The Mississippi Stockholder proposal of Occidental Petroleum Corp. regarding mandatory retirement at age 70 for each officer and director aims to address the company's corporate governance structure. This proposition is intended to bring about age diversity and potentially infuse fresh perspectives into the decision-making process within the organization. By mandating retirement at age 70, the proposal seeks to ensure that there is a regular turnover of leadership positions while promoting the inclusion of newer generations with different experiences and approaches. Keywords: Mississippi, Stockholder proposal, Occidental Petroleum Corp., mandatory retirement, officer, director, age 70, corporate governance, age diversity, decision-making, turnover, leadership positions, newer generations, experiences, approaches. Different types of Mississippi Stockholder proposals related to mandatory retirement at age 70 for officers and directors of Occidental Petroleum Corp. can include: 1. Age Limit Adjustment: This proposal suggests modifying the retirement age from the current age limit to a higher or lower number than 70, depending on the specific needs and circumstances of the corporation. 2. Phased Retirement: This variation proposes a gradual transition instead of a sudden retirement at age 70. Directors and officers would be encouraged to reduce their responsibilities gradually, allowing for a smoother transfer of knowledge and continuity within the company. 3. Exceptions and Extensions: This type of proposal highlights the need for flexibility in certain cases whereby competent officers or directors who have reached the age of 70 can continue serving the company based on their exceptional contributions, expertise, or other relevant factors. 4. Succession Planning and Mentoring: This proposal emphasizes the implementation of an effective succession planning program to ensure a seamless transition of leadership positions. It could also encourage the mentoring of younger executives to prepare them for future roles within the company. 5. Performance Evaluations: A proposal of this nature suggests incorporating regular performance evaluations to assess the competence, abilities, and effectiveness of officers and directors nearing retirement age. This evaluation process could determine whether retirement should be mandatory or if extensions could be granted based on performance. These are potential variations of Mississippi Stockholder proposals pertaining to mandatory retirement at age 70 for officers and directors of Occidental Petroleum Corp. Each proposal aims to address specific aspects of corporate governance, board composition, and leadership renewal within the company.

Mississippi Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70

Description

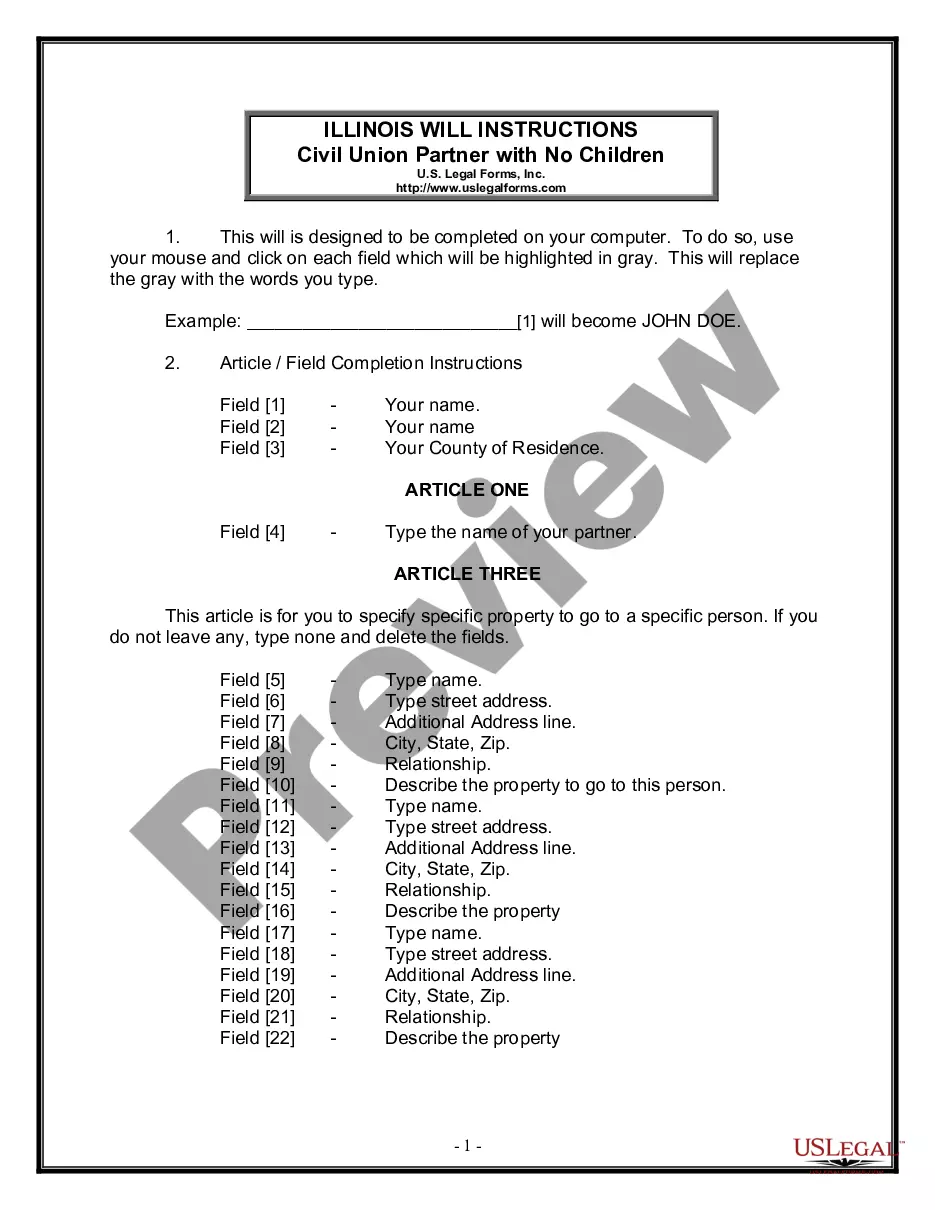

How to fill out Mississippi Stockholder Proposal Of Occidental Petroleum Corp. To Provide That Each Officer And Director Be Subject To Mandatory Retirement At Age 70?

If you have to comprehensive, down load, or print legal record themes, use US Legal Forms, the greatest selection of legal kinds, which can be found on the web. Make use of the site`s easy and convenient research to find the documents you want. Different themes for company and person functions are categorized by types and claims, or keywords. Use US Legal Forms to find the Mississippi Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 in just a few clicks.

If you are presently a US Legal Forms consumer, log in for your accounts and click on the Acquire key to obtain the Mississippi Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70. You can also gain access to kinds you earlier downloaded within the My Forms tab of your accounts.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for your right city/nation.

- Step 2. Take advantage of the Review method to check out the form`s information. Don`t neglect to learn the information.

- Step 3. If you are not satisfied together with the type, use the Look for field towards the top of the display screen to discover other versions in the legal type template.

- Step 4. Upon having found the form you want, click on the Purchase now key. Choose the rates plan you like and add your references to sign up on an accounts.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Find the structure in the legal type and down load it on the system.

- Step 7. Total, edit and print or indication the Mississippi Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70.

Each and every legal record template you buy is your own property permanently. You might have acces to every type you downloaded within your acccount. Click on the My Forms area and choose a type to print or down load yet again.

Remain competitive and down load, and print the Mississippi Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 with US Legal Forms. There are many skilled and state-certain kinds you can use for the company or person needs.

Form popularity

FAQ

The Audit Committee of the Board of Directors of Occidental has selected KPMG LLP as independent auditor to audit the consolidated financial statements of Occidental and its subsidiaries for the year ending December 31, 2021.

Occidental has previously been accused of inflating the role of carbon dioxide removal when it told investors that it could capture 10 gigatonnes by 2030. IPCC author Zeke Hausfather thinks ?carbon dioxide removal is an important part of getting to net zero?.