Mississippi Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

If you require to obtain, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Utilize the site’s simple and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are sorted by categories and states, or keywords.

Every legal document format you acquire is yours forever. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Mississippi Wage Withholding Authorization with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Mississippi Wage Withholding Authorization.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

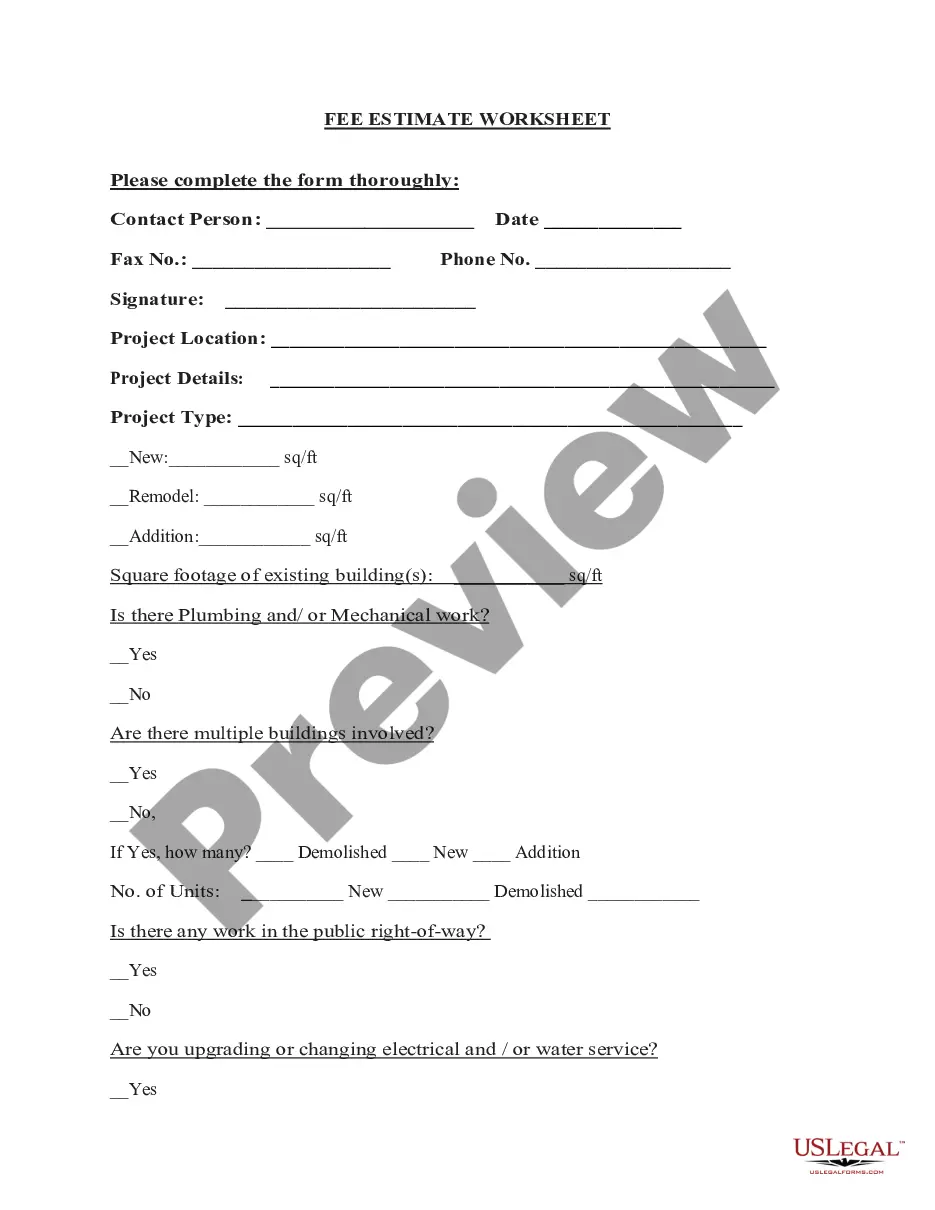

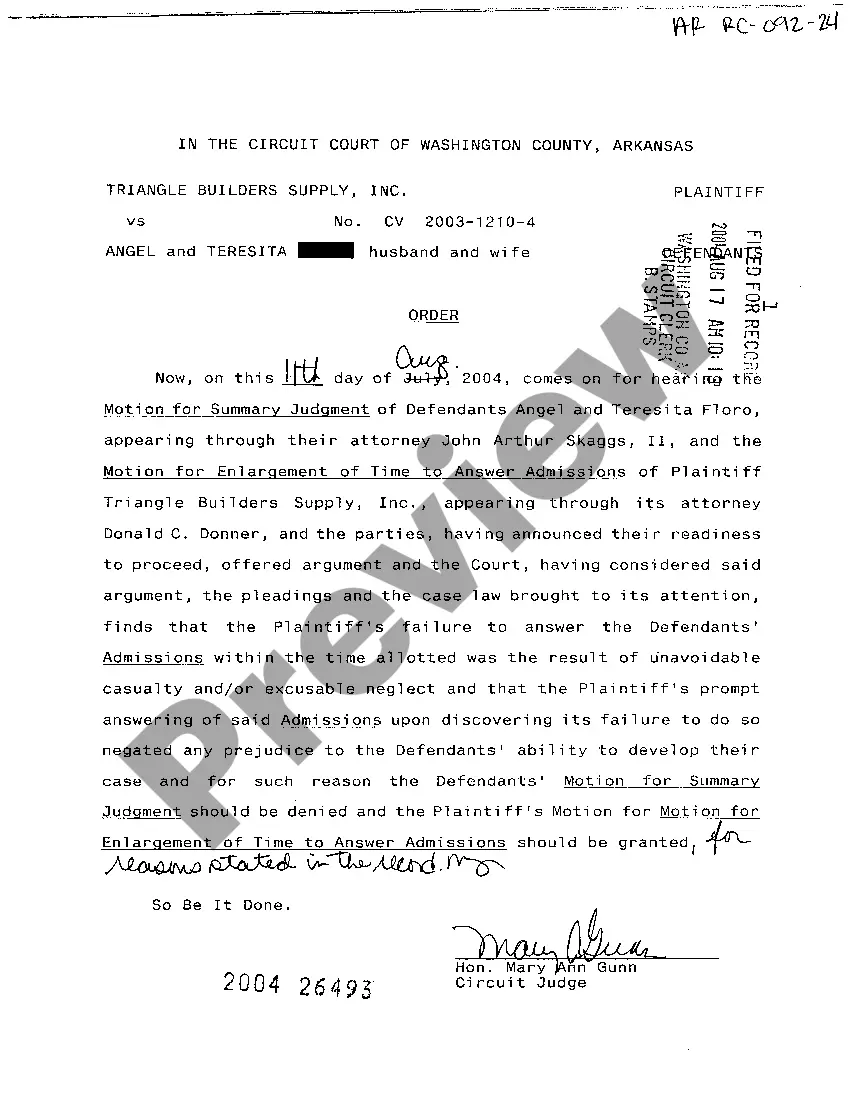

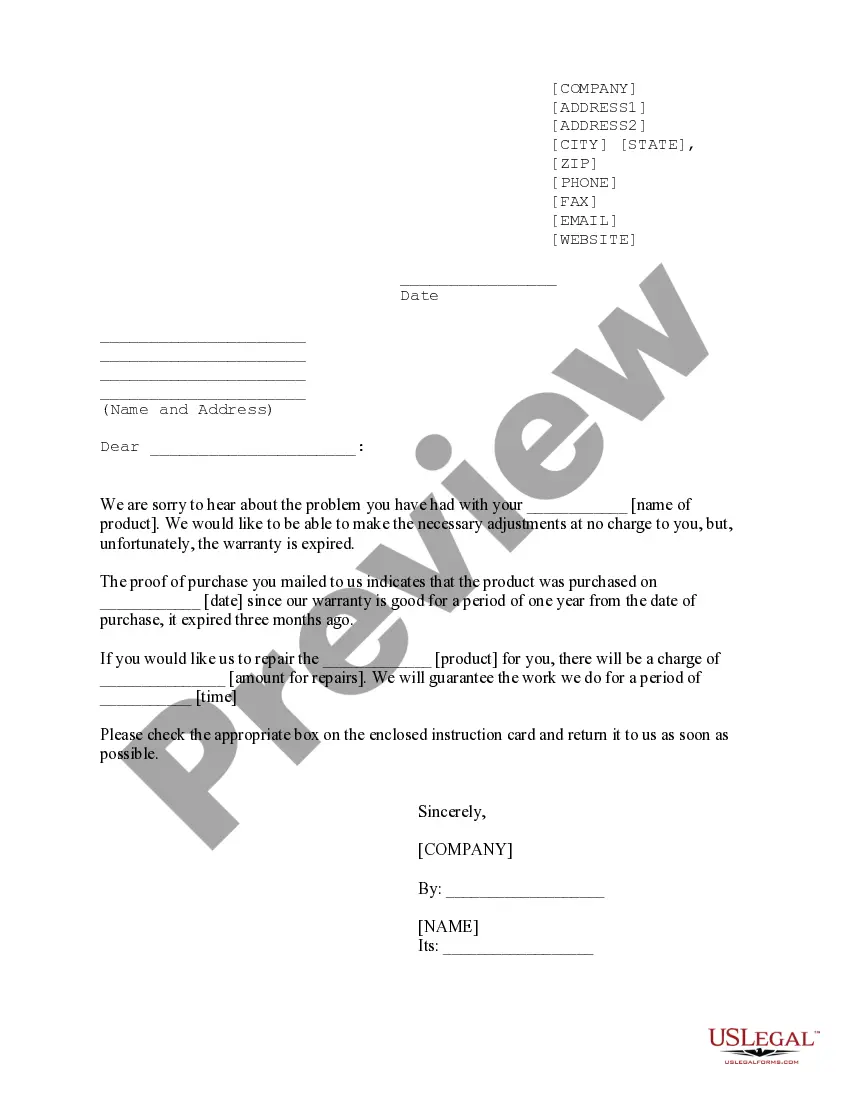

- Step 2. Use the Preview option to review the form’s content. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format.

- Step 4. Once you have found the form you wish to obtain, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to sign up for the account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Mississippi Wage Withholding Authorization.

Form popularity

FAQ

Mississippi Payroll Tax and Registration GuideApply online at the DOR's Taxpayer Access Point portal to receive a Withholding Account Number immediately after completing the registration.Find an existing Withholding Account Number: on Form 89-105, Employer's Withholding Tax Return. by contacting the DOR.

Mississippi Income Tax WithholdingMississippi's law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the State Tax Commission.

When beginning employment or when a change in exemptions is needed, employees are required to complete and furnish to their employers a Form 89-350, Mississippi Employee's Withholding Exemption Certificate, indicating the amount of state personal exemptions to which they are entitled.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

Allowable Paycheck DeductionsPersonal loans (cash advances, 401(k) or retirement loan payment, bail or bond payments, etc.)Personal purchases of a business's goods or services such as: Food purchases from the cafeteria.Employee's health, dental, vision, and other insurance payments or co-payments.

Employee Leasing Companies applying for a withholding account are required to submit with the application either a cash bond or an approved surety bond200b. The amount of the bond must equal twice the withholding tax expected to be paid over a three-month period (or six-months of withholding taxes.)

Taking money out of an employee's pay An employer can only deduct money if: the employee agrees in writing and it's principally for their benefit. it's allowed by a law, a court order, or by the Fair Work Commission, or. it's allowed under the employee's award, or.

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

Mississippi Tax Account Numbers Your Withholding Account Number will begin with 1. You can also retrieve your account number and filing frequency by contacting the agency at 601-923-7088.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.