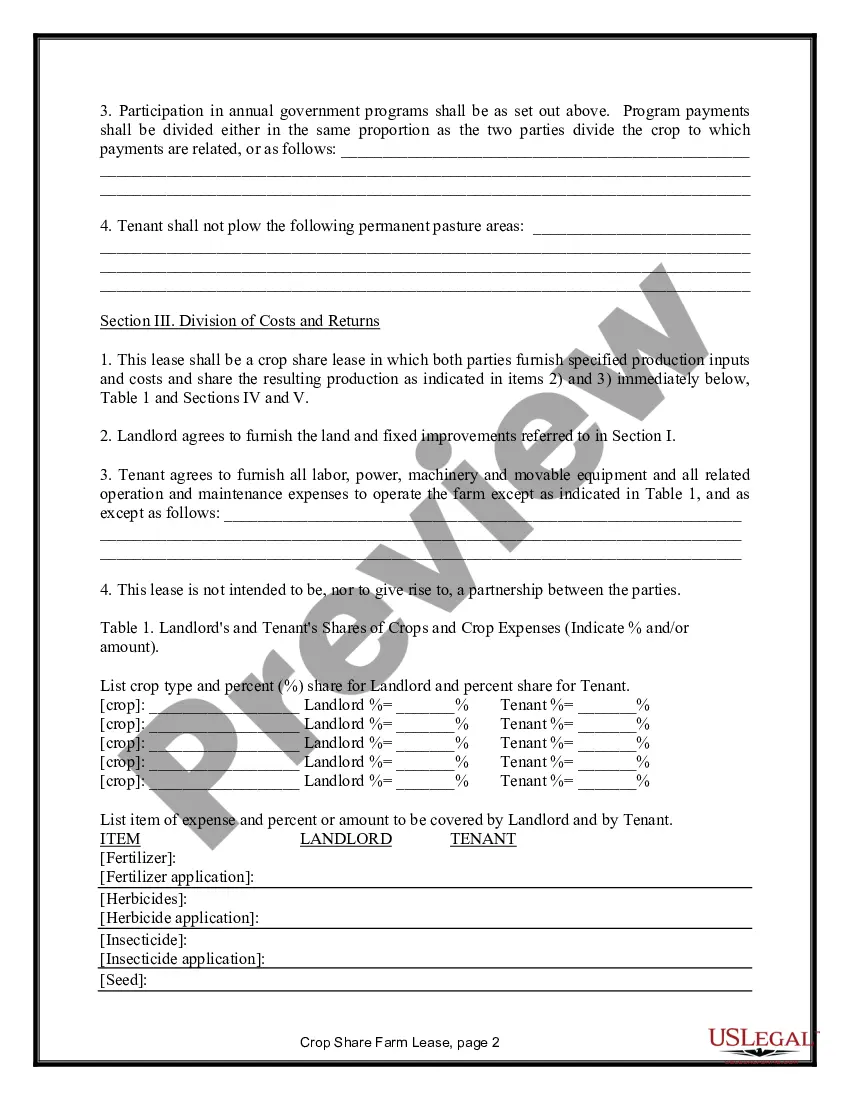

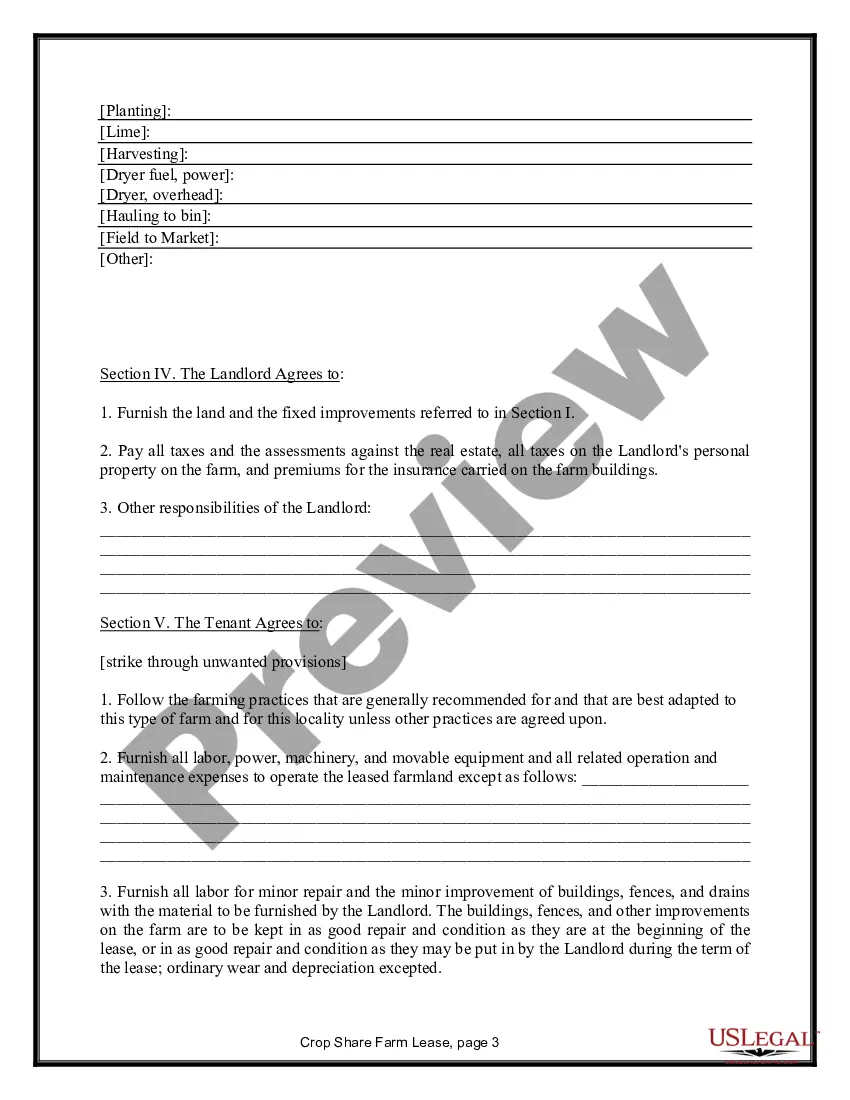

A Mississippi Farm Lease or Rental — Crop Share agreement refers to a contractual arrangement between a landowner (typically referred to as the lessor) and a farmer (the lessee) for the use of farmland in the state of Mississippi. In this type of lease agreement, the landowner provides the land while the farmer contributes their expertise, labor, and equipment to cultivate and manage the crops. Keywords: Mississippi, farm lease, rental, crop share, landowner, farmer, farmland, lease agreement, cultivate, manage crops. There are a few variations of Mississippi Farm Lease or Rental — Crop Share agreements that are commonly used: 1. Crop Share Lease: It is the most traditional form of the farm lease agreement, where the landowner and the farmer share the crops grown on the land in a predetermined ratio, often 50-50. This type of arrangement allows both parties to share the risks and rewards associated with the crop production. 2. Flexible Cash Lease: This type of lease agreement combines elements of both fixed rental payments and crop share arrangements. The landowner receives a base rental payment, which is generally lower than a fixed cash lease, and in addition, a portion of the crop produced is shared between the landowner and the farmer. 3. Cash Rent Lease: Unlike the crop share lease, the landowner receives a fixed rental payment in cash from the farmer for the use of the land. The farmer assumes all the risks and rewards associated with crop production. The rental amount is often determined based on factors such as the quality of the land, market conditions, and historical yields. 4. Custom Farming Lease: This type of lease agreement often involves the farmer providing their expertise, labor, and equipment to cultivate the land on behalf of the landowner. The farmer usually receives compensation either in the form of a cash payment or a portion of the harvested crops. Regardless of the specific type of lease agreement, it is essential for both the landowner and the farmer to have a detailed and well-defined contract that addresses aspects such as lease duration, payment terms, crop selection, maintenance responsibilities, and termination clauses. It is also advisable for both parties to consult legal and financial professionals to ensure that the agreement meets their individual needs and protects their interests.

Mississippi Farm Lease or Rental - Crop Share

Description

How to fill out Mississippi Farm Lease Or Rental - Crop Share?

Are you inside a place that you need to have documents for possibly organization or person reasons just about every day? There are a lot of lawful file layouts accessible on the Internet, but getting kinds you can rely on is not simple. US Legal Forms delivers 1000s of develop layouts, such as the Mississippi Farm Lease or Rental - Crop Share, that happen to be composed in order to meet state and federal needs.

In case you are currently knowledgeable about US Legal Forms web site and possess a free account, basically log in. Next, you can download the Mississippi Farm Lease or Rental - Crop Share web template.

Should you not come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you need and ensure it is for your appropriate city/area.

- Utilize the Preview button to examine the form.

- See the explanation to ensure that you have chosen the right develop.

- When the develop is not what you are looking for, use the Look for field to obtain the develop that suits you and needs.

- Whenever you get the appropriate develop, click Get now.

- Select the rates program you desire, fill in the specified information and facts to produce your account, and purchase the order with your PayPal or charge card.

- Choose a convenient file structure and download your backup.

Discover all of the file layouts you possess purchased in the My Forms food list. You can get a more backup of Mississippi Farm Lease or Rental - Crop Share anytime, if required. Just click on the required develop to download or print the file web template.

Use US Legal Forms, probably the most extensive selection of lawful varieties, to save time as well as avoid errors. The services delivers expertly produced lawful file layouts which you can use for an array of reasons. Create a free account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

"Leases of irrigated land have ranged from $1200 to $1600 per hectare plus irrigation pumping costs and water charges," Banks said. "Groundwater reliability and the type of irrigation infrastructure in use, for example, rotorainer versus centre pivot, are key factors in assessing irrigated land lease values.

Laws in India also restrict leasing rights for agricultural land. These laws force farmers to lease their land in the black market since formal leasing is either banned or poses significant risks.

The advantages of the first are that the tenant in many cases is free to manage the farm as he pleases, and as a long-time proposition he may pay less rent than under crop-sharing arrangements. The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

With a crop-share lease, the landlord receives a share of the crops produced in exchange for the use of the land by the tenant. The amount of the share typically depends on local custom. The landlord usually agrees to pay a portion of the input costs under a crop-share lease.

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

The average cash rent for non-irrigated land is $79 per acre, while irrigated cropland in 2016 is renting for $124 per acre. The spread between the lowest and highest rental rates is above $100 per acre for both irrigated and non-irrigated farmland outside of the Delta in Mississippi.

Mississippi Farmland Prices Over the last 20 years, the price of farmland per acre in mississippi has risen by an average of 6% per year to $3,100 per acre as of 2019. This represents an increase of $2,060 per acre of farmland over this time period.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.