Mississippi Tax Sharing Agreement

Description

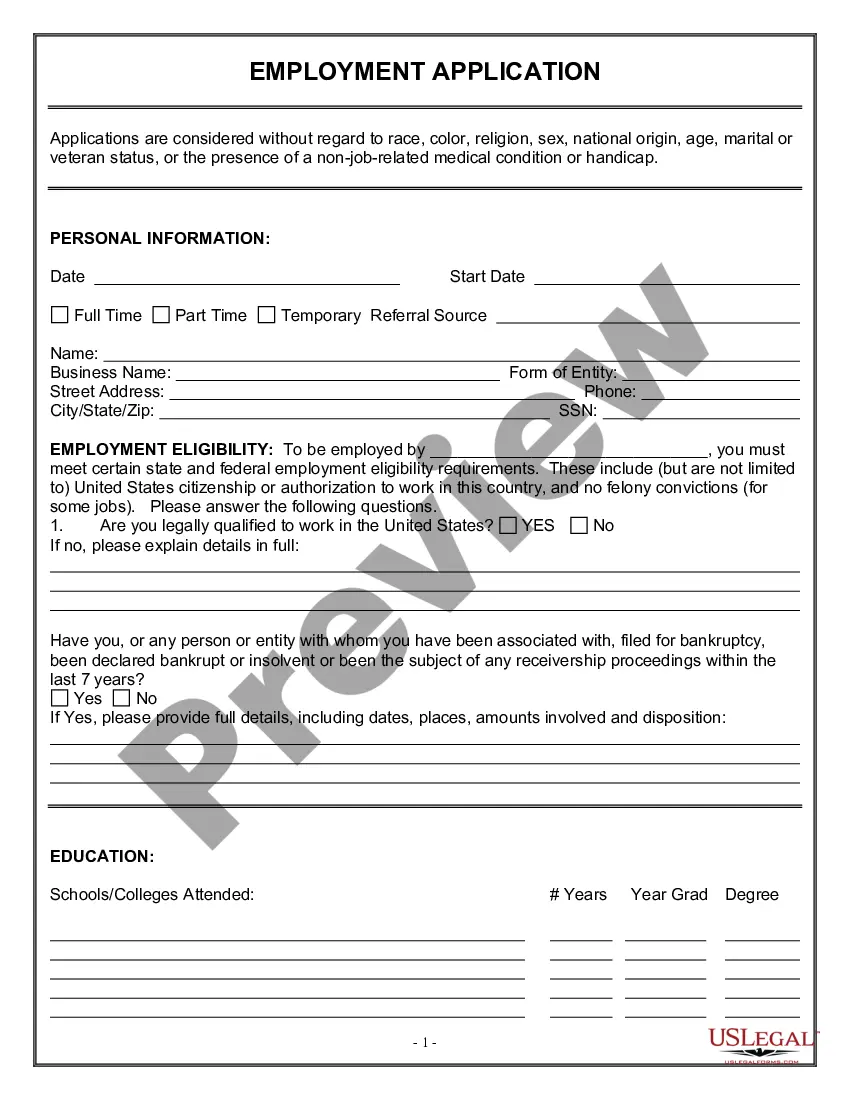

How to fill out Tax Sharing Agreement?

If you want to comprehensive, acquire, or produce authorized document templates, use US Legal Forms, the largest variety of authorized varieties, that can be found online. Utilize the site`s simple and practical lookup to get the paperwork you need. Numerous templates for organization and specific reasons are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the Mississippi Tax Sharing Agreement with a few click throughs.

When you are previously a US Legal Forms consumer, log in in your accounts and then click the Acquire option to obtain the Mississippi Tax Sharing Agreement. You can even accessibility varieties you formerly delivered electronically in the My Forms tab of your accounts.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your correct town/region.

- Step 2. Make use of the Review method to check out the form`s content. Never forget about to read through the explanation.

- Step 3. When you are not satisfied together with the type, take advantage of the Search discipline near the top of the display screen to discover other types of your authorized type design.

- Step 4. When you have located the form you need, click on the Get now option. Choose the prices plan you like and add your credentials to register for the accounts.

- Step 5. Approach the transaction. You may use your charge card or PayPal accounts to perform the transaction.

- Step 6. Select the formatting of your authorized type and acquire it on your gadget.

- Step 7. Comprehensive, modify and produce or sign the Mississippi Tax Sharing Agreement.

Every authorized document design you buy is your own forever. You have acces to every type you delivered electronically in your acccount. Go through the My Forms section and choose a type to produce or acquire again.

Remain competitive and acquire, and produce the Mississippi Tax Sharing Agreement with US Legal Forms. There are thousands of expert and express-certain varieties you can utilize for your organization or specific needs.

Form popularity

FAQ

Mississippi Property Tax Rules Taxes are based on rates and assessed property values determined during the preceding year. For owner-occupied residential properties the assessed value is equal to 10% of market value (also called true value). The rate for all other real estate is 15%.

If you owned and lived in the home for a total of two of the five years before the sale, then up to $250,000 of profit is tax-free (or up to $500,000 if you are married and file a joint return). If your profit exceeds the $250,000 or $500,000 limit, the excess is typically reported as a capital gain on Schedule D.

Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. The state also has relatively low property taxes and relatively moderate sales taxes.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value. The application for exemption must be filed with the individual county on or before April 1.

Real Estate Transfer Taxes Property transfers in the USA are generally subject to transfer taxes. The amount is levied by state authorities, so it will be different for each state. Mississippi does not impose any transfer taxes.

Unlike the federal government, Mississippi makes no distinction between short-term and long-term capital gains ? or even between capital gains and ordinary income. Instead, it taxes all capital gains as ordinary income, using the same rates and brackets as the regular state income tax.