Mississippi Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust

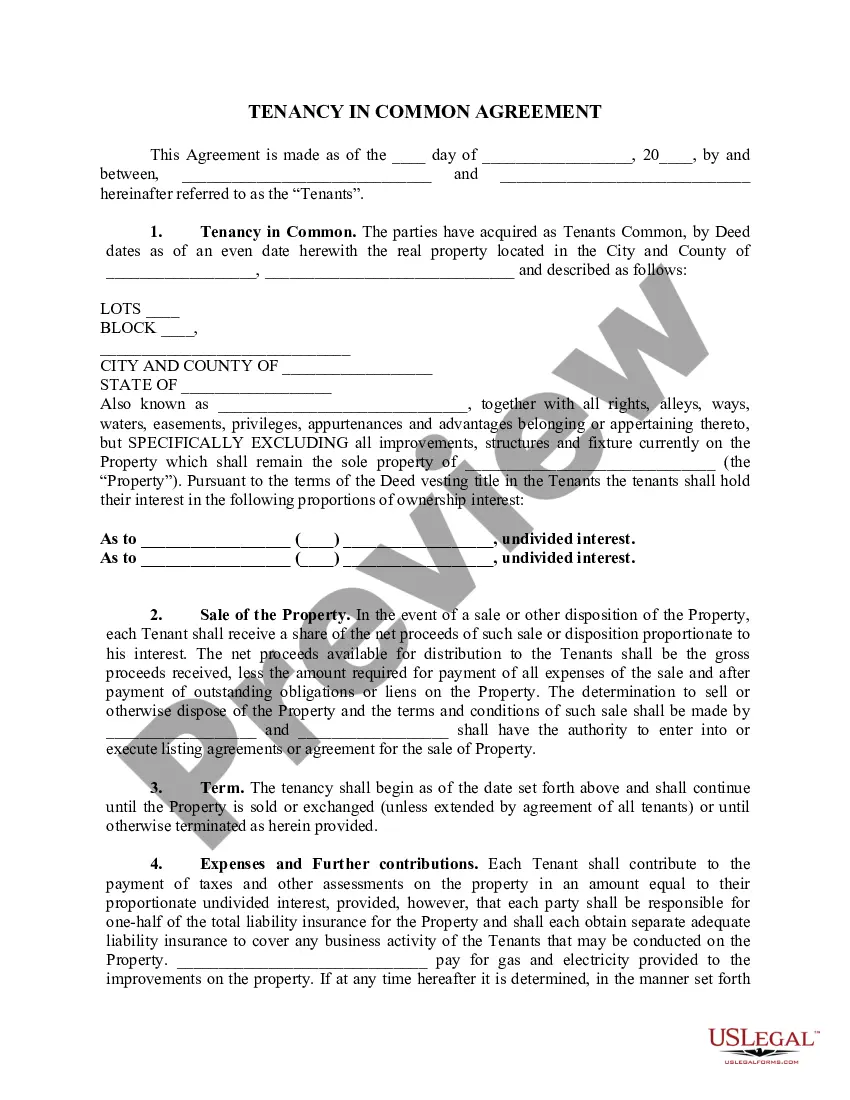

Description

How to fill out Trust Agreement Reference Trust Agreement Between Dean Witter Reynolds, Inc. And The Bank Of New York Regarding Select Equity Trust?

You may spend time on the web trying to find the lawful document format that suits the federal and state requirements you will need. US Legal Forms provides thousands of lawful varieties which can be evaluated by experts. You can actually acquire or print the Mississippi Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust from your service.

If you have a US Legal Forms bank account, you can log in and click on the Download switch. Following that, you can complete, edit, print, or sign the Mississippi Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust. Every single lawful document format you acquire is your own forever. To acquire one more duplicate for any purchased kind, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms site the very first time, follow the straightforward recommendations beneath:

- First, make certain you have chosen the right document format for the area/metropolis of your liking. Read the kind information to ensure you have selected the appropriate kind. If readily available, utilize the Preview switch to look through the document format as well.

- If you want to get one more variation in the kind, utilize the Look for industry to obtain the format that meets your requirements and requirements.

- When you have located the format you desire, click on Acquire now to continue.

- Pick the pricing plan you desire, type your credentials, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can use your credit card or PayPal bank account to purchase the lawful kind.

- Pick the format in the document and acquire it in your device.

- Make alterations in your document if necessary. You may complete, edit and sign and print Mississippi Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust.

Download and print thousands of document themes while using US Legal Forms web site, that offers the most important variety of lawful varieties. Use expert and status-distinct themes to handle your organization or personal demands.