The Mississippi Loan Modification Agreement — Multistate is a legal document that outlines the terms and conditions for modifying an existing loan in the state of Mississippi. This agreement is designed to assist borrowers who are struggling to meet their financial obligations and need to modify the terms of their loan to make it more affordable. The Mississippi Loan Modification Agreement — Multistate typically includes details such as the names and addresses of the borrower and lender, the loan number, the original loan amount, and the date the loan was originally executed. It also outlines the proposed modifications to the loan, such as changes in interest rates, repayment terms, or the overall loan amount. By entering into a Loan Modification Agreement, borrowers and lenders are able to avoid the costly and time-consuming foreclosure process. Instead, they can work together to find a solution that allows the borrower to make manageable payments and keep their home. There are different types of Loan Modification Agreements that can be used in Mississippi, depending on the specific needs of the borrower and lender. Some common types include: 1. Interest Rate Reduction: This modification involves lowering the interest rate on the loan, reducing the monthly payments for the borrower. 2. Term Extension: This modification extends the repayment term of the loan, spreading out the remaining balance over a longer period of time. This can lower the monthly payments but may result in higher overall interest costs. 3. Principal Forbearance: In some cases, lenders may agree to temporarily reduce or suspend a portion of the principal balance owed, allowing the borrower to make reduced payments for a specific period of time. 4. Loan Forgiveness: In rare cases, lenders may agree to forgive a portion of the outstanding loan balance, effectively reducing the total amount owed by the borrower. It is important for both borrowers and lenders to carefully review and understand the terms of the Mississippi Loan Modification Agreement — Multistate before signing. Seeking legal advice is advisable to ensure that all parties are protected and that the agreement meets their individual needs and goals. Overall, the Mississippi Loan Modification Agreement — Multistate provides a flexible solution for borrowers facing financial difficulties, allowing them to modify their loan terms and potentially avoid foreclosure.

Mississippi Loan Modification Agreement - Multistate

Description

How to fill out Mississippi Loan Modification Agreement - Multistate?

If you wish to total, obtain, or printing legal document layouts, use US Legal Forms, the most important selection of legal forms, that can be found on the web. Take advantage of the site`s simple and easy practical search to get the papers you want. Different layouts for business and individual reasons are sorted by classes and states, or search phrases. Use US Legal Forms to get the Mississippi Loan Modification Agreement - Multistate in a number of mouse clicks.

In case you are previously a US Legal Forms buyer, log in in your profile and click the Download option to have the Mississippi Loan Modification Agreement - Multistate. Also you can access forms you previously downloaded in the My Forms tab of the profile.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that correct metropolis/region.

- Step 2. Utilize the Review choice to look through the form`s content. Never forget to read the outline.

- Step 3. In case you are not happy using the kind, utilize the Look for discipline towards the top of the screen to get other variations in the legal kind template.

- Step 4. After you have located the shape you want, click on the Buy now option. Pick the prices prepare you favor and add your qualifications to register on an profile.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Pick the formatting in the legal kind and obtain it on the device.

- Step 7. Complete, change and printing or indicator the Mississippi Loan Modification Agreement - Multistate.

Each and every legal document template you get is your own property eternally. You might have acces to each kind you downloaded within your acccount. Click the My Forms portion and choose a kind to printing or obtain once more.

Compete and obtain, and printing the Mississippi Loan Modification Agreement - Multistate with US Legal Forms. There are millions of skilled and status-distinct forms you can use for your personal business or individual requires.

Form popularity

FAQ

Once your loan modification application is approved, your lender will officially notify you in writing. Lenders usually offer a trial payment period (TPP) as part of this notification. If your lender offers you a TPP, you will go through that trial period before moving forward with your mortgage modification. What Happens After A Loan Modification Is Approved? denbeauxlaw.com ? what-happens-after-a-loan-m... denbeauxlaw.com ? what-happens-after-a-loan-m...

Loan Modification: 10 Simple Tips for Success Explain your hardship. Why are you behind? ... Document your income. ... Outline your expenses. ... Gather your Federal Tax Returns. ... Provide proof of insurance. ... Be prepared to interview with a counselor. ... Stay connected. ... Deliver documents as requested.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan. Loan Modification Vs. Refinance - Rocket Mortgage Rocket Mortgage ? learn ? loan-modif... Rocket Mortgage ? learn ? loan-modif...

Required documentation for a loan modification usually includes a formal application, pay stubs, financial statements, proof of income, bank statements, and tax returns, as well as a hardship statement.

What's the Difference Between a Forbearance Agreement, Repayment Plan, and Loan Modification? While forbearance agreements and repayment plans spread a couple of payments over a longer period, loan modifications permanently alter the monthly payment.

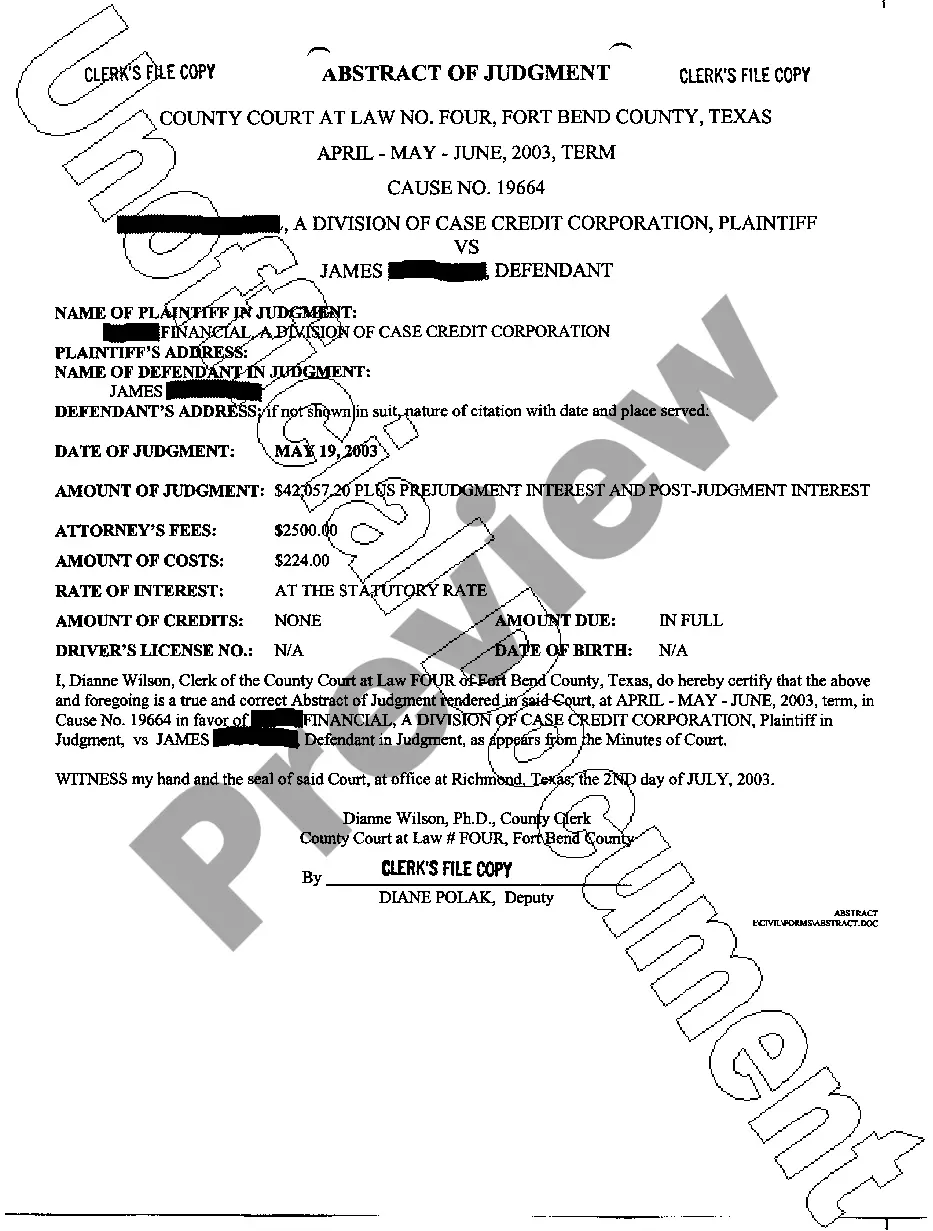

Because these represent mutual agreements, they should be signed by both the borrowers and the plaintiff (who may or may not be the lender or servicer but may be an assignee of the mortgage). There is no doubt that foreclosing plaintiffs understand that they need to sign those mortgage modification agreements.

Once the lender receives your signed documents, they will: Review your signatures, sign the documents themselves, and then record the loan modification. What Happens After a Loan Modification is Approved? nadiakilburn.com ? what-happens-after-a-loan-mo... nadiakilburn.com ? what-happens-after-a-loan-mo...

Could be reported as a settlement: Because you're changing the terms of your loan, some lenders may report your loan modification to the credit bureaus (Experian, TransUnion and Equifax) as a settlement, which can wreak havoc on your credit scores and remain on your credit reports for several years. How Does a Loan Modification Affect Your Credit Scores? - Experian experian.com ? blogs ? how-a-mortgage-mo... experian.com ? blogs ? how-a-mortgage-mo...