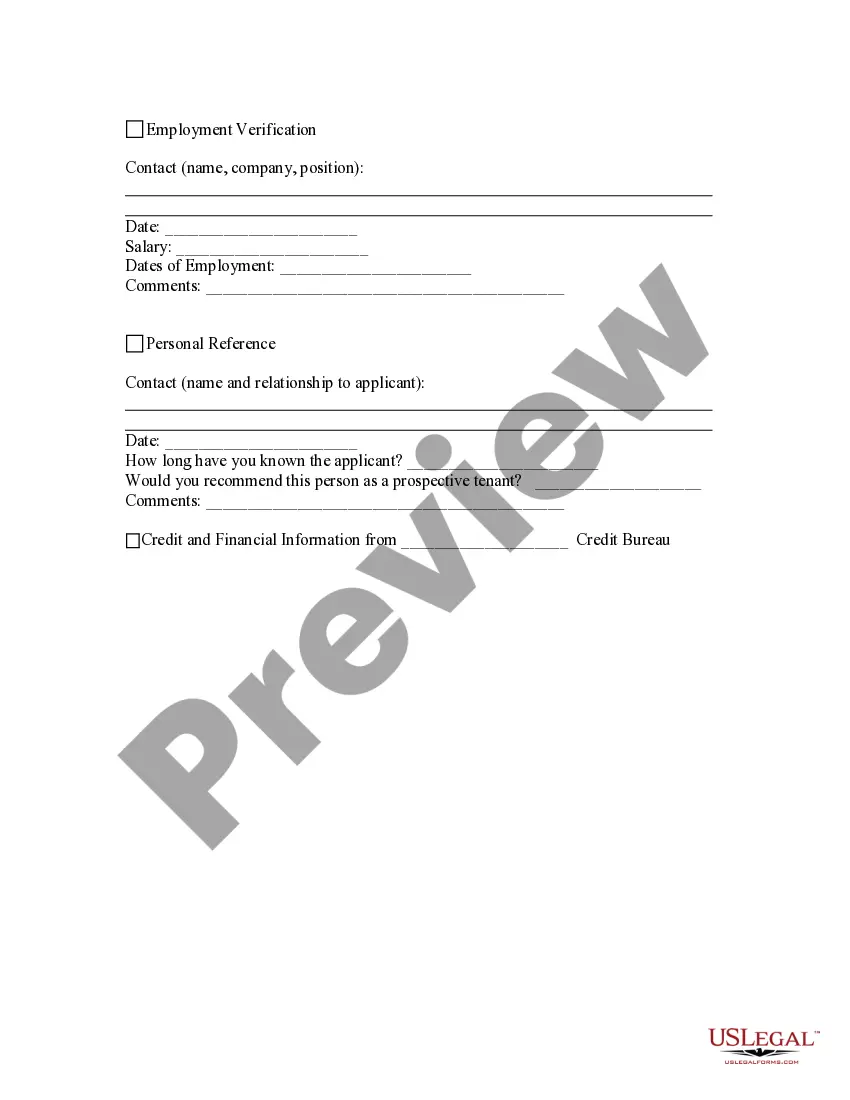

Mississippi Tenant References Checklist: A Comprehensive Guide to Check Tenant References When considering potential tenants for your rental property in Mississippi, it is of utmost importance to gather reliable information about their background, rental history, and financial stability. The Mississippi Tenant References Checklist serves as an essential tool in assessing potential tenants and making informed decisions to protect your property. Here, we will discuss the key elements of this checklist and the different types based on specific reference types. 1. Personal References: — This checklist includes collecting personal references from individuals who can vouch for the applicant's character, behavior, and reliability. — These references could include friends, neighbors, current or previous employers, and professionals who know the applicant well. — Verify the contact details of each reference and ensure that they are genuine and willing to provide feedback. 2. Rental History References: — This category focuses on gathering information related to the applicant's past rental experiences. — Contact the applicant's previous landlords or property managers to gain insights into their rental payment history, property maintenance habits, and overall conduct as a tenant. — Ask specific questions regarding rent payment timeliness, property upkeep, adherence to lease terms, and any previous eviction or legal issues. 3. Employment References: — It is crucial to verify the applicant's employment status, stability, and income to ensure they can meet their financial obligations. — Contact the applicant's current employer to verify their employment details, including job title, length of employment, and income. Ensure confidentiality of income-related information as per legal requirements. — Previous employers can also be contacted for additional insights into the applicant's work ethic, punctuality, and professionalism. 4. Financial References: — This category involves analyzing the applicant's financial stability and capability to afford the rental property. — Check their credit history, including credit score, payment history, outstanding debts, and any past bankruptcies or financial irregularities. — Request bank statements or pay stubs to evaluate their monthly income, debt-to-income ratio, and regular savings behavior. 5. Character References: — While not a mandatory reference, character references to provide an in-depth understanding of the applicant's moral values, integrity, and trustworthiness. — These references could come from religious leaders, community members, or volunteer organizations. They can shed light on the applicant's involvement in the community and their overall reputation. By conducting a thorough evaluation using the Mississippi Tenant References Checklist, landlords can make informed decisions regarding potential tenants. Remember to adhere to Fair Housing Laws and maintain privacy and confidentiality throughout the process.

Mississippi Tenant References Checklist to Check Tenant References

Description

How to fill out Mississippi Tenant References Checklist To Check Tenant References?

It is possible to commit several hours on the web looking for the legal file design which fits the federal and state needs you want. US Legal Forms gives a large number of legal forms that happen to be analyzed by professionals. It is simple to download or print the Mississippi Tenant References Checklist to Check Tenant References from my support.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Down load key. Following that, it is possible to total, modify, print, or indication the Mississippi Tenant References Checklist to Check Tenant References. Every legal file design you purchase is the one you have for a long time. To have yet another copy for any obtained form, go to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site the very first time, stick to the basic guidelines beneath:

- First, be sure that you have selected the right file design for that state/area of your liking. Look at the form explanation to make sure you have chosen the right form. If accessible, utilize the Review key to check through the file design too.

- In order to discover yet another version of your form, utilize the Research field to obtain the design that meets your requirements and needs.

- When you have identified the design you would like, click on Get now to carry on.

- Pick the prices strategy you would like, type your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal profile to pay for the legal form.

- Pick the format of your file and download it to your gadget.

- Make alterations to your file if possible. It is possible to total, modify and indication and print Mississippi Tenant References Checklist to Check Tenant References.

Down load and print a large number of file templates while using US Legal Forms site, that offers the greatest variety of legal forms. Use expert and condition-distinct templates to tackle your small business or individual requires.