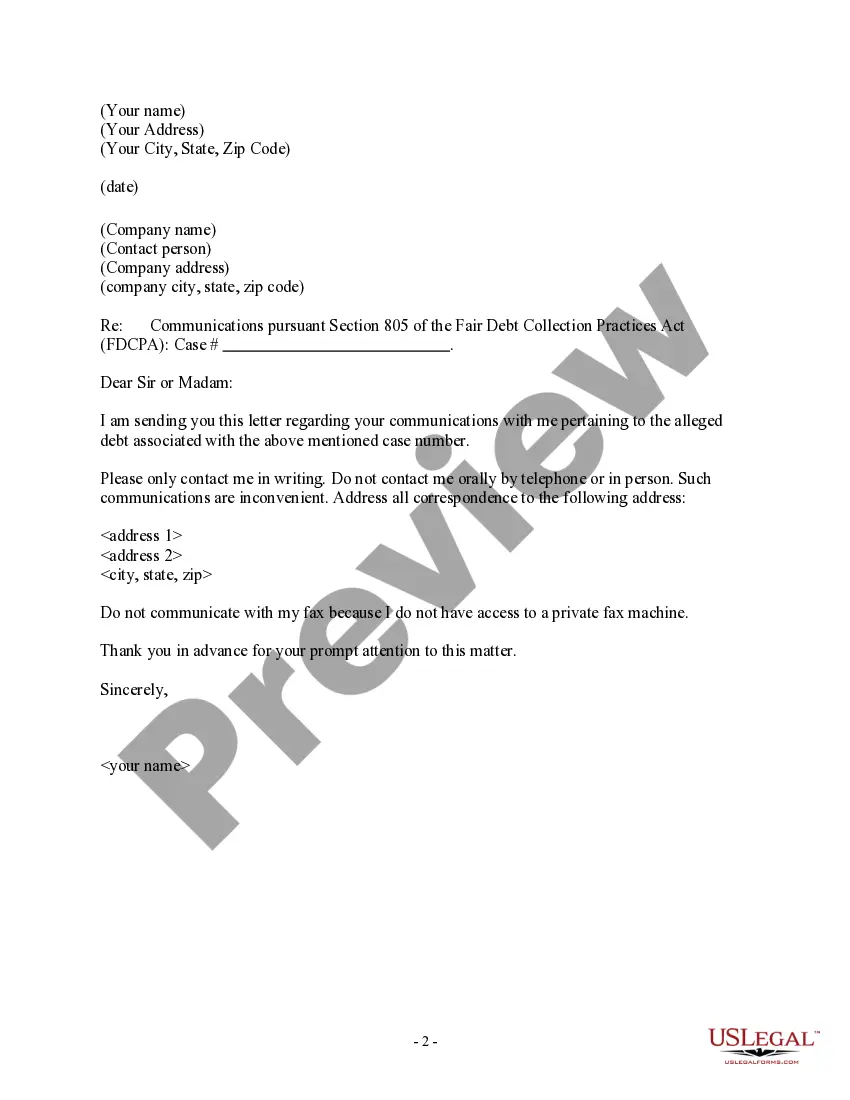

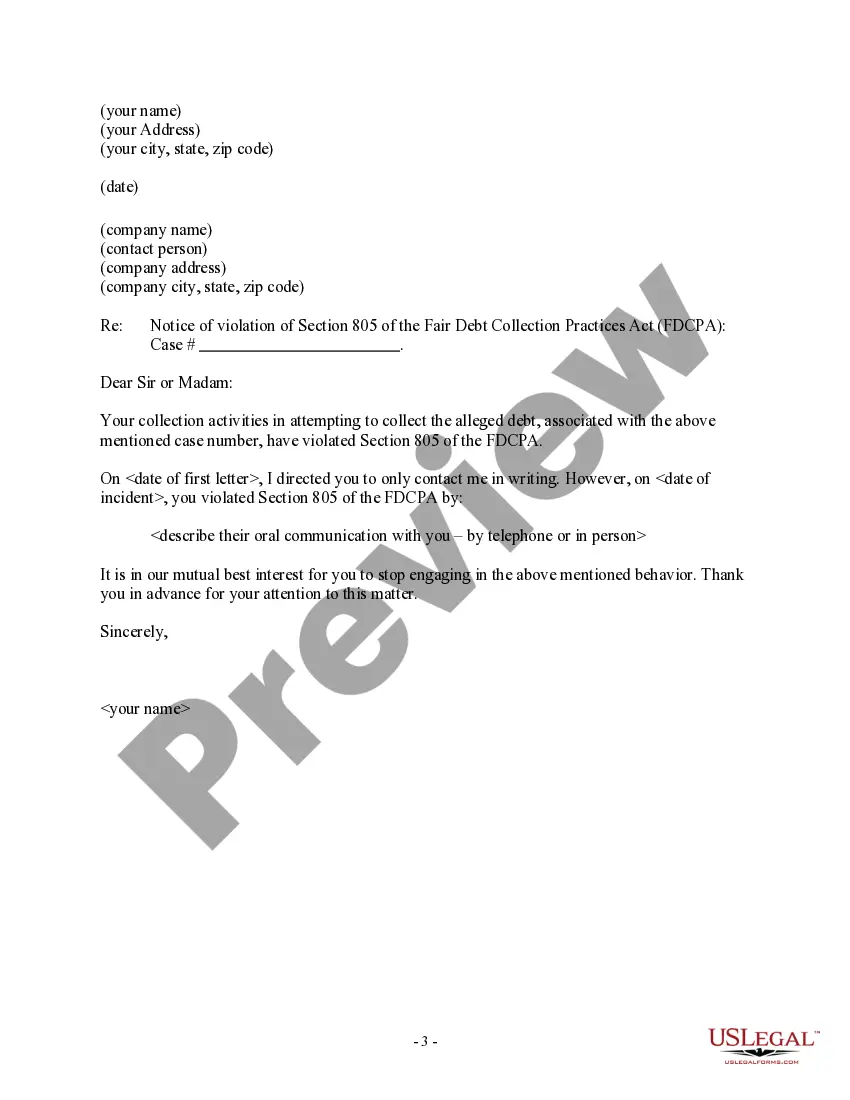

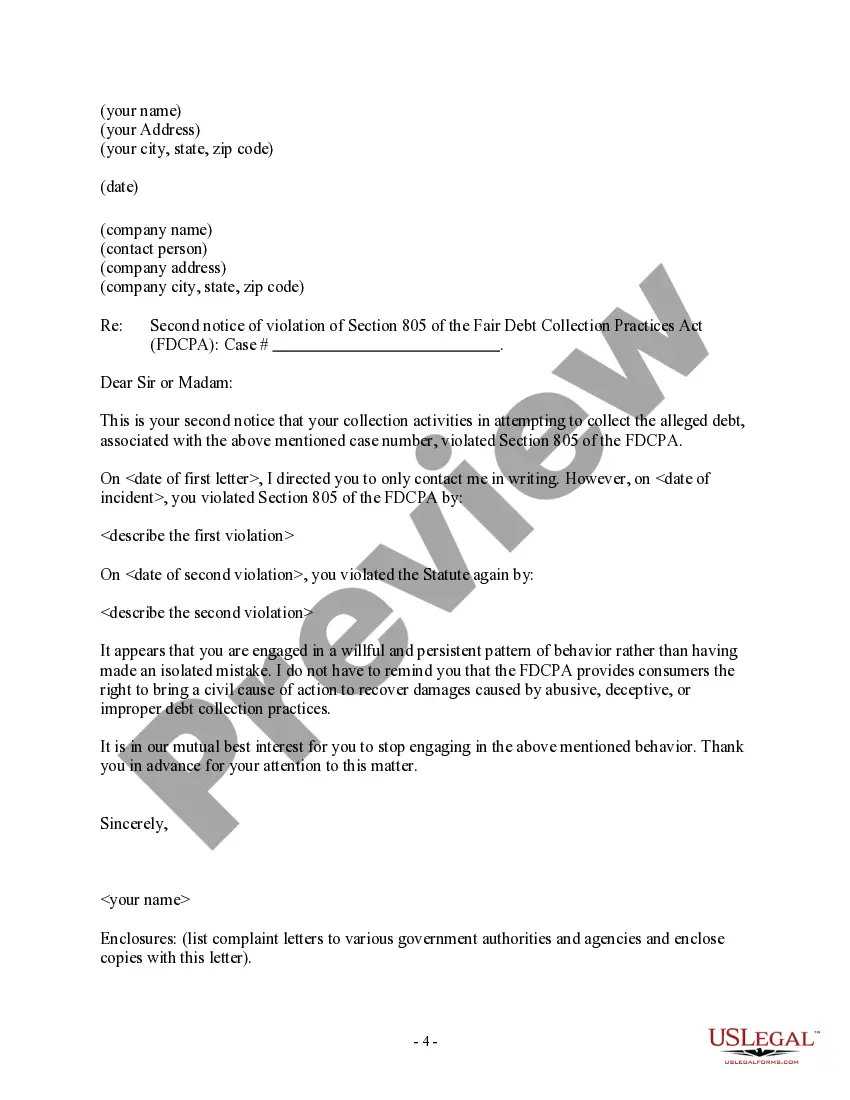

Mississippi Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Mississippi Letter To Debt Collector - Only Contact Me In Writing?

If you have to total, down load, or print out lawful record web templates, use US Legal Forms, the biggest assortment of lawful forms, that can be found on-line. Make use of the site`s simple and easy handy research to obtain the files you require. Various web templates for business and person uses are categorized by types and claims, or keywords and phrases. Use US Legal Forms to obtain the Mississippi Letter to Debt Collector - Only Contact Me In Writing with a number of clicks.

In case you are currently a US Legal Forms customer, log in to your profile and click on the Down load switch to find the Mississippi Letter to Debt Collector - Only Contact Me In Writing. You can even entry forms you in the past acquired from the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that appropriate area/nation.

- Step 2. Use the Preview solution to look over the form`s information. Don`t overlook to read the outline.

- Step 3. In case you are not satisfied with the type, make use of the Search discipline near the top of the screen to find other variations in the lawful type web template.

- Step 4. Once you have located the form you require, click the Buy now switch. Pick the rates strategy you choose and add your credentials to sign up for an profile.

- Step 5. Approach the transaction. You can use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Find the formatting in the lawful type and down load it on your own product.

- Step 7. Full, edit and print out or signal the Mississippi Letter to Debt Collector - Only Contact Me In Writing.

Each and every lawful record web template you buy is your own property eternally. You may have acces to every type you acquired inside your acccount. Click the My Forms section and choose a type to print out or down load yet again.

Compete and down load, and print out the Mississippi Letter to Debt Collector - Only Contact Me In Writing with US Legal Forms. There are thousands of expert and state-specific forms you can utilize for the business or person demands.

Form popularity

FAQ

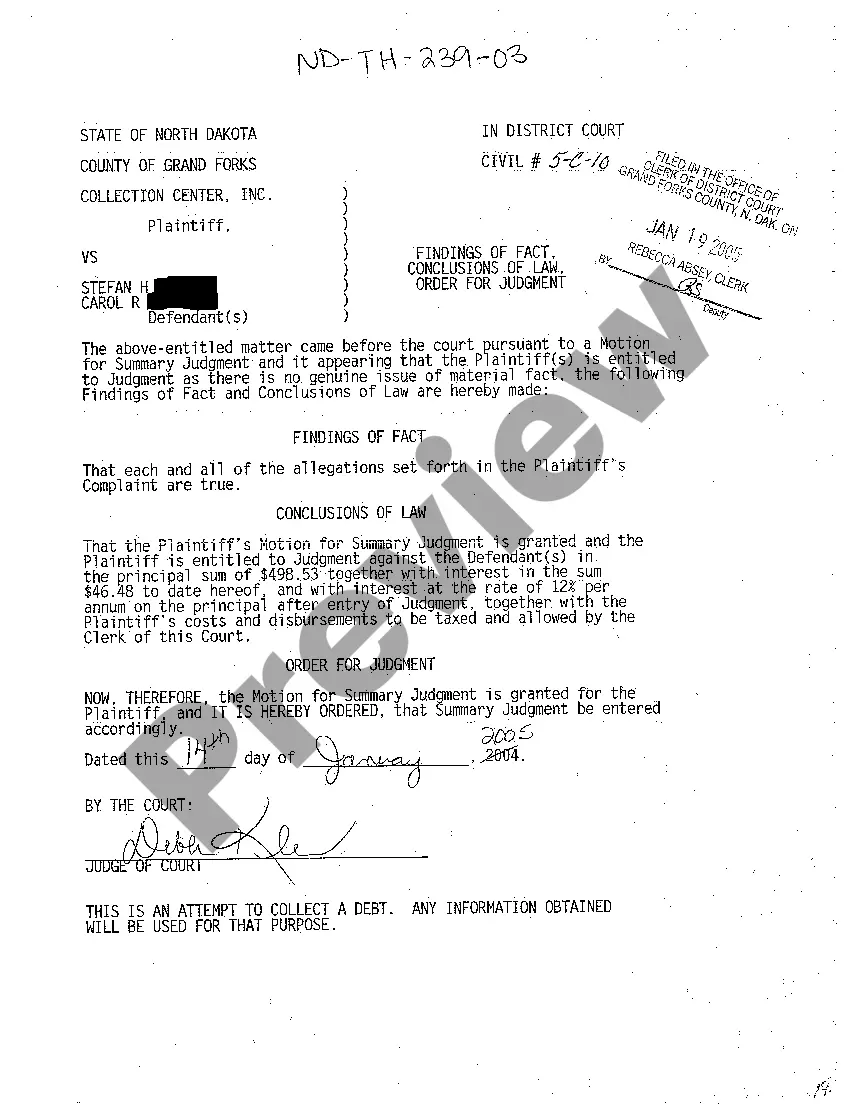

The statute of limitations for debt collection under Mississippi law is typically 3 years but there are exceptions. If the statute of limitations has passed, you can no longer be sued for the debt and you can ignore the debt collector.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

The statute of limitations for debt collection under Mississippi law is typically 3 years but there are exceptions. If the statute of limitations has passed, you can no longer be sued for the debt and you can ignore the debt collector.

The state's civil statute of limitations ranges from one to seven years, but most civil actions have a time limit of two years to file from the date of the (alleged) incident.