Mississippi Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

Discovering the right legal papers format could be a have a problem. Needless to say, there are tons of templates available on the net, but how do you discover the legal develop you need? Make use of the US Legal Forms website. The service provides a huge number of templates, like the Mississippi Term Sheet - Convertible Debt Financing, that can be used for enterprise and personal requirements. Each of the varieties are checked by specialists and meet federal and state demands.

Should you be already signed up, log in in your bank account and click the Download button to find the Mississippi Term Sheet - Convertible Debt Financing. Use your bank account to check through the legal varieties you might have bought in the past. Visit the My Forms tab of your respective bank account and get another copy of your papers you need.

Should you be a new end user of US Legal Forms, listed below are simple directions for you to follow:

- First, make sure you have chosen the appropriate develop for the area/county. It is possible to examine the form using the Review button and study the form explanation to make certain it is the best for you.

- If the develop will not meet your needs, use the Seach discipline to obtain the appropriate develop.

- Once you are positive that the form is proper, click the Purchase now button to find the develop.

- Opt for the pricing prepare you want and enter the required information and facts. Build your bank account and pay money for your order utilizing your PayPal bank account or credit card.

- Choose the data file file format and acquire the legal papers format in your system.

- Total, change and printing and signal the obtained Mississippi Term Sheet - Convertible Debt Financing.

US Legal Forms is the greatest collection of legal varieties where you will find different papers templates. Make use of the service to acquire skillfully-made paperwork that follow state demands.

Form popularity

FAQ

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note. Convertible Note Financing Term Sheet (Seed-Stage Start-Up) fenwick.com ? legacy ? FenwickDocuments fenwick.com ? legacy ? FenwickDocuments

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round). How should convertible note financing be handled on the balance sheet? kruzeconsulting.com ? convertible-note-balance-s... kruzeconsulting.com ? convertible-note-balance-s...

Convertible Note - Reporting Requirements FIRC and KYC of the non-resident investor. Name and address of the investor and AD bank. Copy of MOA / AOA. Certificate of Incorporation. Startup Registration Certificate. Certificate from Practising Company Secretary.

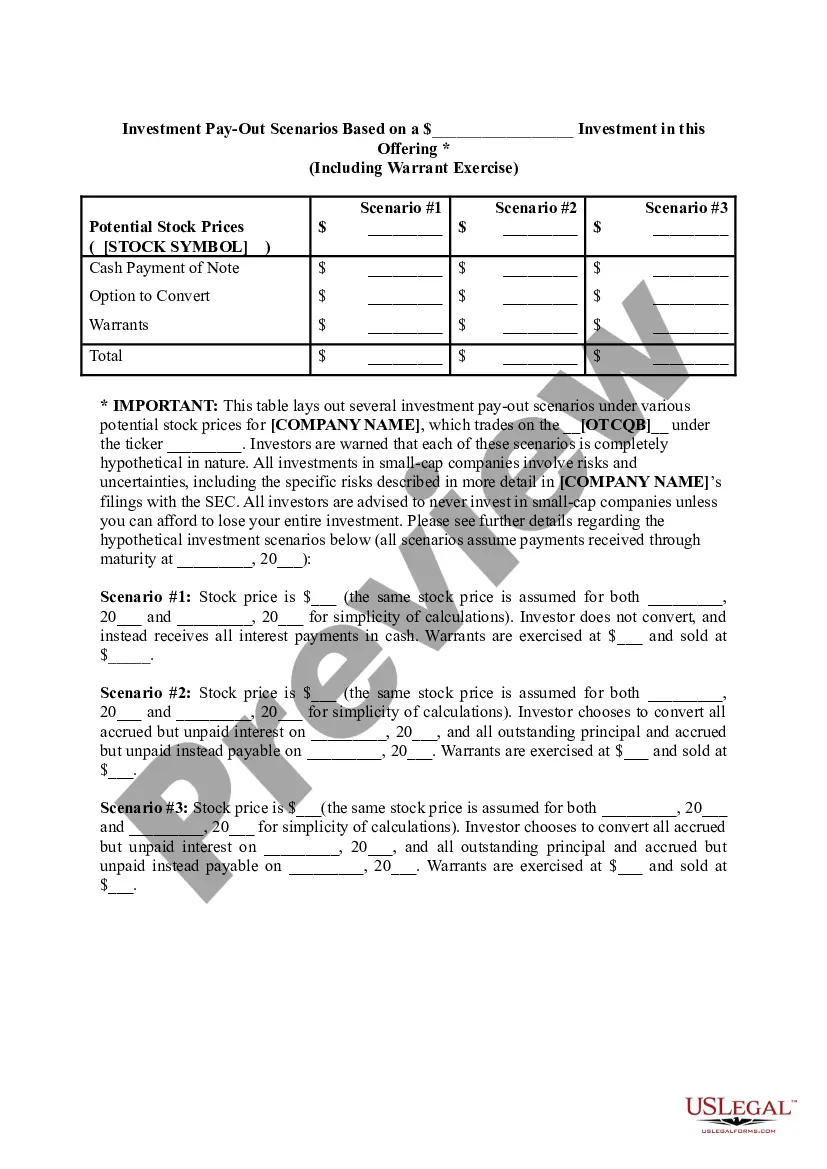

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months). Convertible Notes vs SAFE's - Accounting/Tax Considerations shaycpa.com ? convertible-notes-vs-safes-accounti... shaycpa.com ? convertible-notes-vs-safes-accounti...

Repayment Method With most convertible debt, you will repay the investment by converting the entire value to stock. Some investors, though, may also include language that obligates you to pay back a certain percentage of the original investment as cash and the remainder as stock. Convertible Debt For Startups: The Complete Guide - Bond Collective bondcollective.com ? blog ? convertible-debt bondcollective.com ? blog ? convertible-debt

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.