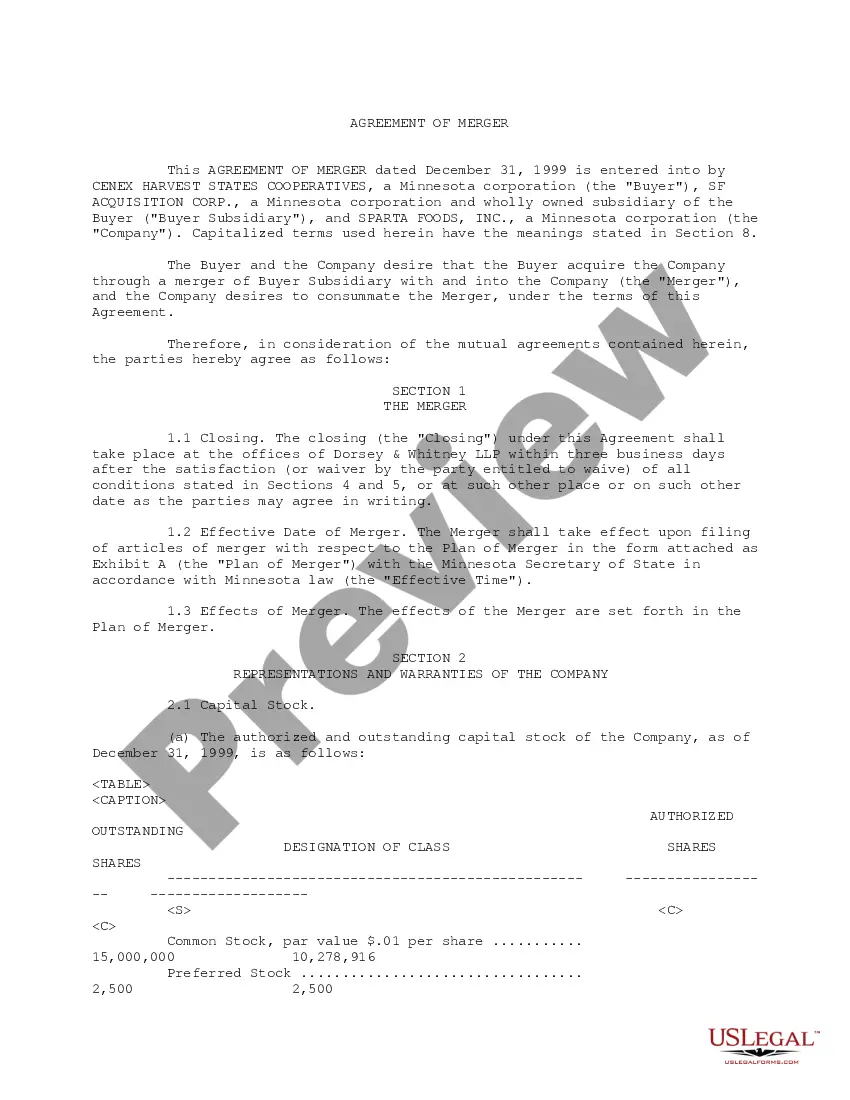

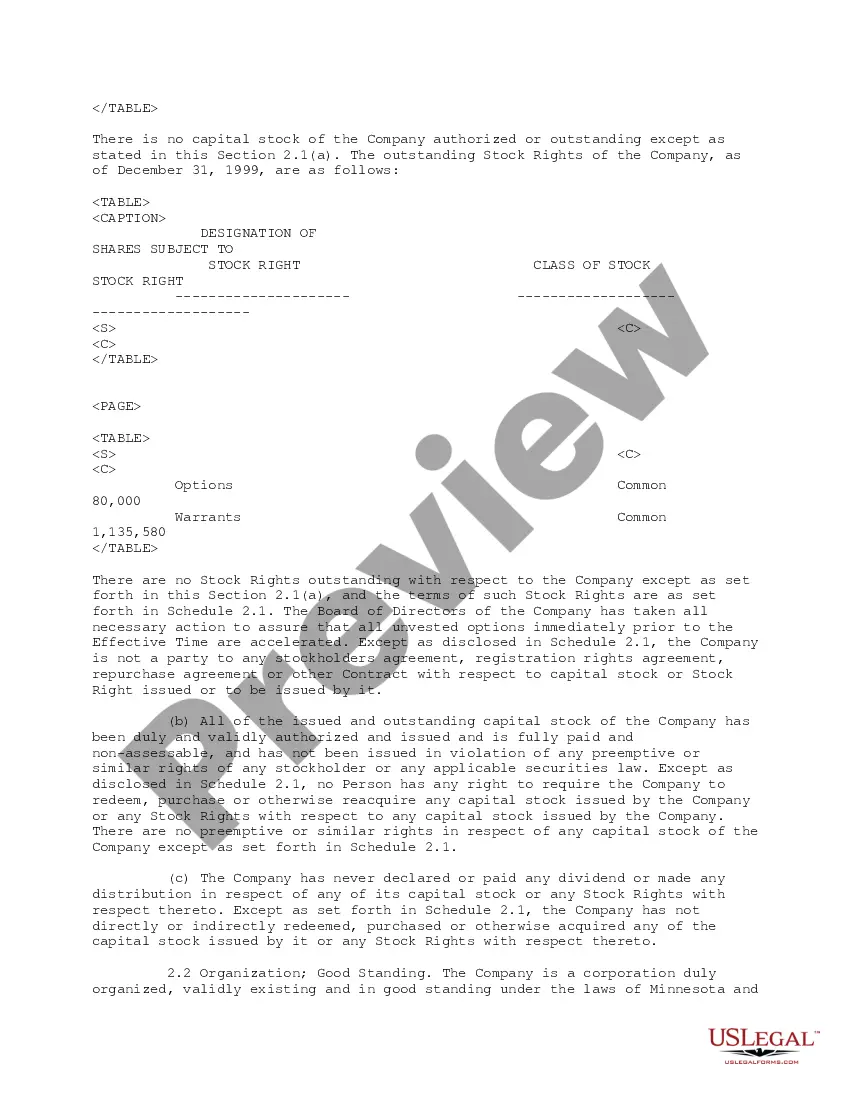

Mississippi Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

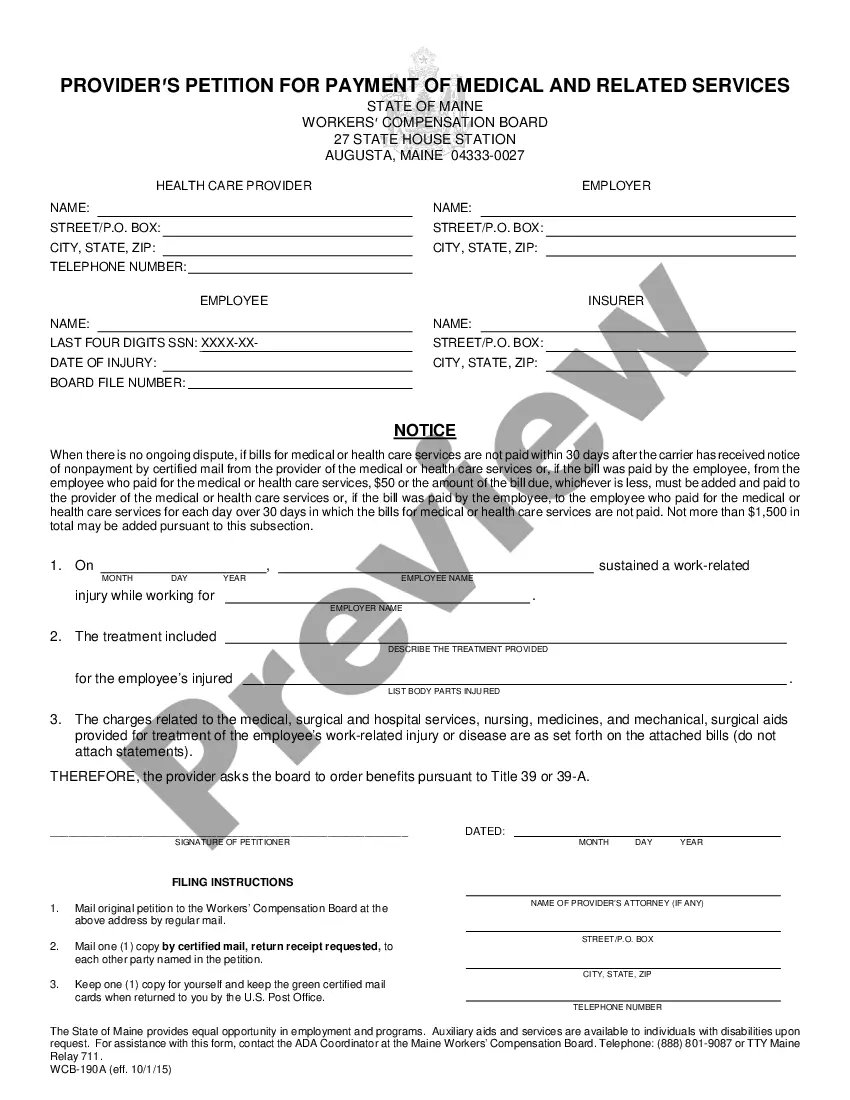

Discovering the right legitimate papers web template can be a have difficulties. Of course, there are tons of themes available on the net, but how do you find the legitimate develop you require? Make use of the US Legal Forms website. The service offers a huge number of themes, like the Mississippi Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., which you can use for business and personal requirements. All the forms are checked out by professionals and satisfy federal and state requirements.

Should you be presently registered, log in to your accounts and click on the Acquire button to have the Mississippi Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Utilize your accounts to appear from the legitimate forms you might have ordered previously. Visit the My Forms tab of your respective accounts and acquire an additional copy from the papers you require.

Should you be a fresh end user of US Legal Forms, listed here are simple guidelines for you to adhere to:

- First, ensure you have chosen the appropriate develop for your personal town/area. You are able to check out the shape utilizing the Preview button and browse the shape description to make sure it will be the right one for you.

- If the develop does not satisfy your needs, take advantage of the Seach industry to discover the correct develop.

- Once you are certain that the shape is proper, select the Acquire now button to have the develop.

- Pick the rates plan you need and type in the required details. Design your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Choose the file formatting and acquire the legitimate papers web template to your product.

- Total, change and print and signal the received Mississippi Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

US Legal Forms is definitely the greatest library of legitimate forms for which you can discover different papers themes. Make use of the company to acquire appropriately-manufactured paperwork that adhere to express requirements.