Title: Understanding the Mississippi Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. Introduction: In the realm of corporate restructuring, mergers often serve as crucial strategic moves to enhance growth and expand market presence. This article delves into the intricacies of the Mississippi Agreement and Plan of Merger, as executed by Gel co Corp. and Grossman Corp. The Mississippi Agreement can take various forms, tailoring to specific merger requirements. Let's explore these variations in detail below. 1. Definition and Purpose: The Mississippi Agreement and Plan of Merger refers to a legally binding contract that outlines the terms and conditions agreed upon by two or more companies, namely Gel co Corp. and Grossman Corp., to consolidate their businesses. The primary objective is to facilitate a merger transaction that amalgamates the assets, liabilities, and operations of both entities, resulting in a single corporate entity. 2. Formation of the Agreement: The Mississippi Agreement and Plan of Merger is established following careful negotiations, due diligence, and approved by the respective boards of Gel co Corp. and Grossman Corp. All contractual specifications are incorporated, ensuring legal compliance and transparency throughout the merger process. 3. Key Components: The agreement includes several crucial components that determine the terms of the merger. These components may vary depending on the specific type of Mississippi Agreement and Plan of Merger, which are as follows: a) Stock-for-Stock Merger: In a stock-for-stock merger, shareholders of Gel co Corp. exchange their shares for shares of Grossman Corp. This type of merger is often chosen when both firms aim to combine their resources and expertise without any immediate financial implications. The terms of the issuance and exchange of stock are detailed within the agreement. b) Cash Merger: A cash merger involves the acquisition of Gel co Corp. by Grossman Corp. for a predetermined amount of cash. This type of merger frequently occurs when Gel co Corp. faces financial distress or when Grossman Corp. seeks to expand its assets considerably. c) Assets Acquisition Merger: With assets acquisition mergers, Grossman Corp. acquires specific assets of Gel co Corp., such as patents, trademarks, intellectual property, or facilities. This type of merger allows Grossman Corp. to strengthen its market position within a particular industry or geographical location. d) Subsidiary Merger: In this type of merger, Gel co Corp. becomes a subsidiary of Grossman Corp., providing streamlined control and operational benefits. Subsidiary mergers offer flexibility in managing diverse business units while leveraging synergies and maximizing profitability. 4. Terms and Conditions: The Mississippi Agreement and Plan of Merger outline terms and conditions that both Gel co Corp. and Grossman Corp. must adhere to throughout and after the merger process. These include financial implications, voting rights, transfer of assets and liabilities, employee considerations, tax implications, and any other relevant details necessary to ensure a smooth transition. Conclusion: The Mississippi Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. is a crucial step towards achieving organizational growth and market consolidation. By analyzing the different types of mergers that can be executed under the Mississippi Agreement, it becomes evident that the agreement allows for flexibility, enabling the corporations to tailor their merger to their unique circumstances and strategic objectives.

Mississippi Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

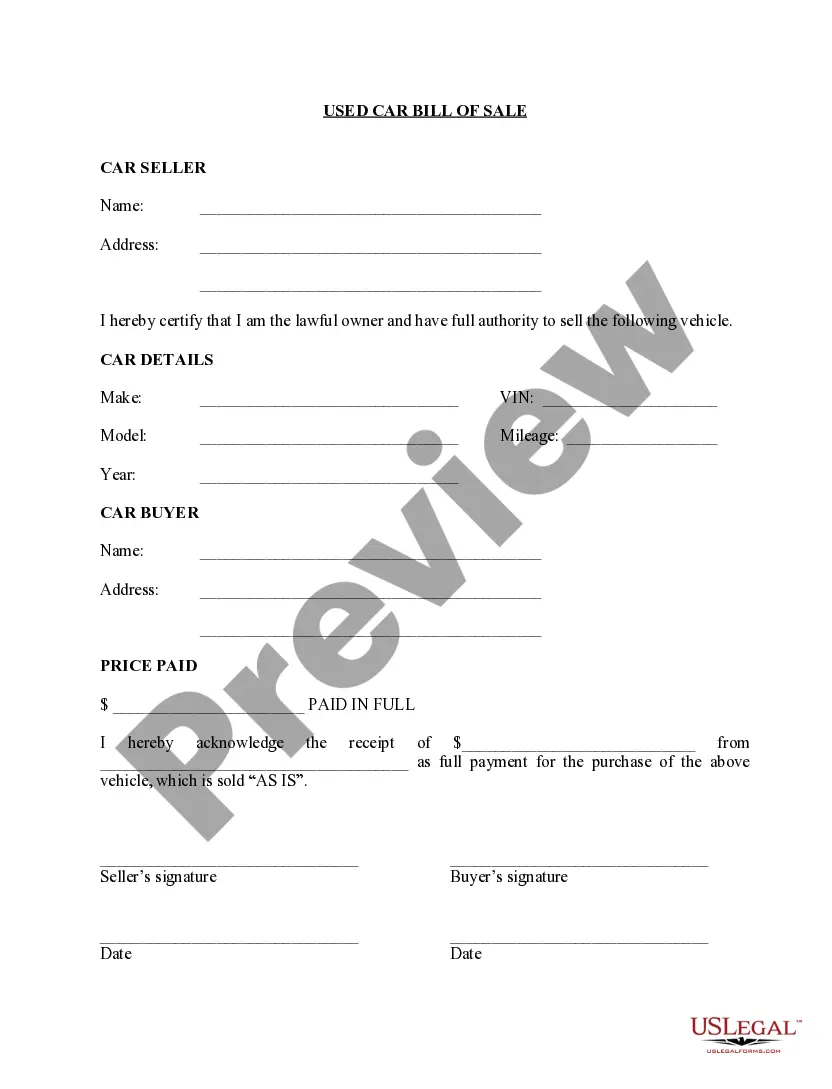

How to fill out Mississippi Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

If you need to total, down load, or print lawful document themes, use US Legal Forms, the biggest assortment of lawful types, that can be found on the web. Use the site`s simple and easy practical search to get the papers you will need. Different themes for organization and person uses are sorted by categories and claims, or search phrases. Use US Legal Forms to get the Mississippi Agreement and plan of merger by Gelco Corp. and Grossman Corp. within a handful of click throughs.

When you are presently a US Legal Forms customer, log in to your profile and click the Obtain key to find the Mississippi Agreement and plan of merger by Gelco Corp. and Grossman Corp.. You can even accessibility types you formerly acquired within the My Forms tab of your profile.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for the right metropolis/land.

- Step 2. Take advantage of the Review solution to look through the form`s content material. Do not forget to read the explanation.

- Step 3. When you are unsatisfied with all the type, take advantage of the Lookup area on top of the screen to get other versions of the lawful type design.

- Step 4. Once you have discovered the shape you will need, click on the Get now key. Opt for the rates strategy you favor and add your references to register for the profile.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal profile to perform the transaction.

- Step 6. Find the formatting of the lawful type and down load it on the product.

- Step 7. Total, change and print or sign the Mississippi Agreement and plan of merger by Gelco Corp. and Grossman Corp..

Each and every lawful document design you purchase is your own eternally. You possess acces to every type you acquired inside your acccount. Select the My Forms section and select a type to print or down load once again.

Contend and down load, and print the Mississippi Agreement and plan of merger by Gelco Corp. and Grossman Corp. with US Legal Forms. There are many skilled and condition-certain types you can use for your personal organization or person demands.