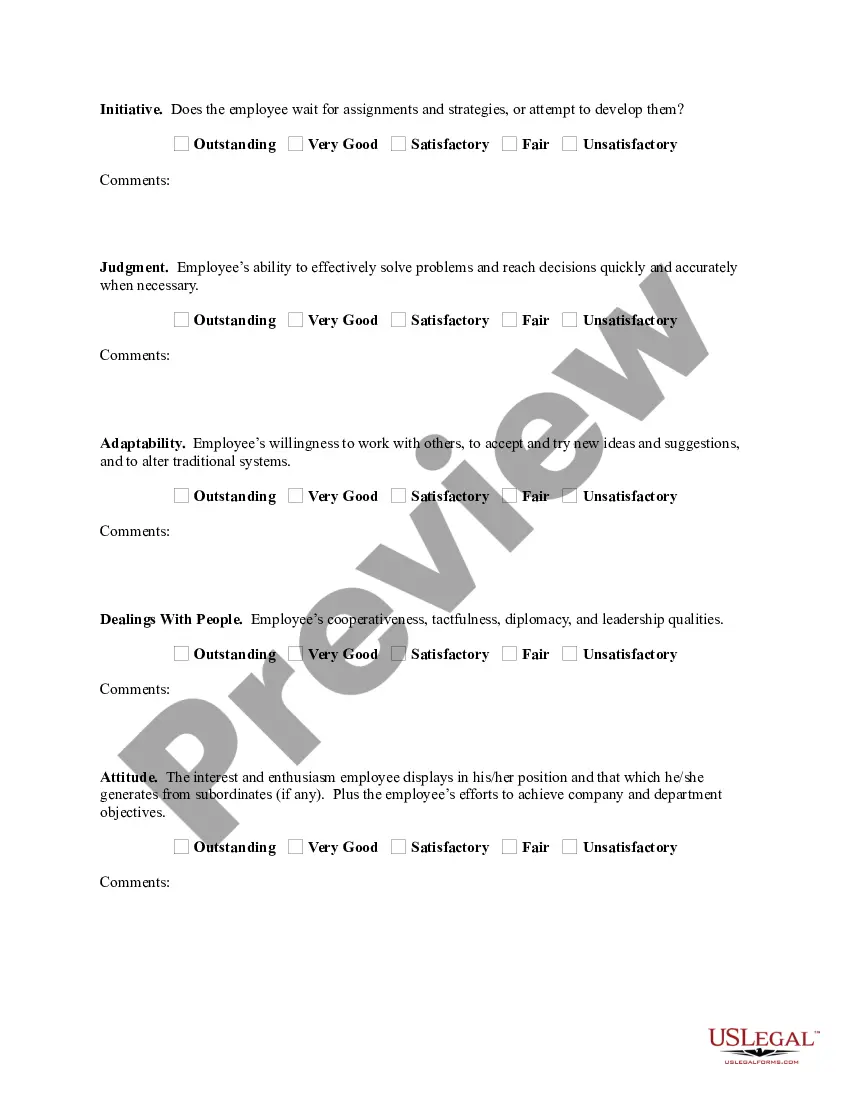

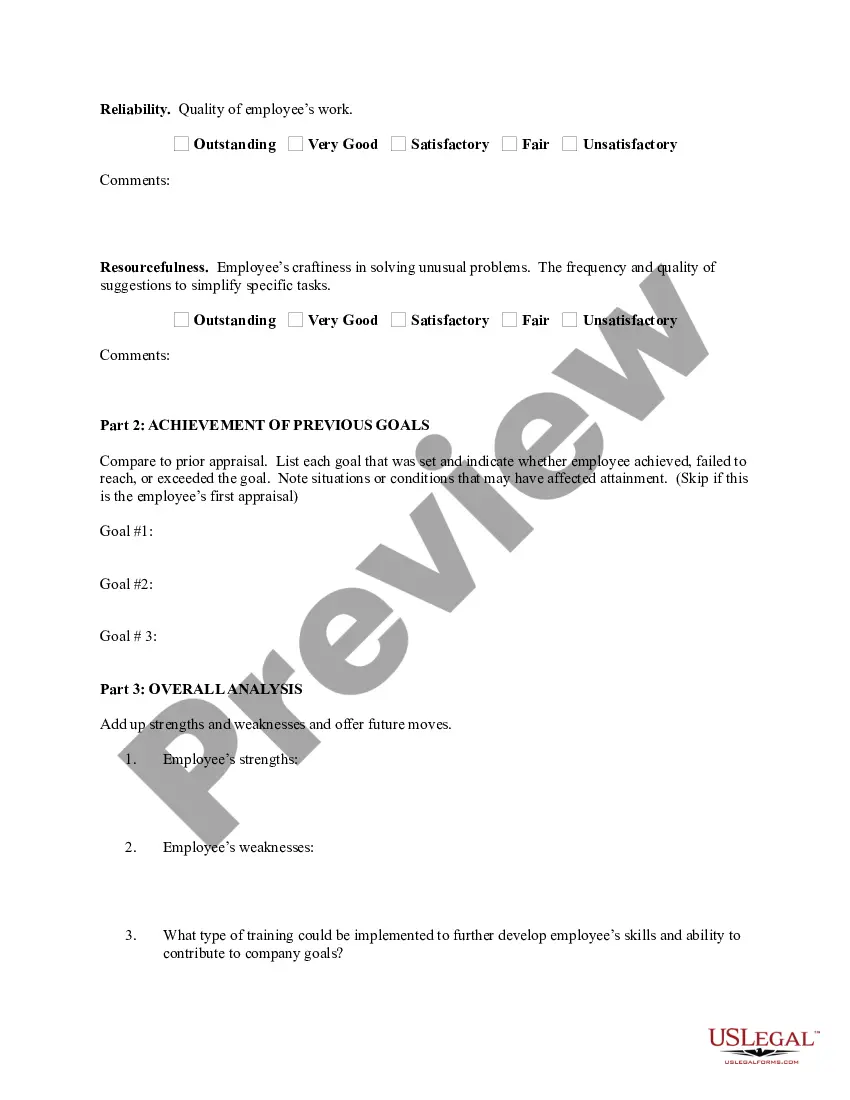

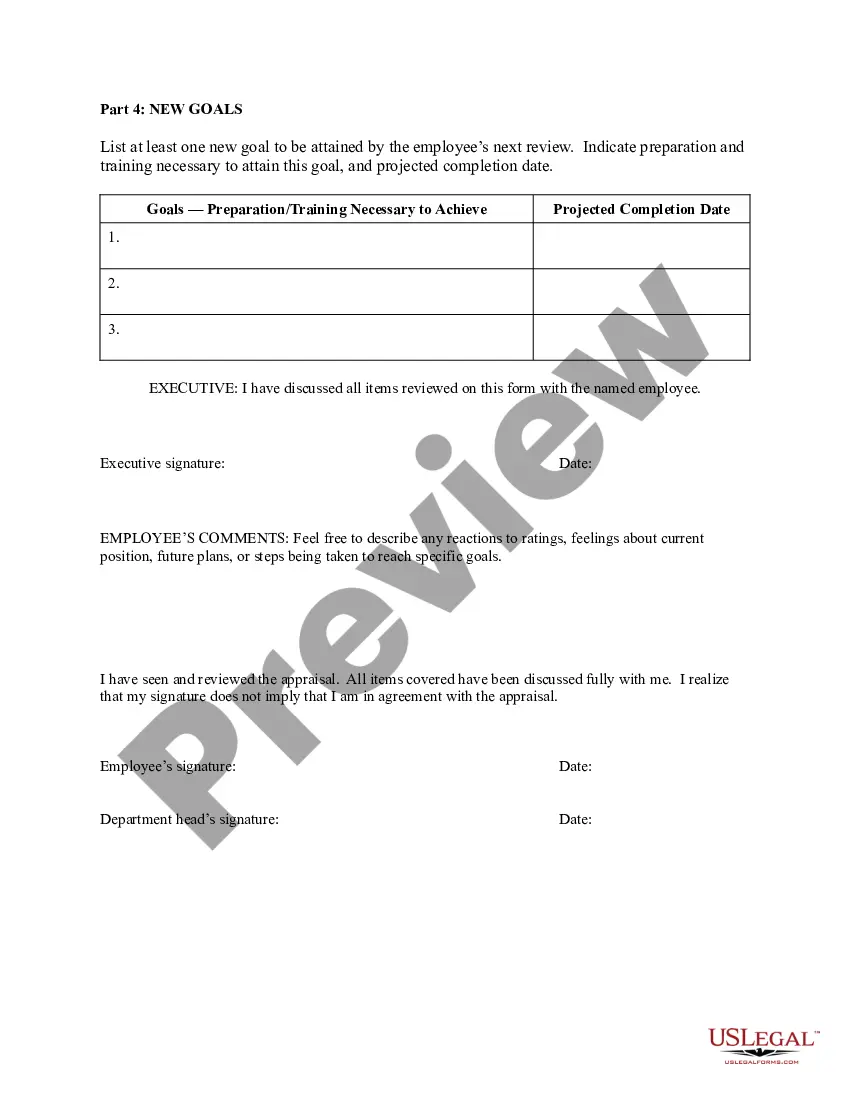

Mississippi Performance Evaluation for Exempt Employees

Description

How to fill out Mississippi Performance Evaluation For Exempt Employees?

Discovering the right legal papers web template might be a have a problem. Needless to say, there are tons of layouts accessible on the Internet, but how will you find the legal kind you will need? Utilize the US Legal Forms internet site. The support gives 1000s of layouts, including the Mississippi Performance Evaluation for Exempt Employees, which can be used for company and private demands. All of the varieties are checked by specialists and meet state and federal requirements.

If you are previously signed up, log in in your account and click on the Down load key to obtain the Mississippi Performance Evaluation for Exempt Employees. Use your account to search from the legal varieties you have acquired previously. Go to the My Forms tab of your account and have yet another copy from the papers you will need.

If you are a brand new customer of US Legal Forms, listed here are easy guidelines so that you can comply with:

- Initially, ensure you have chosen the proper kind for the town/county. It is possible to look through the shape making use of the Preview key and read the shape outline to make sure it will be the right one for you.

- When the kind does not meet your expectations, make use of the Seach discipline to obtain the right kind.

- When you are certain the shape would work, select the Purchase now key to obtain the kind.

- Choose the pricing plan you need and enter the necessary info. Build your account and pay money for an order utilizing your PayPal account or bank card.

- Select the file file format and obtain the legal papers web template in your gadget.

- Full, edit and printing and sign the obtained Mississippi Performance Evaluation for Exempt Employees.

US Legal Forms is the biggest catalogue of legal varieties where you can find different papers layouts. Utilize the company to obtain appropriately-produced documents that comply with express requirements.

Form popularity

FAQ

Performance evaluations are not mandatory, according to the U.S. Department of Labor. They are a matter between you and your employees or your employees' representative. Performance evaluations help you to determine merit increases and come up with employee development strategies.

No law requires companies to conduct job reviews, but businesses that do may have a better understanding of their employees. The information gained from performance reviews can be used to determine raises, succession plans and employee-development strategies.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Exempt Employees must meet basic salary threshold of $913/week $47,476/year) and meet applicable Department of Labor Tests for executive exemption, administrative exemption, professional exemption, or computer exemption. Exempt employees are paid a salary that covers the amount of time required to perform the job.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

Under federal law, it's illegal to discriminate against a worker on the basis of age (over 40), disability, race, nationality, gender, religion or pregnancy status. Many states add additional categories to this list, too.

Performance appraisals can be highly useful in the talent management process and can help ensure that employers are doing their best to retain high-performing employees.

The Fair Labor Standards Act (FLSA) does not require performance evaluations. Performance evaluations are generally a matter of agreement between an employer and employee (or the employee's representative).

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.