Mississippi Proxy Statement - Neuberger and Berman - with exhibits

Description

How to fill out Proxy Statement - Neuberger And Berman - With Exhibits?

Are you presently in a placement the place you will need papers for both enterprise or individual reasons just about every time? There are a variety of legitimate papers templates available on the net, but discovering ones you can trust is not easy. US Legal Forms provides a large number of form templates, such as the Mississippi Proxy Statement - Neuberger and Berman - with exhibits, that happen to be composed to meet federal and state needs.

When you are already knowledgeable about US Legal Forms site and have an account, just log in. After that, you can download the Mississippi Proxy Statement - Neuberger and Berman - with exhibits template.

If you do not come with an account and would like to begin using US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for that appropriate town/region.

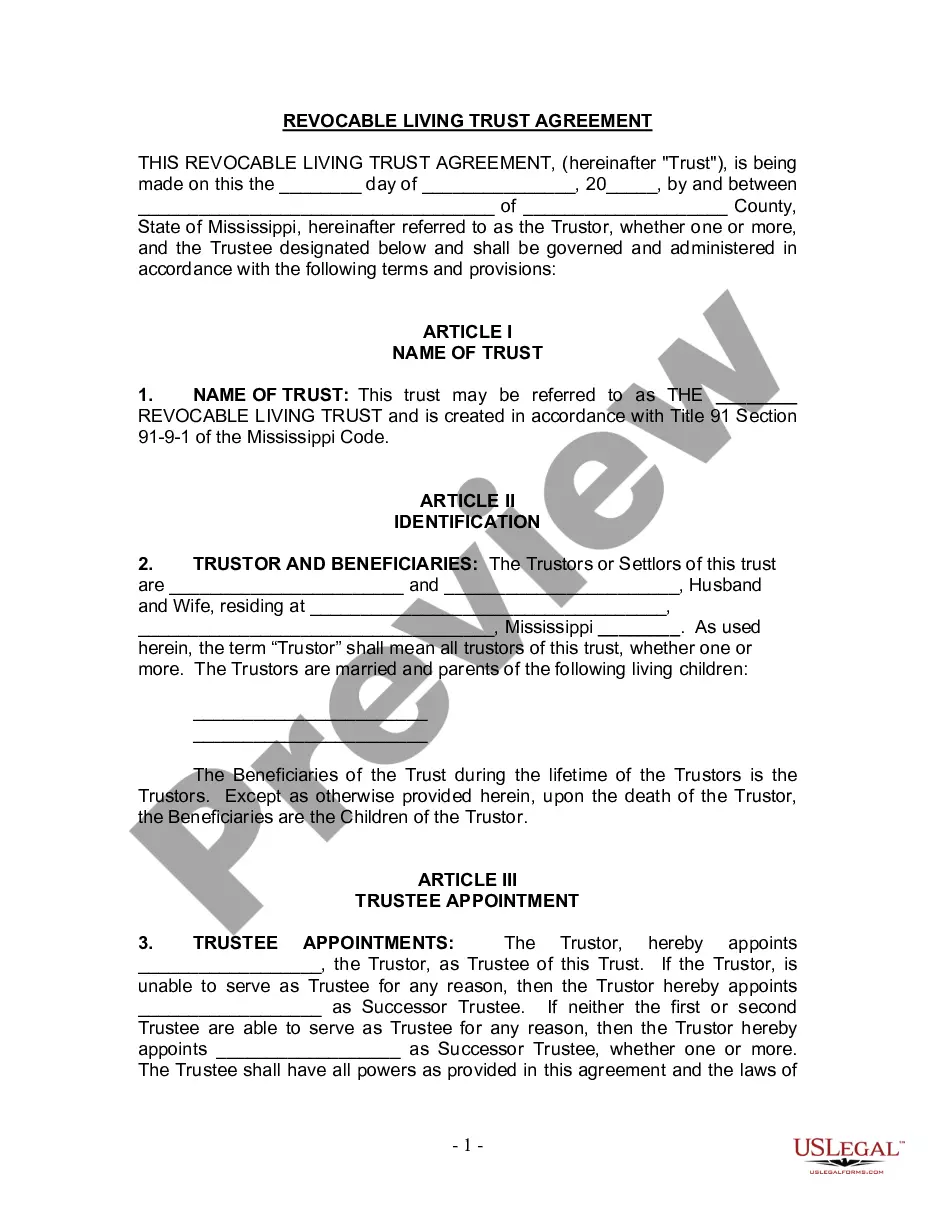

- Utilize the Preview switch to check the shape.

- Browse the outline to ensure that you have chosen the correct form.

- In case the form is not what you`re trying to find, make use of the Lookup area to find the form that meets your needs and needs.

- If you find the appropriate form, click Get now.

- Select the pricing strategy you would like, fill in the required info to produce your money, and purchase an order with your PayPal or Visa or Mastercard.

- Pick a handy data file format and download your backup.

Discover all of the papers templates you may have bought in the My Forms menus. You can aquire a more backup of Mississippi Proxy Statement - Neuberger and Berman - with exhibits anytime, if required. Just click on the necessary form to download or printing the papers template.

Use US Legal Forms, one of the most substantial assortment of legitimate kinds, to save lots of time as well as stay away from faults. The service provides expertly manufactured legitimate papers templates which you can use for a range of reasons. Make an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Preference shareholders don't have voting rights, whereas equity shares have voting rights. Q. Equity shareholders have a right to________.

Neuberger Berman generally believes in the alignment of voting rights with economic interest (i.e., one vote, one share).

A proxy statement generally includes the names and short biographies of individuals on a company's board of directors, including those who are running for reelection and new candidates chosen by the board's nominating committee.

Ultimately, we aim to prioritize engagement that is expected to have a high impact on the protection of and improvement to the value of our clients' assets, be it through the advancement of actionable disclosure, understanding of risks and risk management at an issuer, or through influence and action to mitigate risks ...