianship ends completely.

The fact that the child has a guardian does not mean the parent has no rights. Parental rights usually include the option to spend time with the child, as well as the authority to make major decisions and sign contracts for the child. Having a guardian does not generally change this.

In order to file for Mississippi guardianships, you'll have to file a petition with the local court, undergo investigation from the court, testify in front of the court, and eventually be approved if a judge determines the guardianship is in the best interests of the ward.

The Seven Powers of Conservatorship Power to give consent for the conservatee to marry. Power to act for the conservatee's right to enter into a legal contract. Power to accept, give, or withhold medical consent for the conservatee. Power to arrange for the conservatee's residence or dwelling.