The Mississippi Notice of Adverse Action — Non-Employmen— - Due to Consumer Investigative Report is a legal document that communicates to an individual their right to be informed when an adverse action is taken against them based on information contained in a consumer investigative report. In Mississippi, individuals have certain rights under the Fair Credit Reporting Act (FCRA) which dictate how consumer reports can be obtained and used. When a consumer investigative report is obtained by a non-employer, such as a landlord or insurance company, and the information contained therein leads to an adverse action, it is required by law to issue a notice to the affected individual. The Mississippi Notice of Adverse Action — Non-Employmen— - Due to Consumer Investigative Report serves as a formal communication to the consumer, detailing the reasons for the adverse action and providing them with an opportunity to dispute or correct any inaccuracies within the investigative report. This notice ensures transparency and fairness in the decision-making process when negative information is used against an individual. Keywords: Mississippi, Notice of Adverse Action, Non-Employment, Consumer Investigative Report, adverse action, Fair Credit Reporting Act, FCRA, consumer rights, non-employer, landlord, insurance company, formal communication, reasons, dispute, accuracy, transparency, fairness, decision-making process. Different types of Mississippi Notice of Adverse Action — Non-Employmen— - Due to Consumer Investigative Report may include: 1. Rental Application Denial: If a prospective tenant's consumer investigative report reveals negative information, such as prior evictions or unpaid rental debts, a landlord can issue this notice to substantiate their decision to deny the rental application. 2. Insurance Policy Denial: When an insurance company denies an individual's application for coverage based on adverse information found in a consumer investigative report, they must issue this notice, outlining the specific reasons for the denial. 3. Loan Denial: If a financial institution denies a loan application due to negative information in the consumer investigative report, they are obligated to provide the applicant with a notice detailing the adverse action taken and the source of the information leading to the denial. 4. Membership Denial: Some organizations or clubs require a background check or consumer investigative report before granting membership. If adverse information is uncovered and leads to a denial, this notice is used to inform the individual of the decision and the reasons behind it. 5. Professional License Denial: Certain professions or occupations may conduct consumer investigative reports as part of the licensing process. If negative information is discovered that results in a license denial, this notice is sent to the applicant to explain the adverse action taken. Keywords: Rental Application Denial, Insurance Policy Denial, Loan Denial, Membership Denial, Professional License Denial, information, applicant, membership, financial institution, background check, licensing process.

Mississippi Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report

Description

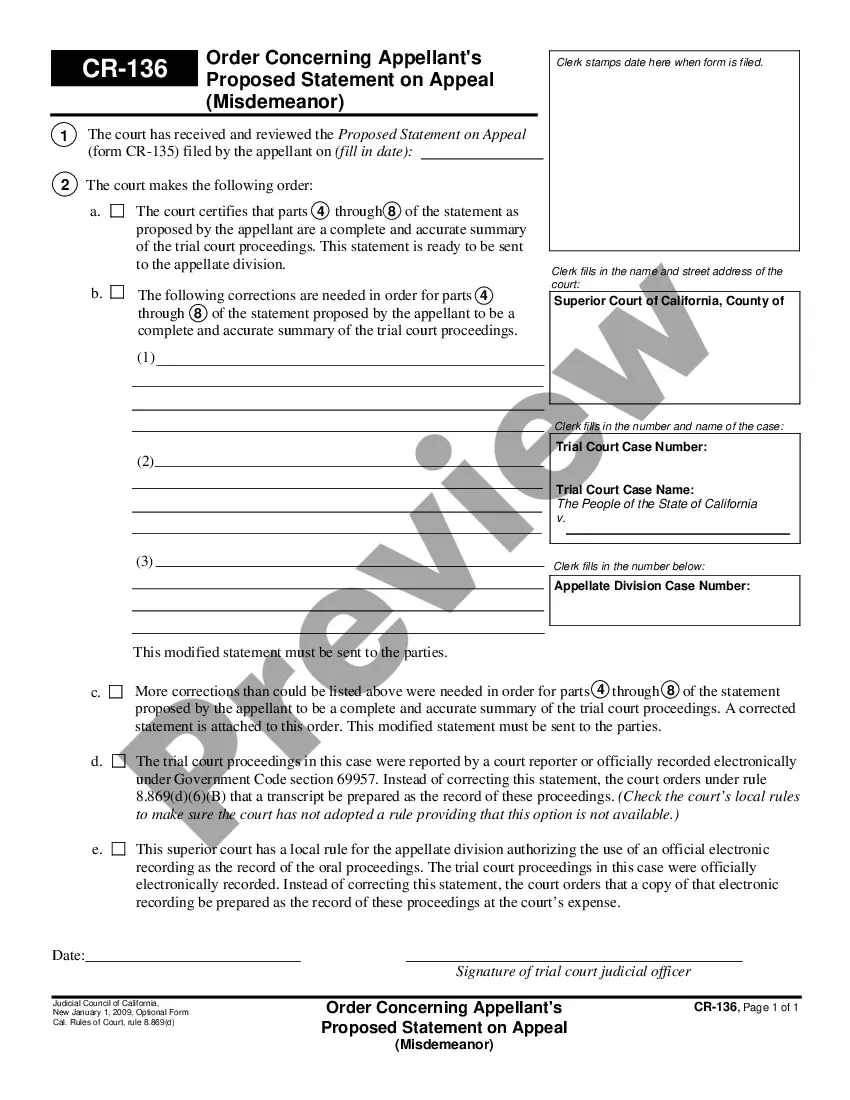

How to fill out Mississippi Notice Of Adverse Action - Non-Employment - Due To Consumer Investigative Report?

If you need to comprehensive, acquire, or produce lawful document layouts, use US Legal Forms, the most important assortment of lawful forms, which can be found on-line. Make use of the site`s simple and easy practical lookup to obtain the paperwork you want. Numerous layouts for business and individual reasons are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Mississippi Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report in a handful of click throughs.

When you are already a US Legal Forms buyer, log in to your profile and click on the Acquire switch to obtain the Mississippi Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report. You can even access forms you previously delivered electronically from the My Forms tab of the profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the form for the correct area/nation.

- Step 2. Utilize the Preview option to examine the form`s content material. Never forget to see the outline.

- Step 3. When you are not happy using the develop, use the Research discipline near the top of the screen to discover other versions of the lawful develop format.

- Step 4. Once you have located the form you want, select the Purchase now switch. Opt for the costs strategy you choose and put your credentials to sign up to have an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the format of the lawful develop and acquire it in your device.

- Step 7. Full, revise and produce or indicator the Mississippi Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report.

Every single lawful document format you get is the one you have eternally. You may have acces to each and every develop you delivered electronically inside your acccount. Select the My Forms portion and decide on a develop to produce or acquire once again.

Contend and acquire, and produce the Mississippi Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report with US Legal Forms. There are millions of specialist and express-certain forms you can utilize for your personal business or individual demands.

Form popularity

FAQ

An investigative consumer report offers insight employers use to gain a better understanding of a person's character through interviews. These are often in the form of personal and/or professional references. When deciding which might be best, ask what information are you trying to gain.

Section 1681a of the Fair Credit Reporting Act defines an investigative consumer report as a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or

Employers routinely obtain consumer reports that include the verification of the applicant/employee's Social Security number; current and previous residences; employment history, including all personnel files; education; references; credit history and reports; criminal history, including records from any criminal

A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments. Increasingly, these records also include your activity on social media, such as Twitter and Facebook.

Essentially, personal or professional reference verification, and employment verification that stray beyond the realm of facts and into personal character assessments and opinions are considered Investigative Consumer Reports.

An investigative consumer report is more like a detailed background check. Facts that create a picture of who you are as a person are included in this kind of report, and the gathering of that information might even include interviews with your neighbors, friends and associates.

When you apply for a job, your prospective employer may use a consumer report to evaluate you as a potential employee. A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through