A Mississippi Self-Employed Independent Contractor Employment Agreement — commission for new business is a legally binding document that outlines the terms and conditions between a self-employed individual and a hiring company in the state of Mississippi. This agreement specifically focuses on the payment structure, responsibilities, and expectations related to generating new business and earning commissions. Keywords: Mississippi, self-employed, independent contractor, employment agreement, commission, new business. This employment agreement is designed for individuals based in Mississippi who work as independent contractors and have a primary responsibility to generate new business for the hiring company. The agreement defines the working relationship, ensuring that both parties understand their rights and obligations. Key components of the Mississippi Self-Employed Independent Contractor Employment Agreement — commission for new business include: 1. Identification of Parties: The agreement clearly identifies the self-employed individual (contractor) and the hiring company (client), including their legal names, addresses, and contact information. 2. Services Provided: The agreement outlines the services the contractor will provide to generate new business. It may include sales, marketing, lead generation, client acquisition, or other relevant activities. 3. Compensation Structure: The agreement details how the contractor will be compensated for their efforts in generating new business. This typically includes a commission-based structure, where the contractor earns a percentage of the revenue from each successful sale or new client brought in. The specific commission percentage and payment terms are clearly stated. 4. Scope of Work: The agreement defines the scope of work for the contractor, outlining the specific tasks, targets, and goals to be achieved. It may also include any sales quotas or performance metrics that need to be met for the contractor to be eligible for commission payments. 5. Confidentiality and Non-Disclosure: To protect the hiring company's proprietary information, the agreement includes clauses regarding confidentiality and non-disclosure. The contractor is required to maintain the confidentiality of any sensitive business information they come across during their engagement. 6. Term and Termination: The agreement specifies the duration of the engagement, which could be a fixed term or an ongoing arrangement. It also outlines the conditions under which either party can terminate the agreement, such as breach of contract or failure to meet performance expectations. Additional variants or types of Mississippi Self-Employed Independent Contractor Employment Agreements with a commission for new business may include variations in compensation structures, such as tiered commissions based on sales volume or monetary thresholds achieved. Other agreements may specify different services to be provided, such as lead generation specifically for a particular product or industry. In conclusion, a Mississippi Self-Employed Independent Contractor Employment Agreement — commission for new business is a crucial legal document that helps establish a clear understanding between the hiring company and the self-employed contractor regarding the compensation, services, and expectations related to generating new business.

Mississippi Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Mississippi Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

If you have to total, obtain, or printing legal record web templates, use US Legal Forms, the largest collection of legal types, that can be found on the web. Make use of the site`s simple and practical search to obtain the files you require. Numerous web templates for business and specific uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Mississippi Self-Employed Independent Contractor Employment Agreement - commission for new business in just a handful of clicks.

When you are currently a US Legal Forms client, log in to your account and click on the Download switch to find the Mississippi Self-Employed Independent Contractor Employment Agreement - commission for new business. Also you can gain access to types you previously delivered electronically from the My Forms tab of your account.

If you use US Legal Forms the very first time, refer to the instructions under:

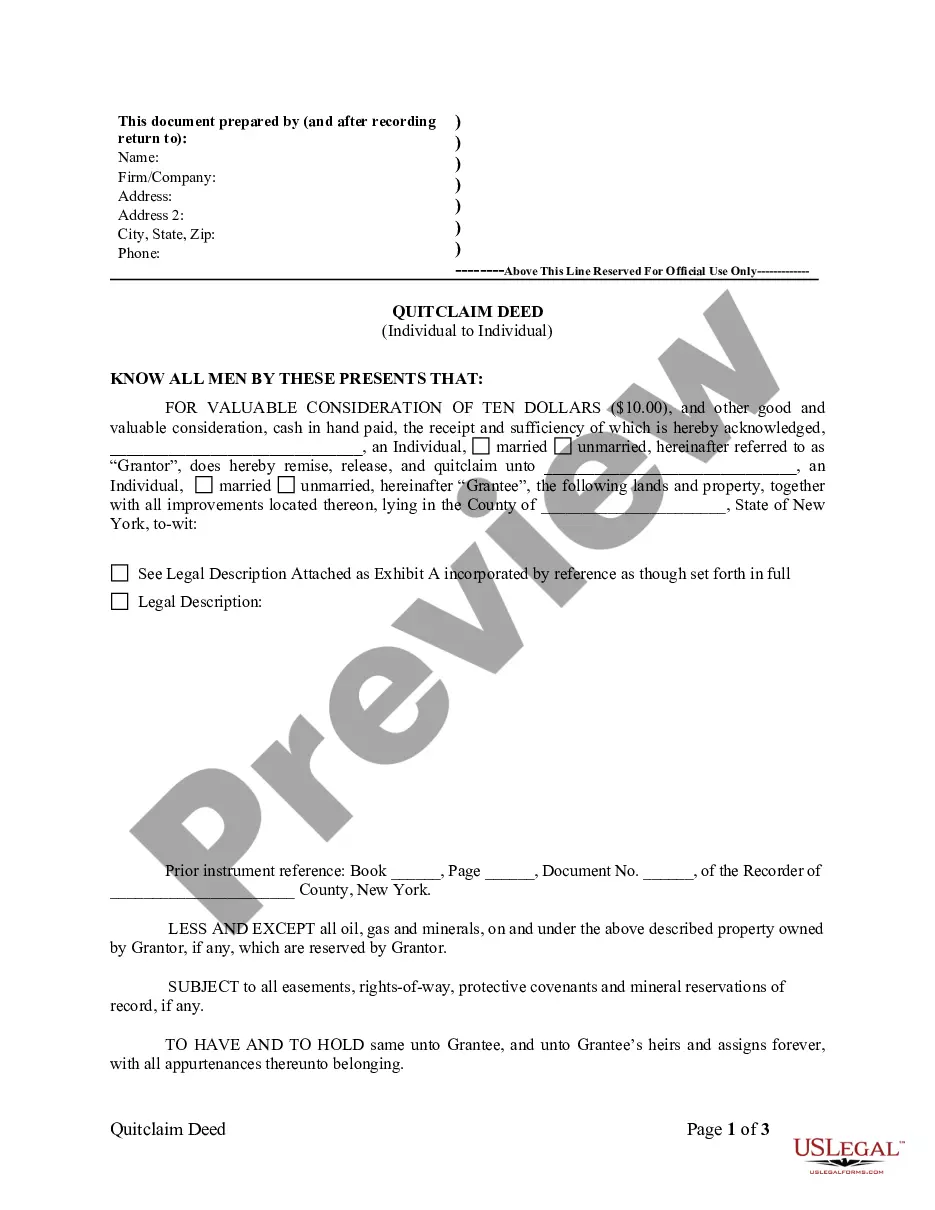

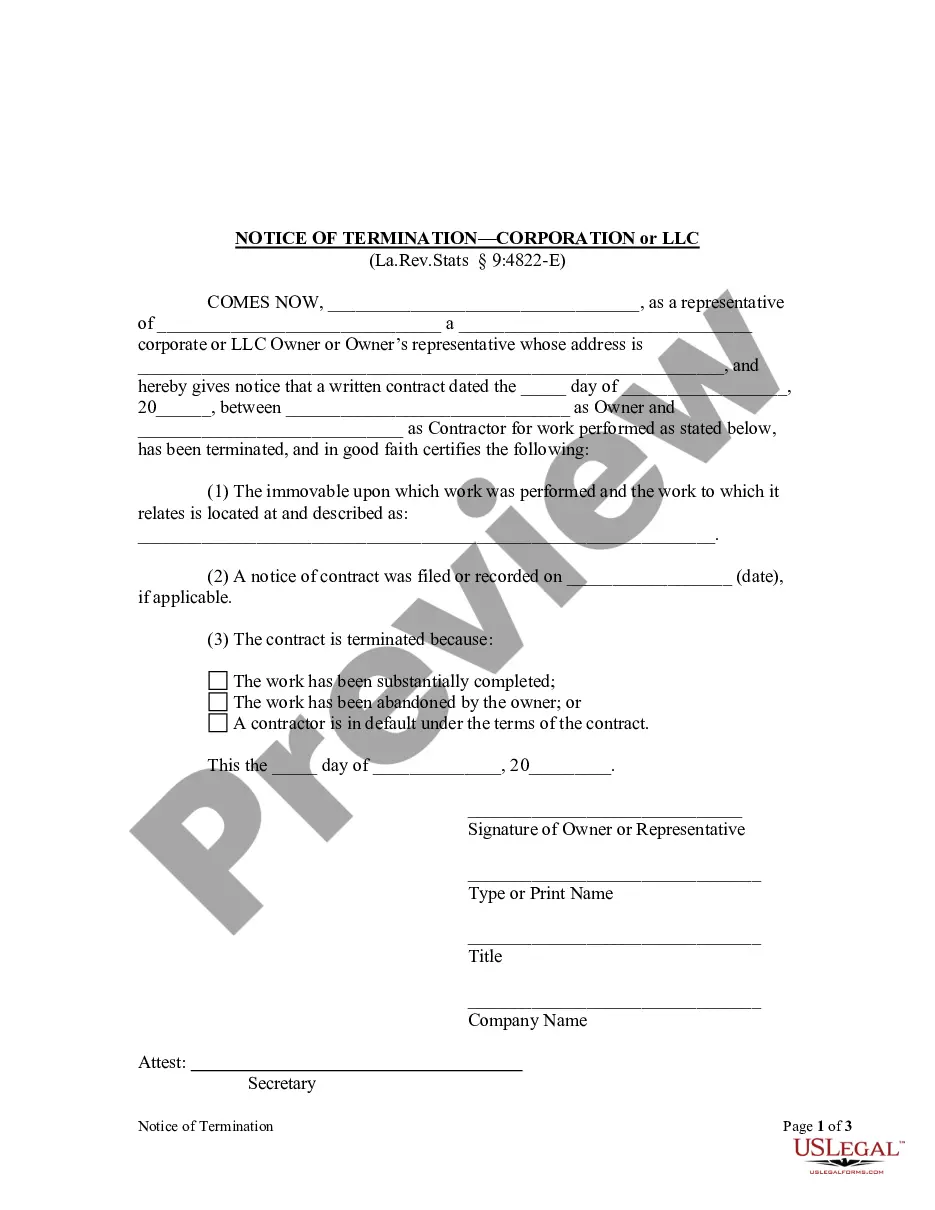

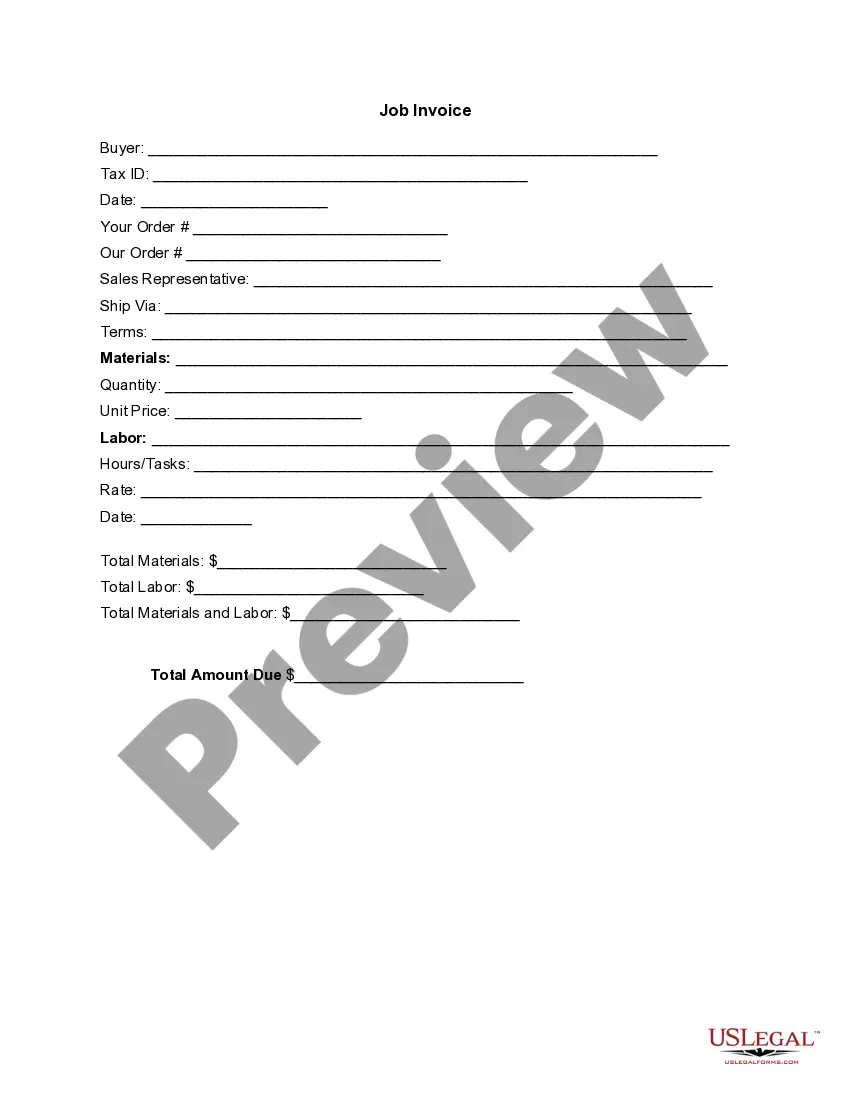

- Step 1. Ensure you have chosen the shape for that appropriate city/country.

- Step 2. Make use of the Preview choice to examine the form`s content material. Do not neglect to see the description.

- Step 3. When you are unhappy using the form, make use of the Research field towards the top of the monitor to find other models from the legal form template.

- Step 4. Upon having found the shape you require, select the Buy now switch. Select the costs plan you choose and include your qualifications to sign up on an account.

- Step 5. Approach the deal. You may use your credit card or PayPal account to finish the deal.

- Step 6. Find the format from the legal form and obtain it on your own system.

- Step 7. Total, edit and printing or sign the Mississippi Self-Employed Independent Contractor Employment Agreement - commission for new business.

Each and every legal record template you buy is your own property permanently. You have acces to each form you delivered electronically in your acccount. Go through the My Forms section and select a form to printing or obtain once more.

Be competitive and obtain, and printing the Mississippi Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms. There are thousands of expert and state-certain types you can use for your personal business or specific requirements.

Form popularity

FAQ

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.30-Nov-2020

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?