Mississippi Utilization by a REIT of Partnership Structures in Financing Five Development Projects A real estate investment trust (REIT) can leverage the benefits of partnership structures to finance and undertake development projects in the state of Mississippi. By forming partnerships with various stakeholders, a REIT can pool resources and expertise to fund and manage multiple real estate ventures. This article explores the concept of Mississippi utilization by a REIT in financing development projects and sheds light on different partnership structures that can be employed for this purpose. Keywords: REIT, real estate investment trust, Mississippi, utilization, partnership structures, financing, development projects, stakeholders, pooling resources, expertise, ventures. Introduction: Mississippi presents lucrative opportunities for real estate development, attracting Rests seeking to expand their portfolio. To finance and execute multiple projects simultaneously, Rests often utilize partnership structures that allow them to tap into diverse sources of capital, share risks and responsibilities, and leverage expertise. Let's delve into the different types of partnership structures a REIT can employ while financing five development projects in Mississippi. 1. Limited Partnership (LP): Rests may opt for a limited partnership structure, where they serve as general partners and investors contribute capital as limited partners. In this arrangement, limited partners act as passive investors, while the REIT assumes management responsibilities, such as project development, acquisition, and leasing. This structure allows the REIT to access funding from multiple limited partners, diversifying their investment base. 2. Limited Liability Partnership (LLP): A REIT can also establish a limited liability partnership, similar to an LP but with increased liability protection for the partners. LLP offers the advantage of shielding the REIT's general partners from personal liability, ensuring their personal assets remain safeguarded. This structure enhances the attractiveness of the partnership to potential investors, as they have confidence in the REIT's commitment to protect their interests. 3. Joint Ventures (JV): In financing development projects in Mississippi, a REIT can enter into joint ventures with other entities, such as local developers, institutional investors, or construction firms. JV's allow for shared control, risk, and profits. These partnerships can be structured in various ways, with the REIT and the partner contributing capital, knowledge, or expertise proportionately to the venture. JV's can be particularly advantageous when collaborating with entities familiar with the local market and regulatory landscape. 4. Public-Private Partnerships (PPP): For specific large-scale development projects, a REIT might explore public-private partnerships. By partnering with governmental bodies or agencies, the REIT can access public funding, incentives, and subsidies. PPP offer a unique avenue to combine private sector resources and expertise with public infrastructure development goals. These partnerships often involve long-term leases or revenue-sharing arrangements, allowing the REIT to collaborate closely with public entities for mutual benefit. 5. Property-Specific Partnerships: In some cases, a REIT might choose to form partnerships specifically tailored to financing a particular development project. These partnerships can include various stakeholders, such as landowners, construction firms, or local businesses. A property-specific partnership enables the REIT to align the interests of all involved parties and leverage their unique contributions towards the project's success. Conclusion: Maximizing the utilization of partnership structures in financing multiple development projects in Mississippi provides a REIT with several advantages. Whether through limited partnerships, limited liability partnerships, joint ventures, public-private partnerships, or property-specific partnerships, a REIT can effectively pool resources, mitigate risks, and tap into diverse expertise. These partnership structures facilitate the REIT's ability to undertake large-scale real estate ventures while fostering collaborations that contribute to overall project success and collective economic growth in Mississippi.

Mississippi Utilization by a REIT of partnership structures in financing five development projects

Description

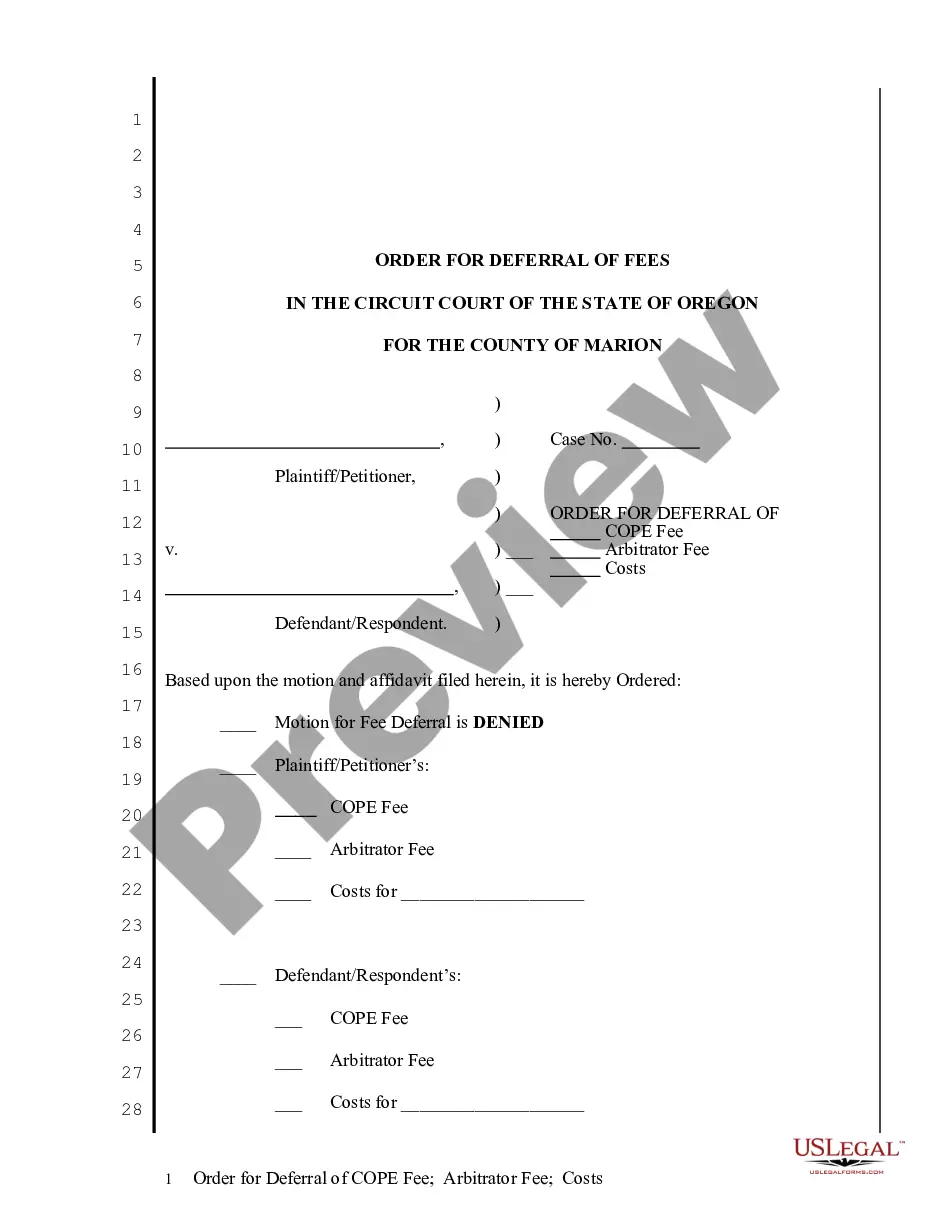

How to fill out Mississippi Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

If you need to full, obtain, or print out legitimate file templates, use US Legal Forms, the greatest assortment of legitimate types, which can be found on-line. Use the site`s simple and easy hassle-free search to discover the documents you want. Different templates for business and personal purposes are sorted by types and claims, or search phrases. Use US Legal Forms to discover the Mississippi Utilization by a REIT of partnership structures in financing five development projects with a number of mouse clicks.

In case you are previously a US Legal Forms client, log in to the accounts and click the Acquire button to find the Mississippi Utilization by a REIT of partnership structures in financing five development projects. You may also access types you earlier delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct metropolis/country.

- Step 2. Utilize the Preview solution to look through the form`s articles. Never forget to learn the explanation.

- Step 3. In case you are not happy with all the develop, take advantage of the Research industry at the top of the display screen to get other variations of your legitimate develop template.

- Step 4. After you have discovered the shape you want, select the Acquire now button. Select the rates program you like and include your qualifications to register for the accounts.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Find the structure of your legitimate develop and obtain it on your own system.

- Step 7. Total, revise and print out or indication the Mississippi Utilization by a REIT of partnership structures in financing five development projects.

Each and every legitimate file template you buy is your own eternally. You might have acces to every develop you delivered electronically with your acccount. Click on the My Forms section and pick a develop to print out or obtain once again.

Compete and obtain, and print out the Mississippi Utilization by a REIT of partnership structures in financing five development projects with US Legal Forms. There are many skilled and express-distinct types you can utilize for your business or personal requirements.

Form popularity

FAQ

Whereas REITs pay dividends to investors, real estate funds aim to generate value through the appreciation of the securities they own. REITs are fundamentally a current-income strategy, as they are required to pay out at least 90% of taxable income each year as dividends to shareholders.

Are REITs Good Investments? Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

In a side-by-side structure, a REIT operates alongside other investment vehicles, such as private equity funds or other non-REIT structures. This arrangement allows investors to choose between traditional REIT investments and alternative investment strategies offered by the other vehicles.

What is the Minimum Investment Amount for Private REITs? Typically $1,000 - $25,000; private REITs that are designed for institutional or accredited investors generally require a much higher minimum investment.

A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns?and in most cases operates?income-producing real estate or related assets. Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

Rise Companies Corp., our sponsor and the parent company of our Manager, is also the parent company of Fundrise, LLC, our affiliate. Fundrise, LLC owns and operates an online investment platform .fundrise.com (the ?Fundrise Platform?).

REITs, or real estate investment trusts, were created by Congress in 1960 to give all individuals the opportunity to benefit from investing in income-producing real estate. REITs allow anyone to own or finance properties the same way they invest in other industries, through the purchase of stock.