A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Mississippi Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

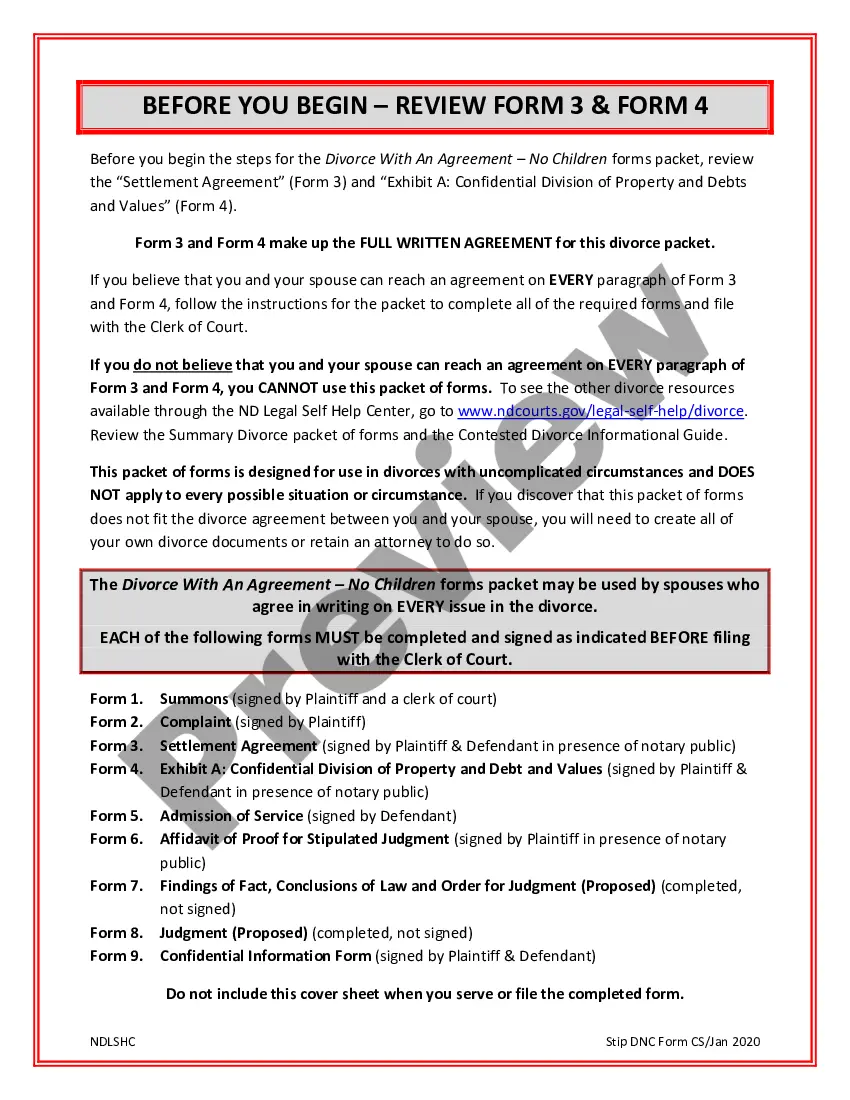

How to fill out Mississippi Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

US Legal Forms - one of the most significant libraries of legal kinds in the United States - provides a wide range of legal papers themes you are able to acquire or print. Making use of the website, you will get 1000s of kinds for company and specific reasons, sorted by classes, claims, or keywords and phrases.You can find the newest variations of kinds such as the Mississippi Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law within minutes.

If you already have a membership, log in and acquire Mississippi Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law from your US Legal Forms catalogue. The Acquire option will show up on each type you see. You have access to all in the past delivered electronically kinds in the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, allow me to share simple instructions to get you started off:

- Ensure you have selected the proper type for the city/region. Click on the Preview option to examine the form`s content. See the type outline to ensure that you have selected the right type.

- In the event the type doesn`t satisfy your requirements, make use of the Look for area at the top of the display screen to discover the one that does.

- Should you be happy with the shape, affirm your option by clicking on the Buy now option. Then, select the rates program you want and provide your qualifications to sign up for the accounts.

- Method the purchase. Make use of charge card or PayPal accounts to perform the purchase.

- Pick the structure and acquire the shape on your product.

- Make changes. Complete, modify and print and sign the delivered electronically Mississippi Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Every single design you included with your money does not have an expiration time which is your own permanently. So, in order to acquire or print yet another version, just check out the My Forms portion and click in the type you require.

Gain access to the Mississippi Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with US Legal Forms, probably the most comprehensive catalogue of legal papers themes. Use 1000s of skilled and state-specific themes that satisfy your small business or specific requirements and requirements.

Form popularity

FAQ

In Mississippi, the statute of limitations for credit card debt, medical bills, and financial loans is 3 years. Debt collectors are paid more if they collect more from you.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.