Mississippi Amendment of Terms of Class B Preferred Stock: A Comprehensive Overview The Mississippi Amendment of terms of Class B preferred stock refers to the legal process by which modifications or alterations are made to the existing terms and conditions of Class B preferred stock in the state of Mississippi. This amendment serves as a mechanism for companies to adjust the rights, preferences, restrictions, and other provisions associated with their Class B preferred stock. Class B preferred stock is a specific class of ownership interest within a company, representing a type of equity security with certain benefits and privileges. Unlike common stock, which is more commonly held by shareholders, preferred stock often carries preferential treatment in terms of dividends, liquidation proceeds, and other shareholder rights. This distinction allows Class B preferred stockholders to enjoy certain advantages over common stockholders when it comes to financial distributions or corporate actions. The Mississippi Amendment allows companies to modify or change various aspects of their Class B preferred stock, tailoring the terms to better suit their evolving business needs or align with market trends. Some commonly modified terms may include dividend rates, voting rights, conversion rights, redemption provisions, anti-dilution protections, and liquidation preferences. The Mississippi Amendment of terms of Class B preferred stock can be applied to various subtypes or series of preferred stock, depending on the needs and objectives of the issuing company. Each series or subtype can have unique features and attributes distinct from other classes of preferred stock within the company. These subtypes may include: 1. Series A-1 Preferred Stock: This subtype of Class B preferred stock may have specific characteristics that differentiate it from other series within the same class. These differences could be related to dividend rates, conversion prices, or liquidation preferences. 2. Series B-1 Preferred Stock: Similar to Series A-1, this subtype has specific attributes and terms that differentiate it from other series of Class B preferred stock. The modifications may include redemption provisions, voting rights, or conversion ratios distinct to this particular series. 3. Series C-1 Preferred Stock: As the series progresses, each subsequent subtype may introduce further modifications to fit varying requirements. Series C-1 may incorporate altered preferences regarding anti-dilution measures or modify provisions related to major corporate actions. It is important to note that the exact nature and naming conventions of different subtypes of Class B preferred stock may vary among companies and depend on their individual organizational documents, bylaws, or articles of incorporation. As such, companies must adhere to applicable state laws and regulations while amending the terms of their Class B preferred stock. In conclusion, the Mississippi Amendment of terms of Class B preferred stock refers to the legal process of making amendments or modifications to the existing terms and provisions associated with Class B preferred stock. This amendment allows companies to tailor the rights, preferences, restrictions, and other provisions to suit their specific needs and objectives. Various subtypes or series of Class B preferred stock may exist, such as Series A-1, Series B-1, and Series C-1, each with unique characteristics and attributes defined by the issuing company.

Mississippi Amendment of terms of Class B preferred stock

Description

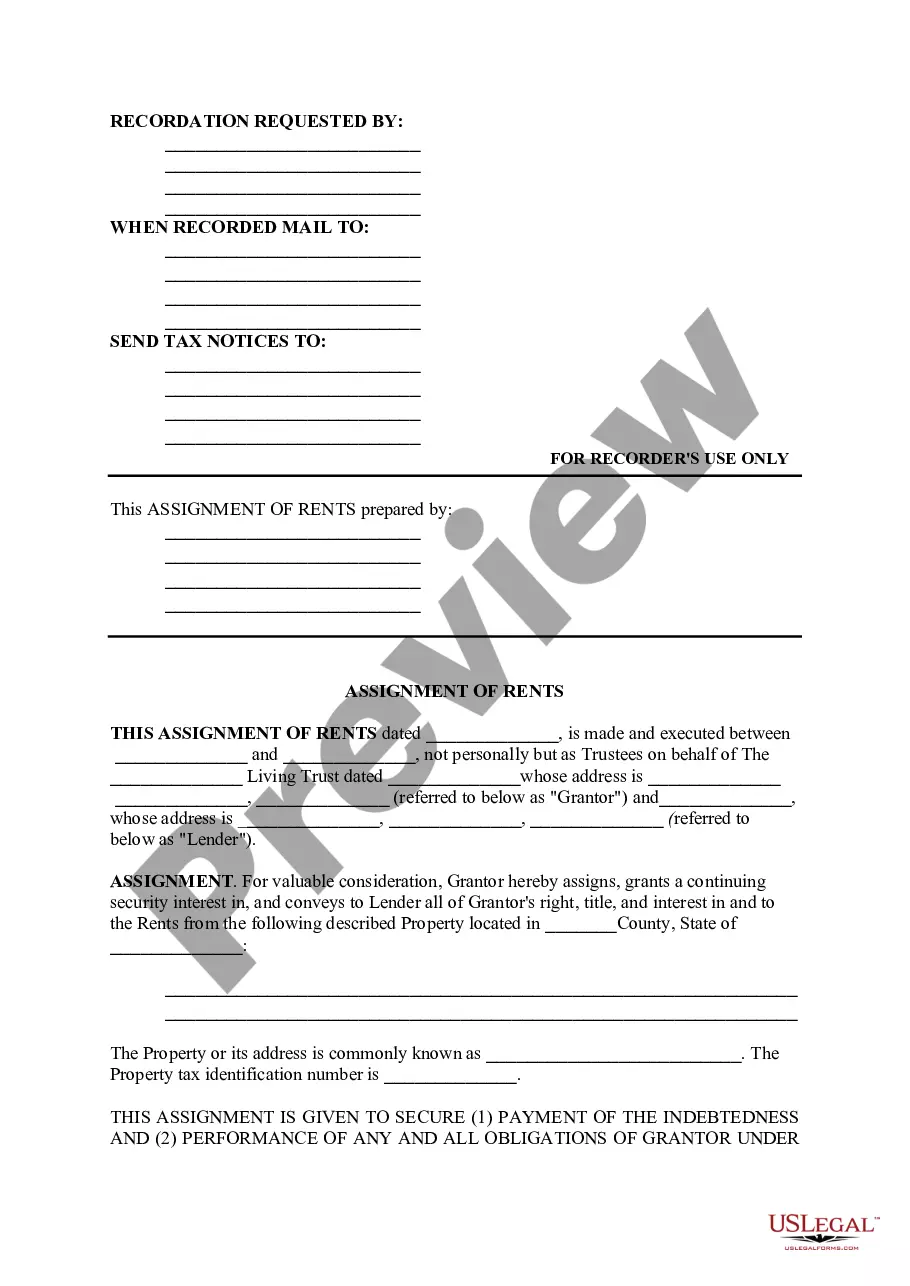

How to fill out Mississippi Amendment Of Terms Of Class B Preferred Stock?

You are able to devote time online attempting to find the lawful papers format that suits the state and federal demands you need. US Legal Forms gives a large number of lawful forms which can be reviewed by pros. You can easily acquire or print the Mississippi Amendment of terms of Class B preferred stock from your service.

If you have a US Legal Forms bank account, it is possible to log in and then click the Acquire button. Afterward, it is possible to comprehensive, modify, print, or signal the Mississippi Amendment of terms of Class B preferred stock. Every single lawful papers format you buy is your own eternally. To get an additional copy of any obtained kind, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site the very first time, adhere to the basic directions beneath:

- Initially, ensure that you have chosen the correct papers format for the state/metropolis of your choice. Look at the kind description to ensure you have picked the correct kind. If offered, utilize the Review button to appear through the papers format as well.

- If you would like locate an additional variation of your kind, utilize the Search field to discover the format that fits your needs and demands.

- Upon having discovered the format you need, just click Purchase now to continue.

- Choose the prices program you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can utilize your bank card or PayPal bank account to fund the lawful kind.

- Choose the formatting of your papers and acquire it for your device.

- Make alterations for your papers if needed. You are able to comprehensive, modify and signal and print Mississippi Amendment of terms of Class B preferred stock.

Acquire and print a large number of papers themes making use of the US Legal Forms website, that provides the most important assortment of lawful forms. Use specialist and express-certain themes to deal with your small business or personal requires.

Form popularity

FAQ

Class F Shares are a particular breed of Preferred Stock issued only to founders. The shares are bestowed with super-voting rights: each Class F Share is equal to 10 Class A Shares.

Blank check preferred stock facilitates the ability of the company to adopt a "white squire" defense when faced with a hostile bid, which involves sale to a friendly party (i.e., a party that is interested in making an investment in, but presumably is not seeking to gain control of, the target) of a block of the ...

A Shares typically come with full voting and pre-emption rights, whereas B shares do not. Usually, investors will pay over a certain amount to receive the full rights that come with A shares, an average of £1,000 - £4,000, but this is a decision for each company to make for themselves.

Cumulative preferred stock includes a provision that requires the company to pay shareholders all dividends, including those that were omitted in the past, before the common shareholders are able to receive their dividend payments. These dividend payments are guaranteed but not always paid out when they are due.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

Stockholder approval is initially required to authorize a class of blank check preferreds, but the board thereafter has broad discretion to fix the terms of the issue. The preferred shares could be given special voting rights or be convertible to common stock, which is useful in a hostile takeover bid defense.

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.

A blank check company stock is a publicly-listed stock of a developmental-stage company with no established business plan or operations. These companies are often formed with the intent of either purchasing or merging with a private company.