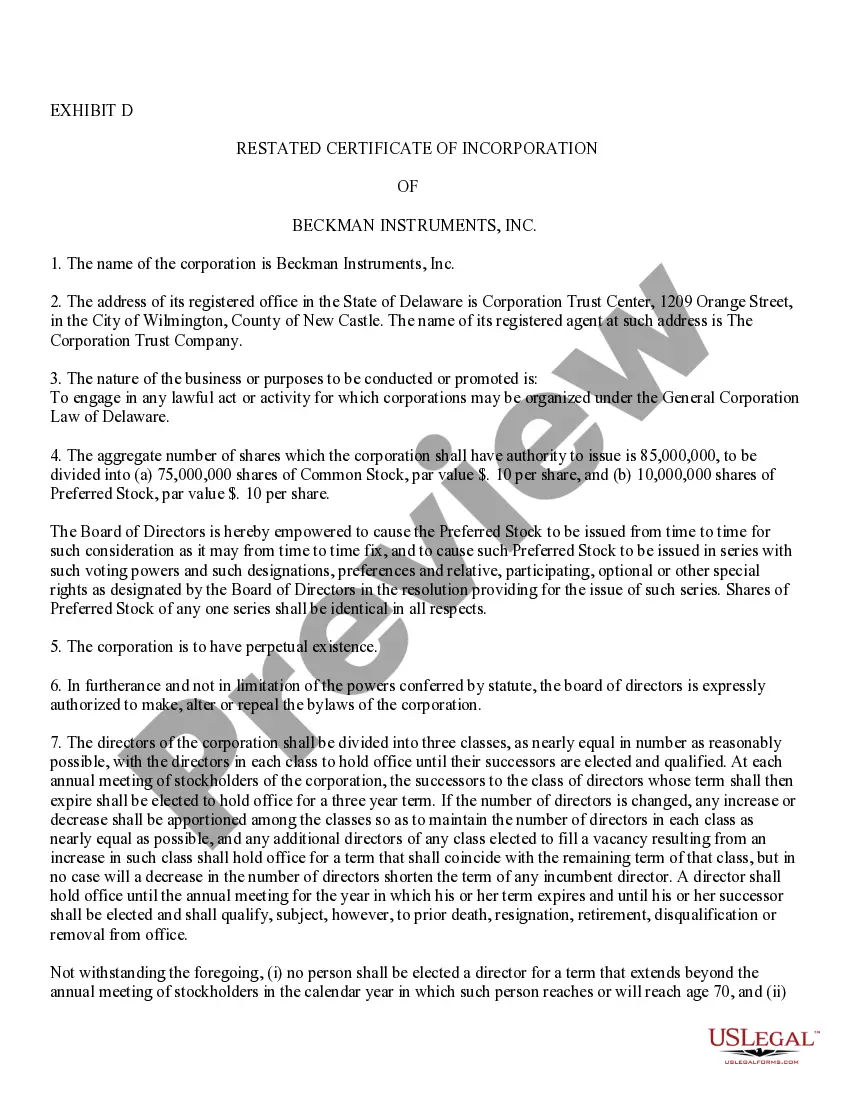

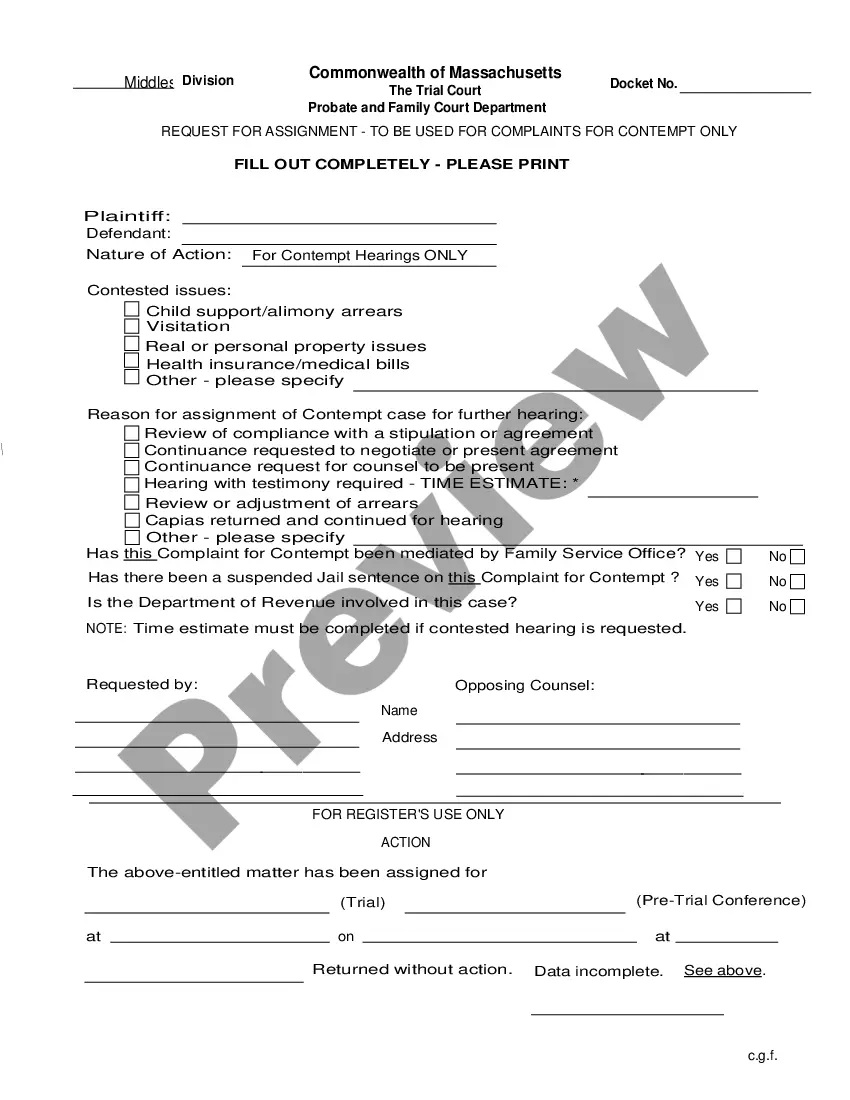

Mississippi Approval of Amendments to Restated Certificate of Incorporation with Amendment When a corporation in Mississippi wishes to make changes to its Restated Certificate of Incorporation, it is required to seek approval from the state. The Approval of Amendments to Restated Certificate of Incorporation is a legal process that allows a corporation to modify its governing document while ensuring compliance with the state's laws and regulations. The Restated Certificate of Incorporation is a foundational document that outlines the key information and provisions concerning the corporation's existence, structure, and operations. It typically includes details such as the corporation's name, purpose, duration, registered agent, and authorized shares of stock. Amendments to this certificate may be necessary due to various reasons, including changes in the corporation's business objectives, ownership structure, or other internal matters. To initiate the Mississippi Approval of Amendments to Restated Certificate of Incorporation, the corporation must submit the required documentation and fees to the Mississippi Secretary of State's office. The relevant form, typically titled "Application for Amendment to Certificate of Incorporation," must accurately articulate the nature of the desired amendment and provide all necessary supporting information. Common types of amendments that may require approval include: 1. Name Change: If the corporation wishes to change its legal name, it must file an amendment reflecting the new name. This process ensures that the corporation's records remain updated and accurate. 2. Purpose Modification: Sometimes, a corporation may need to alter its stated purpose due to changes in its business or strategic direction. This type of amendment clarifies or broadens the corporation's activities or restricts them, depending on the circumstances. 3. Authorized Share Increase/Reduction: When a corporation intends to change the number of authorized shares of stock, an amendment is necessary. This may involve increasing the authorized share capital to accommodate new investors or reducing it due to a decrease in business activities or ownership changes. 4. Director or Officer Changes: If the corporation experiences changes in its board of directors or officers, an amendment may be required to update this information in the Restated Certificate of Incorporation. 5. Capital Structure Modifications: Amendments may be necessary to alter the classes of shares, voting rights, or other aspects of the corporation's capital structure. The approval process for amendments varies depending on the nature of the change and the specific requirements set forth by the Mississippi Secretary of State. The corporation must ensure the accuracy and completeness of the submitted documents to avoid any delays or rejections. Once the Mississippi Secretary of State approves the amendments, the corporation's Restated Certificate of Incorporation will be officially updated. It's crucial for the corporation to keep a copy of the approval documentation and amended certificate for future reference and compliance purposes. In conclusion, the Mississippi Approval of Amendments to Restated Certificate of Incorporation is a vital process that allows corporations to modify their governing documents to reflect changes in their businesses or organizational structures. By following the state's requirements and obtaining the necessary approval, corporations in Mississippi can ensure compliance and maintain an accurate and up-to-date legal framework for their operations.

Mississippi Approval of Amendments to Restated Certificate of Incorporation with Amendment When a corporation in Mississippi wishes to make changes to its Restated Certificate of Incorporation, it is required to seek approval from the state. The Approval of Amendments to Restated Certificate of Incorporation is a legal process that allows a corporation to modify its governing document while ensuring compliance with the state's laws and regulations. The Restated Certificate of Incorporation is a foundational document that outlines the key information and provisions concerning the corporation's existence, structure, and operations. It typically includes details such as the corporation's name, purpose, duration, registered agent, and authorized shares of stock. Amendments to this certificate may be necessary due to various reasons, including changes in the corporation's business objectives, ownership structure, or other internal matters. To initiate the Mississippi Approval of Amendments to Restated Certificate of Incorporation, the corporation must submit the required documentation and fees to the Mississippi Secretary of State's office. The relevant form, typically titled "Application for Amendment to Certificate of Incorporation," must accurately articulate the nature of the desired amendment and provide all necessary supporting information. Common types of amendments that may require approval include: 1. Name Change: If the corporation wishes to change its legal name, it must file an amendment reflecting the new name. This process ensures that the corporation's records remain updated and accurate. 2. Purpose Modification: Sometimes, a corporation may need to alter its stated purpose due to changes in its business or strategic direction. This type of amendment clarifies or broadens the corporation's activities or restricts them, depending on the circumstances. 3. Authorized Share Increase/Reduction: When a corporation intends to change the number of authorized shares of stock, an amendment is necessary. This may involve increasing the authorized share capital to accommodate new investors or reducing it due to a decrease in business activities or ownership changes. 4. Director or Officer Changes: If the corporation experiences changes in its board of directors or officers, an amendment may be required to update this information in the Restated Certificate of Incorporation. 5. Capital Structure Modifications: Amendments may be necessary to alter the classes of shares, voting rights, or other aspects of the corporation's capital structure. The approval process for amendments varies depending on the nature of the change and the specific requirements set forth by the Mississippi Secretary of State. The corporation must ensure the accuracy and completeness of the submitted documents to avoid any delays or rejections. Once the Mississippi Secretary of State approves the amendments, the corporation's Restated Certificate of Incorporation will be officially updated. It's crucial for the corporation to keep a copy of the approval documentation and amended certificate for future reference and compliance purposes. In conclusion, the Mississippi Approval of Amendments to Restated Certificate of Incorporation is a vital process that allows corporations to modify their governing documents to reflect changes in their businesses or organizational structures. By following the state's requirements and obtaining the necessary approval, corporations in Mississippi can ensure compliance and maintain an accurate and up-to-date legal framework for their operations.