Mississippi Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you want to comprehensive, obtain, or print out authorized papers themes, use US Legal Forms, the greatest collection of authorized kinds, which can be found on the web. Take advantage of the site`s simple and hassle-free lookup to discover the papers you will need. Various themes for company and individual purposes are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Mississippi Proposal to Approve Adoption of Employees' Stock Option Plan with a number of mouse clicks.

If you are presently a US Legal Forms client, log in for your bank account and click the Acquire switch to find the Mississippi Proposal to Approve Adoption of Employees' Stock Option Plan. You can also accessibility kinds you previously delivered electronically within the My Forms tab of your own bank account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that proper metropolis/country.

- Step 2. Take advantage of the Preview solution to look through the form`s content. Never overlook to learn the outline.

- Step 3. If you are unsatisfied with all the form, utilize the Lookup field near the top of the display screen to find other variations of your authorized form design.

- Step 4. Once you have located the form you will need, select the Get now switch. Choose the rates strategy you choose and put your accreditations to register for the bank account.

- Step 5. Method the deal. You may use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Select the structure of your authorized form and obtain it on the product.

- Step 7. Full, modify and print out or indication the Mississippi Proposal to Approve Adoption of Employees' Stock Option Plan.

Every single authorized papers design you purchase is your own property for a long time. You might have acces to every form you delivered electronically inside your acccount. Go through the My Forms area and pick a form to print out or obtain once more.

Contend and obtain, and print out the Mississippi Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms. There are millions of expert and status-particular kinds you may use for your personal company or individual requirements.

Form popularity

FAQ

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders.

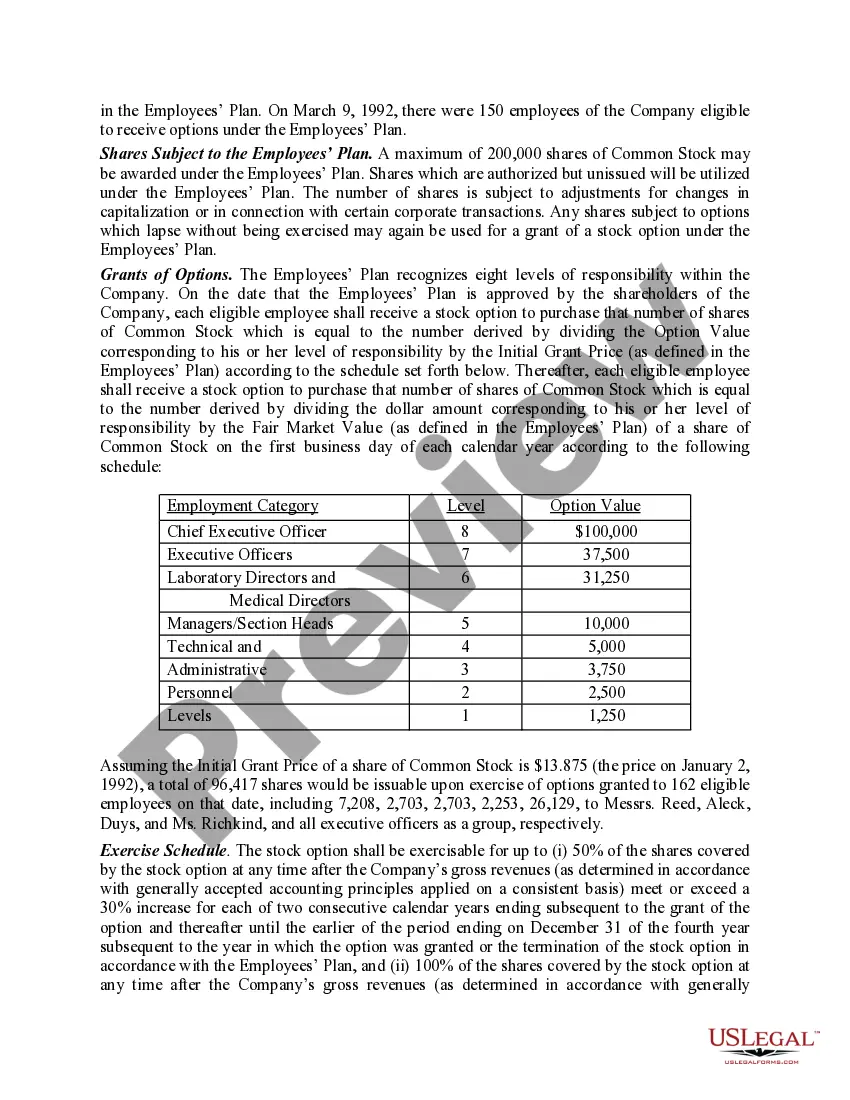

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.