A Mississippi Investment Management Agreement is a contract that outlines the terms and conditions between an investor and Morgan Stanley Dean Witter Advisors, Inc. for the provision of management and investment advisory services in the state of Mississippi. This agreement enables individuals or entities to engage Morgan Stanley Dean Witter Advisors, Inc. to handle their investment portfolios and make informed investment decisions on their behalf. The primary goal is to align the investor's financial objectives with suitable investment strategies and maximize their returns. Key terms and provisions covered in a Mississippi Investment Management Agreement include: 1. Parties: Identifies the investor (referred to as the client) and Morgan Stanley Dean Witter Advisors, Inc. (the investment manager) as the contracted parties. 2. Scope of Services: Defines the range of services that Morgan Stanley Dean Witter Advisors, Inc. will provide, such as investing in various asset classes, managing portfolios, providing advice, monitoring performance, and reviewing investment strategies. The agreement may also mention specific instructions or restrictions provided by the client. 3. Investment Objectives and Risk Tolerance: Outlines the client's investment objectives, such as capital preservation, growth, income generation, or a combination of these. It also includes discussions on the client's risk tolerance, which helps in determining suitable investment strategies and asset allocations. 4. Compensation: States the fees and expenses associated with the investment management services. This may include an annual management fee based on a percentage of the assets under management, transactional charges, custody fees, and other expenses. 5. Reporting and Communication: Specifies the frequency and format of investment reports that will be provided to the client. It also defines the regularity and methods of communication between the client and Morgan Stanley Dean Witter Advisors, Inc. 6. Termination: Outlines the conditions under which either party can terminate the agreement, including provisions for early termination, notice periods, and potential penalties or fees. Different types of Mississippi Investment Management Agreements may exist, depending on the specific client's requirements and objectives. For example: 1. General Investment Management Agreement: A standard agreement suitable for individual investors or entities seeking comprehensive investment management services from Morgan Stanley Dean Witter Advisors, Inc. 2. Specialized Investment Management Agreement: Tailored agreements for clients with unique investment needs, such as high-net-worth individuals, institutional investors, or philanthropic organizations. These agreements may involve additional services like tax planning, estate planning, or socially responsible investing. 3. Limited Scope Investment Management Agreement: Contracts that outline a specific investment objective or restricted investment strategy. These agreements might be suitable for clients who want to allocate a portion of their portfolio to a specific asset class or investment style. In summary, a Mississippi Investment Management Agreement with Morgan Stanley Dean Witter Advisors, Inc. is a legally binding document that governs the relationship between an investor and the investment manager. It ensures that investment objectives are aligned, appropriate investment strategies are implemented, and clients' interests are protected throughout the investment process.

Mississippi Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services

Description

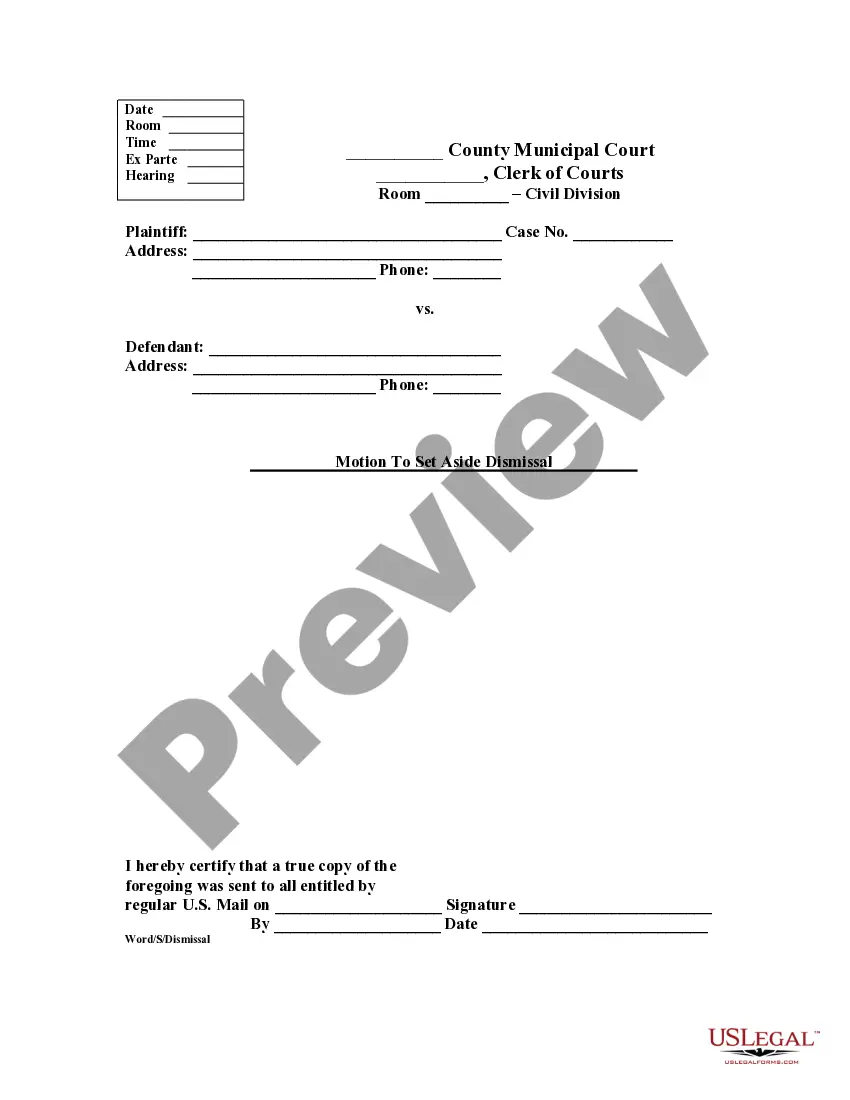

How to fill out Investment Management Agreement Regarding The Employment Of Morgan Stanley Dean Witter Advisors, Inc. To Render Management And Investment Advisory Services?

US Legal Forms - one of the most significant libraries of legal varieties in the States - delivers a wide array of legal file templates you are able to down load or produce. Utilizing the internet site, you may get thousands of varieties for company and individual functions, sorted by groups, suggests, or keywords.You can find the latest types of varieties like the Mississippi Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services within minutes.

If you already possess a monthly subscription, log in and down load Mississippi Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services from your US Legal Forms local library. The Obtain key will appear on every single develop you view. You gain access to all previously downloaded varieties inside the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, allow me to share easy directions to obtain started:

- Ensure you have picked the right develop to your area/state. Go through the Review key to examine the form`s information. Browse the develop description to actually have selected the correct develop.

- When the develop doesn`t match your specifications, use the Research field at the top of the monitor to obtain the one who does.

- When you are happy with the form, verify your selection by visiting the Acquire now key. Then, choose the rates program you like and offer your accreditations to sign up on an accounts.

- Approach the transaction. Utilize your charge card or PayPal accounts to perform the transaction.

- Select the formatting and down load the form on your product.

- Make modifications. Complete, modify and produce and signal the downloaded Mississippi Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services.

Every web template you added to your account does not have an expiration date and is also yours permanently. So, in order to down load or produce another backup, just visit the My Forms segment and click on the develop you require.

Gain access to the Mississippi Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services with US Legal Forms, probably the most considerable local library of legal file templates. Use thousands of specialist and condition-distinct templates that fulfill your company or individual needs and specifications.

Form popularity

FAQ

Dean Witter's net worth as of Aug. 31 was $103.4 million, and Reynolds' net worth on June 30 was $62.8 million. Witter has 146 brokerage offices with 2,200 account executives in 39 states and Reynolds has 84 U.S. offices with 1,350 account executives.

In addition to the acquisition of Dean Witter, Sears also acquired Coldwell Banker, the real estate brokerage company in 1981. Sears intended for Dean Witter to form the foundation for a larger Sears Financial Services Network that would be available to customers through the company's retail stores.

We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals. For 87 years, we've had a passion for what's possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

I am interested in working at Morgan Stanley because I believe it is a great opportunity to gain experience in the financial services industry. I am particularly interested in Morgan Stanley's commitment to providing excellent customer service and the company's commitment to innovation and financial expertise.

(''Dean Witter Discover'') and Morgan Stanley Group Inc. (''Morgan Stanley'') and was formed pursuant to a merger of equals that was effected on (the ''Merger''). MSDW was originally incorporated under the laws of the State of Delaware in 1981, and its predecessor companies date back to 1924.

Purcell was named chairman and chief executive of what became Morgan Stanley, Dean Witter, Discover & Company, later shortened to Morgan Stanley in March 2001. Mack stayed on as president until 2001.

The ultimate parent undertaking and controlling entity of the Company is Morgan Stanley, which together with the Group and Morgan Stanley's other subsidiary undertakings, forms the ?Morgan Stanley Group?.