A Mississippi General Security Agreement is a legal document that grants a secured party a secured interest in certain collateral owned by a debtor. In essence, it provides protection to the lender or creditor by granting them rights to the debtor's assets or property in the event of default or non-payment. Let's delve into the details and some important keywords related to this agreement. Keywords: Mississippi, General Security Agreement, secured party, secured interest, collateral, debtor, creditor, default, non-payment. A Mississippi General Security Agreement is a legally binding contract that allows a creditor or lender to secure its position by obtaining rights to specific assets belonging to a debtor. This agreement acts as a safeguard for the creditor if the debtor fails to fulfill their financial obligations, ensuring that the creditor has the legal authority to recover their investment. The secured party, typically a financial institution or lender, provides financing or loans to the debtor, who is the individual or entity receiving the funds. To mitigate the risk of non-payment or default, the secured party requires the debtor to sign a Mississippi General Security Agreement, outlining the terms and conditions of the security interest. Under this agreement, the secured party is granted a secured interest in certain collateral, which refers to tangible or intangible property held by the debtor that serves as security for the loan. Collateral may include assets such as property, equipment, inventory, accounts receivable, or even intellectual property rights. By obtaining a secured interest, the creditor strengthens its position, as it has the legal authority to seize and sell the collateral in case the debtor fails to meet their obligations. It is important to note that Mississippi General Security Agreements can have various types depending on the nature of the collateral or the specifics of the loan. For instance, there might be specific agreements for real estate, chattel, inventory, or accounts receivable. These different types of agreements allow the creditor to accurately identify and properly secure the collateral relevant to the loan being provided. In conclusion, the Mississippi General Security Agreement is a crucial legal document that safeguards the rights of a secured party by granting them a secured interest in a debtor's collateral. By thoroughly outlining the terms and conditions of the agreement, it provides a transparent understanding of the rights and responsibilities of both the creditor and the debtor. This comprehensive agreement ensures the protection of the creditor's investment and offers a legal recourse in case of default or non-payment.

Mississippi General Security Agreement granting secured party secured interest

Description

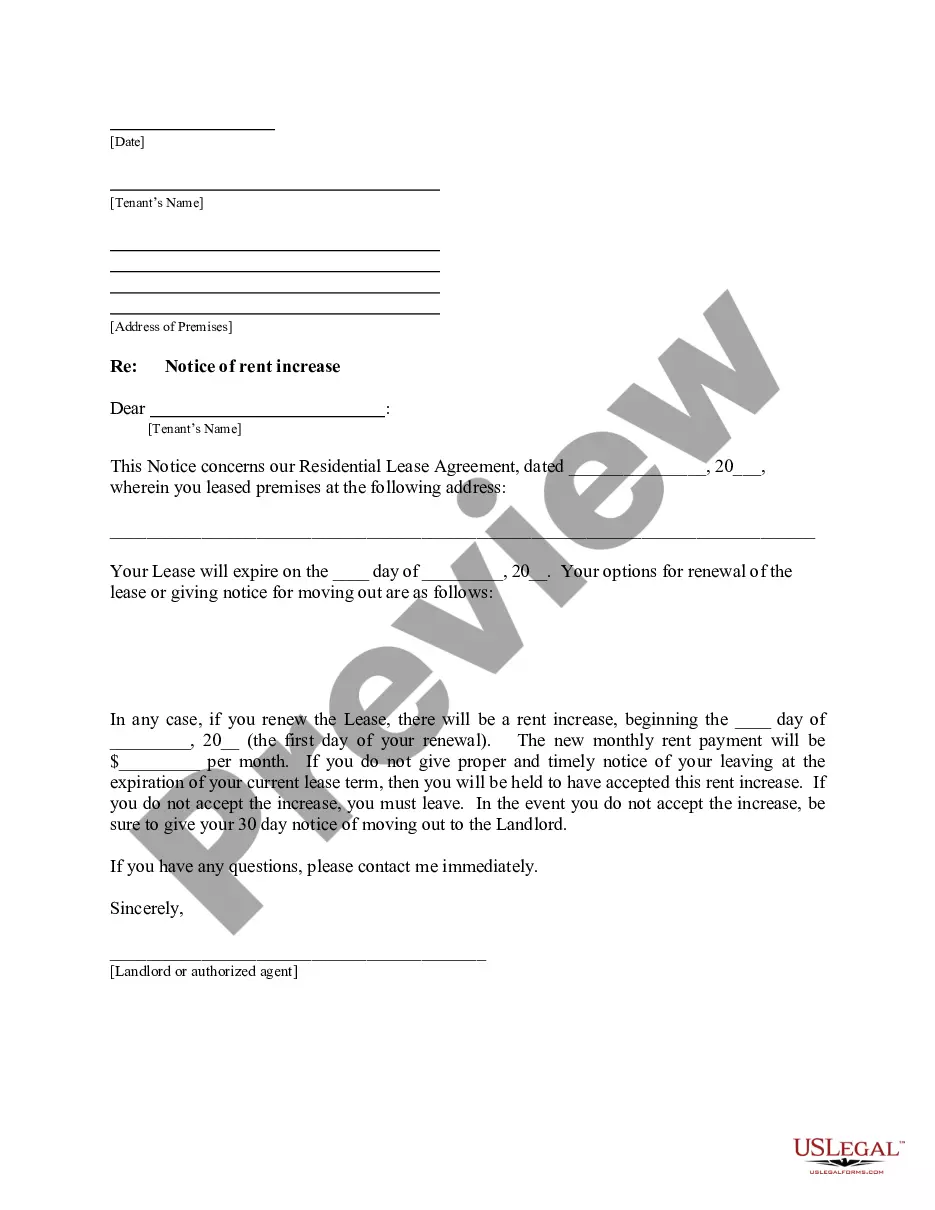

How to fill out Mississippi General Security Agreement Granting Secured Party Secured Interest?

If you wish to complete, acquire, or print legitimate document layouts, use US Legal Forms, the greatest variety of legitimate varieties, which can be found on the Internet. Utilize the site`s simple and convenient lookup to discover the documents you want. Different layouts for enterprise and personal functions are categorized by types and says, or search phrases. Use US Legal Forms to discover the Mississippi General Security Agreement granting secured party secured interest in just a number of mouse clicks.

Should you be already a US Legal Forms customer, log in for your profile and click the Down load option to find the Mississippi General Security Agreement granting secured party secured interest. You can even access varieties you earlier delivered electronically inside the My Forms tab of your own profile.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for the right area/land.

- Step 2. Utilize the Preview option to check out the form`s content. Never neglect to read the explanation.

- Step 3. Should you be not happy with the kind, make use of the Research discipline at the top of the screen to discover other types of the legitimate kind web template.

- Step 4. After you have identified the shape you want, click on the Acquire now option. Choose the costs program you prefer and add your qualifications to register for an profile.

- Step 5. Approach the transaction. You should use your credit card or PayPal profile to finish the transaction.

- Step 6. Select the format of the legitimate kind and acquire it on your own product.

- Step 7. Comprehensive, change and print or indication the Mississippi General Security Agreement granting secured party secured interest.

Each legitimate document web template you acquire is your own property eternally. You possess acces to every single kind you delivered electronically with your acccount. Click on the My Forms segment and select a kind to print or acquire once more.

Compete and acquire, and print the Mississippi General Security Agreement granting secured party secured interest with US Legal Forms. There are many skilled and condition-particular varieties you may use for the enterprise or personal needs.