Mississippi Bylaws of Mitchell Hutchins Securities Trust

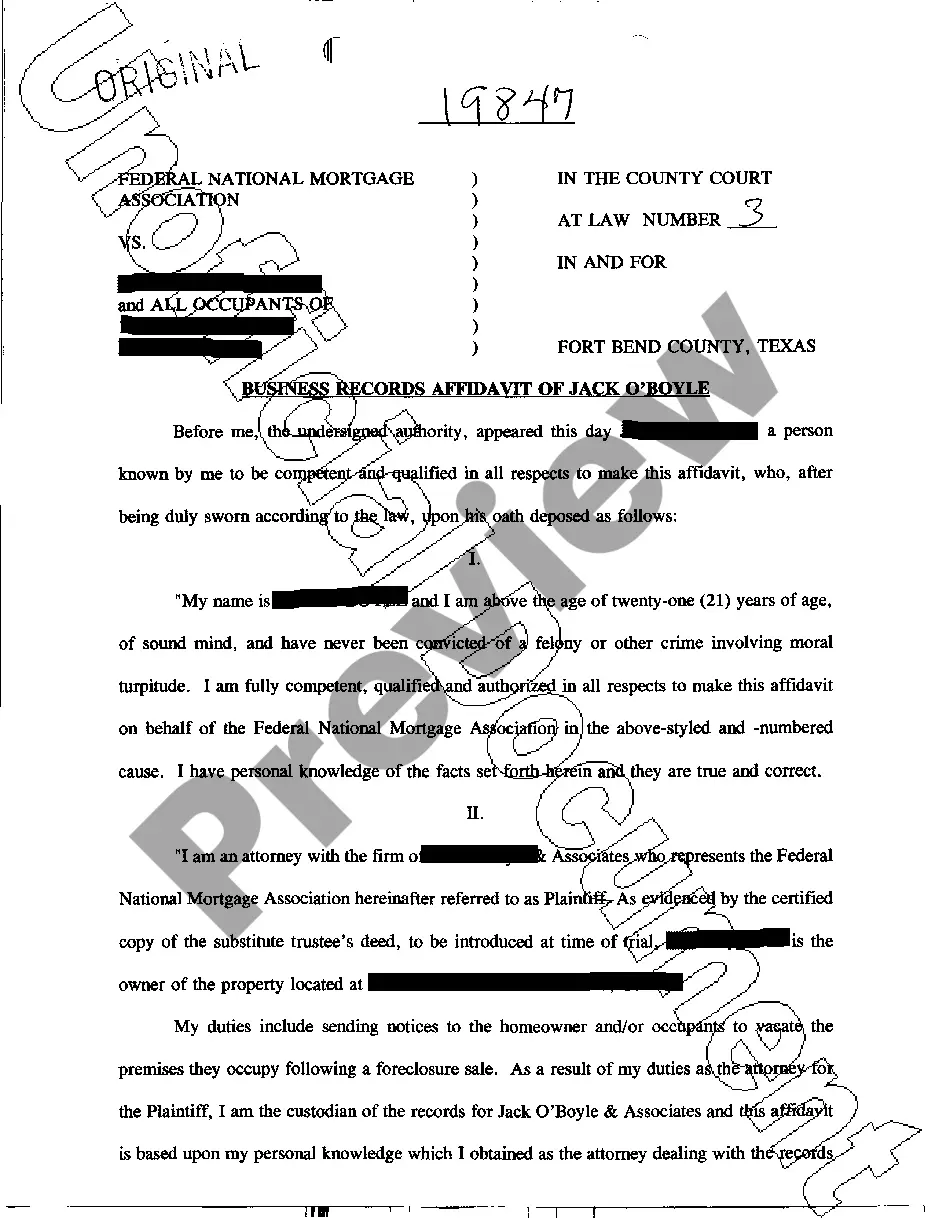

Description

How to fill out Bylaws Of Mitchell Hutchins Securities Trust?

Discovering the right authorized document design could be a have difficulties. Needless to say, there are plenty of themes available online, but how would you find the authorized type you want? Use the US Legal Forms web site. The service gives 1000s of themes, like the Mississippi Bylaws of Mitchell Hutchins Securities Trust, that can be used for enterprise and private needs. All of the varieties are checked out by professionals and satisfy federal and state needs.

Should you be already registered, log in to the bank account and click the Acquire key to obtain the Mississippi Bylaws of Mitchell Hutchins Securities Trust. Use your bank account to search from the authorized varieties you have purchased earlier. Go to the My Forms tab of your respective bank account and obtain another backup of the document you want.

Should you be a brand new end user of US Legal Forms, listed below are easy directions for you to stick to:

- Initial, make certain you have selected the right type for your personal area/county. You can look through the form while using Review key and look at the form explanation to make sure this is basically the right one for you.

- When the type does not satisfy your preferences, utilize the Seach discipline to discover the correct type.

- Once you are sure that the form is proper, click on the Get now key to obtain the type.

- Opt for the prices prepare you want and type in the essential details. Build your bank account and purchase an order utilizing your PayPal bank account or Visa or Mastercard.

- Choose the submit structure and down load the authorized document design to the gadget.

- Comprehensive, revise and print out and sign the acquired Mississippi Bylaws of Mitchell Hutchins Securities Trust.

US Legal Forms may be the most significant collection of authorized varieties that you can discover numerous document themes. Use the company to down load expertly-made papers that stick to express needs.