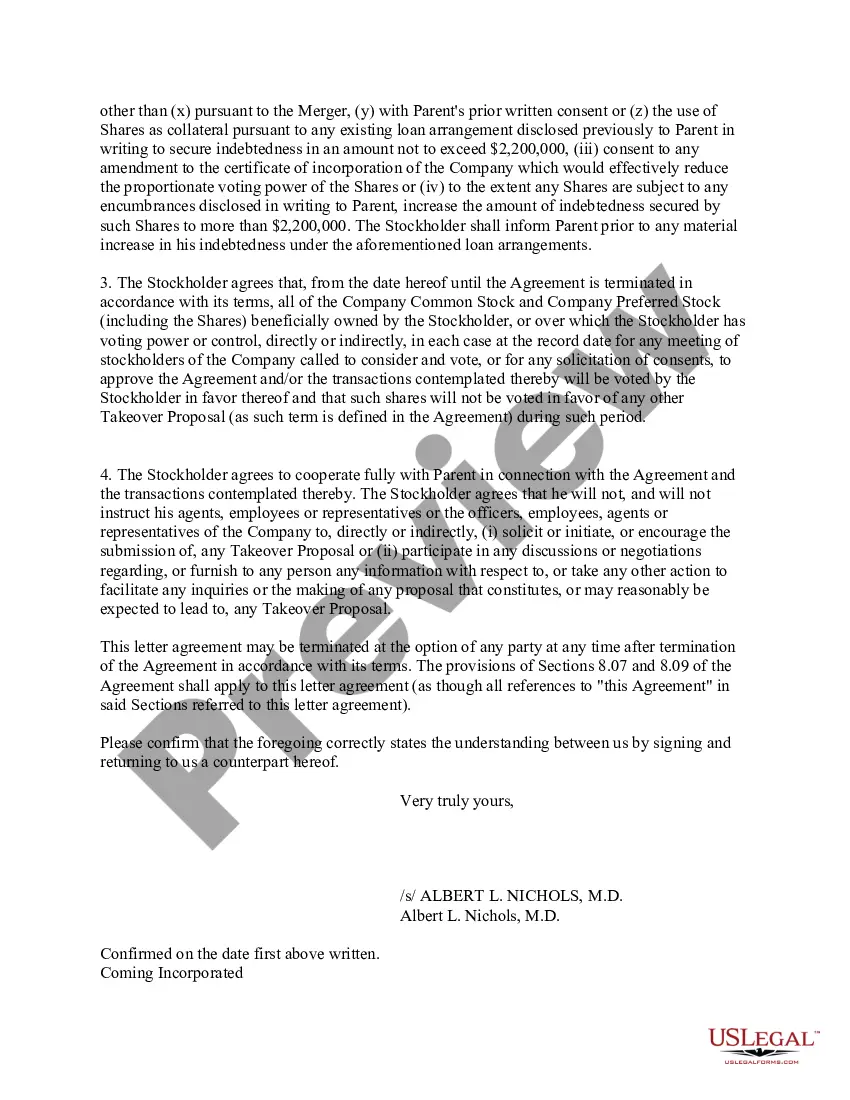

Mississippi Letter agreement

Description

How to fill out Letter Agreement?

Discovering the right legal papers design can be quite a have difficulties. Naturally, there are plenty of templates available on the Internet, but how will you get the legal develop you need? Use the US Legal Forms web site. The support offers a large number of templates, including the Mississippi Letter agreement, which you can use for company and private requirements. All of the forms are inspected by pros and satisfy federal and state requirements.

In case you are presently signed up, log in for your bank account and then click the Acquire option to obtain the Mississippi Letter agreement. Make use of bank account to appear from the legal forms you possess purchased previously. Go to the My Forms tab of your respective bank account and get yet another backup in the papers you need.

In case you are a new consumer of US Legal Forms, listed below are basic directions so that you can stick to:

- Initially, make certain you have chosen the correct develop for your personal town/county. It is possible to look through the form utilizing the Review option and read the form outline to guarantee this is the right one for you.

- In the event the develop fails to satisfy your expectations, make use of the Seach discipline to get the appropriate develop.

- When you are positive that the form is proper, click on the Buy now option to obtain the develop.

- Pick the costs plan you want and enter the necessary details. Design your bank account and pay money for the transaction using your PayPal bank account or Visa or Mastercard.

- Select the file structure and obtain the legal papers design for your product.

- Total, revise and printing and sign the received Mississippi Letter agreement.

US Legal Forms may be the biggest collection of legal forms for which you can discover numerous papers templates. Use the company to obtain expertly-manufactured files that stick to express requirements.

Form popularity

FAQ

Those seven elements are: Identification (Defining all the parties involved) Offer (The agreement) Acceptance (Agreement mirrored by other parties) Mutual consent (Signatory consent of all parties) Consideration (The value exchanged for the offer) Capacity (Legal/mental competence of all parties)

How to write a letter of agreement Title the document. Add the title at the top of the document. ... List your personal information. ... Include the date. ... Add the recipient's personal information. ... Address the recipient. ... Write an introduction paragraph. ... Write your body. ... Conclude the letter.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How do you write a letter of agreement between two parties? Make sure you detail the specifics of the loan, from the name and address of the debtor and lender to the amount loaned, payment method, and terms of the agreement. Both parties will need to sign the agreement as a way to acknowledge its validity.

However, agreement letters almost always contain this information: Contact information for both parties. Location/state whose laws apply to the agreement. Terms and conditions of the business relationship. Terms of payment. Start date of the agreement. End date of the agreement.