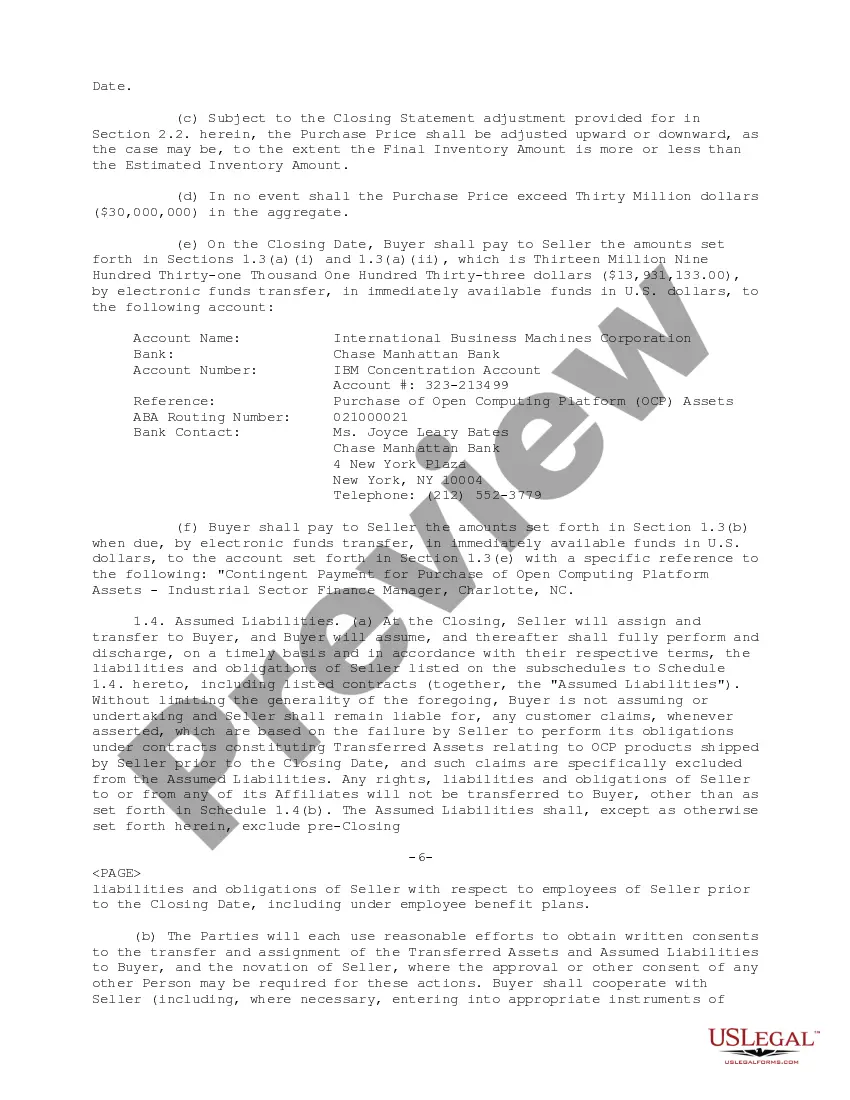

Mississippi Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

Are you inside a situation that you need to have papers for possibly organization or specific reasons just about every working day? There are a lot of legitimate record web templates accessible on the Internet, but getting ones you can rely on isn`t straightforward. US Legal Forms provides a large number of type web templates, just like the Mississippi Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample, that are published to meet state and federal demands.

Should you be previously informed about US Legal Forms internet site and get a free account, merely log in. Afterward, you are able to obtain the Mississippi Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample format.

If you do not offer an bank account and need to begin using US Legal Forms, abide by these steps:

- Discover the type you will need and make sure it is for your right area/area.

- Use the Preview button to analyze the shape.

- Read the information to ensure that you have chosen the correct type.

- In case the type isn`t what you are searching for, utilize the Lookup industry to obtain the type that fits your needs and demands.

- Whenever you get the right type, just click Buy now.

- Opt for the pricing program you would like, complete the necessary details to produce your money, and pay money for the transaction using your PayPal or credit card.

- Decide on a practical data file formatting and obtain your version.

Discover every one of the record web templates you might have purchased in the My Forms menu. You can get a more version of Mississippi Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample at any time, if needed. Just go through the essential type to obtain or produce the record format.

Use US Legal Forms, the most substantial selection of legitimate types, to conserve some time and stay away from errors. The support provides expertly manufactured legitimate record web templates that can be used for an array of reasons. Generate a free account on US Legal Forms and commence making your daily life easier.