Mississippi Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

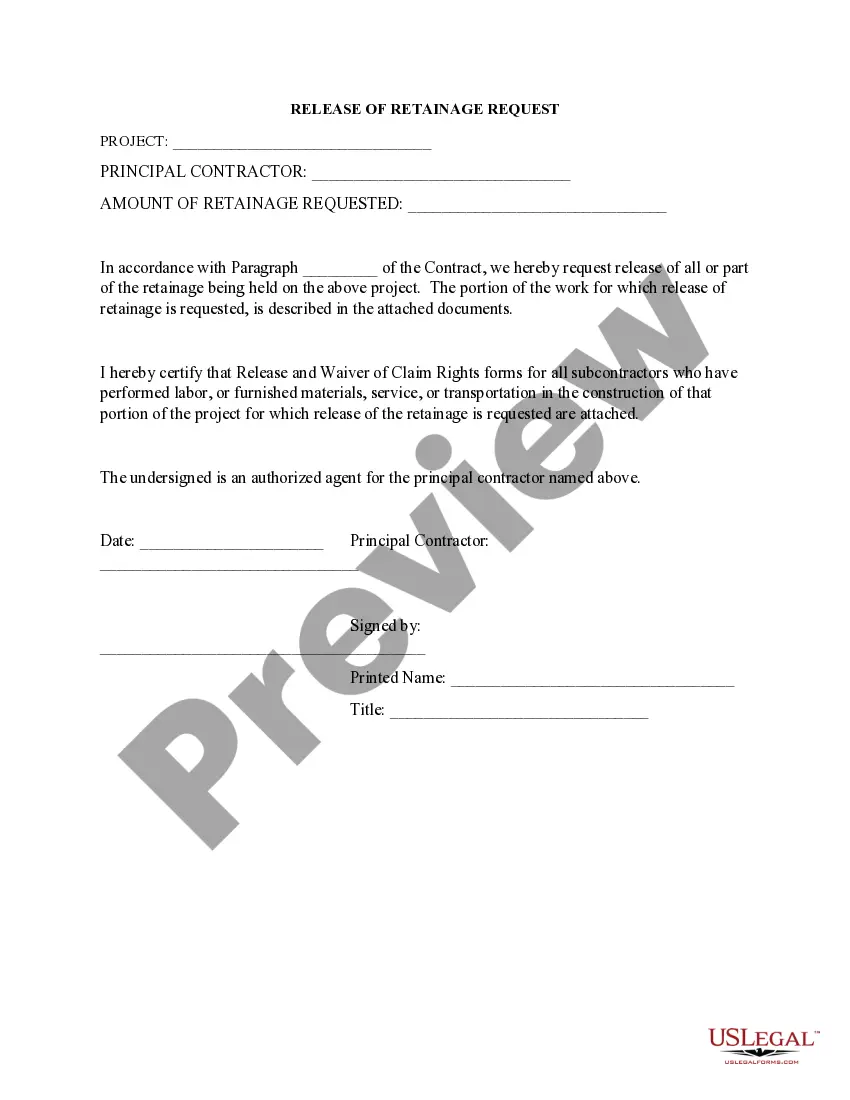

How to fill out Shared Earnings Agreement Between Fund & Company?

US Legal Forms - one of the biggest libraries of lawful forms in the States - gives a wide array of lawful papers layouts you can obtain or print out. Utilizing the website, you can get thousands of forms for organization and person purposes, sorted by classes, says, or key phrases.You will find the latest models of forms like the Mississippi Shared Earnings Agreement between Fund & Company in seconds.

If you already possess a subscription, log in and obtain Mississippi Shared Earnings Agreement between Fund & Company from your US Legal Forms collection. The Obtain button will appear on every kind you view. You have access to all previously acquired forms within the My Forms tab of the profile.

In order to use US Legal Forms initially, listed here are straightforward instructions to help you get began:

- Be sure to have chosen the correct kind for the area/county. Click the Review button to check the form`s content material. Read the kind explanation to actually have chosen the appropriate kind.

- In the event the kind does not match your needs, take advantage of the Lookup industry towards the top of the display to find the the one that does.

- In case you are happy with the shape, confirm your choice by simply clicking the Purchase now button. Then, pick the pricing prepare you prefer and supply your credentials to sign up to have an profile.

- Procedure the purchase. Use your credit card or PayPal profile to finish the purchase.

- Find the structure and obtain the shape on your system.

- Make adjustments. Complete, change and print out and signal the acquired Mississippi Shared Earnings Agreement between Fund & Company.

Every format you put into your money does not have an expiry date and is also the one you have for a long time. So, if you want to obtain or print out one more copy, just proceed to the My Forms area and click in the kind you will need.

Obtain access to the Mississippi Shared Earnings Agreement between Fund & Company with US Legal Forms, the most considerable collection of lawful papers layouts. Use thousands of skilled and condition-specific layouts that meet up with your organization or person needs and needs.

Form popularity

FAQ

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

How To Create A Personal Finance Balance Sheet Gather Financial Documents. Getting all your financial documents ensures you have accurate information. ... Make Or Use A Free Personal Financial Statement Template. ... List Your Assets. ... List Your Liabilities. ... Categorize The Information And Add Up The Values. ... Determine Your Net Worth.

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program. ... Step 2: Fill In Your Personal Information. ... Step 3: Write Down Your Assets. ... Step 4: Write Down Your Liabilities. ... Step 5: Fill Out the Notes Payable to Banks and Others Section. ... Step 6: Fill Out the Stocks and Bonds Section.

How to Fill Out a Personal Financial Statement in 8 Simple Steps General Information. ... Asset Information. ... Liability Information. ... Income Sources. ... Contingent Liabilities. ... Life Insurance. ... Read Authorization Statements. ... Review.