Mississippi Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

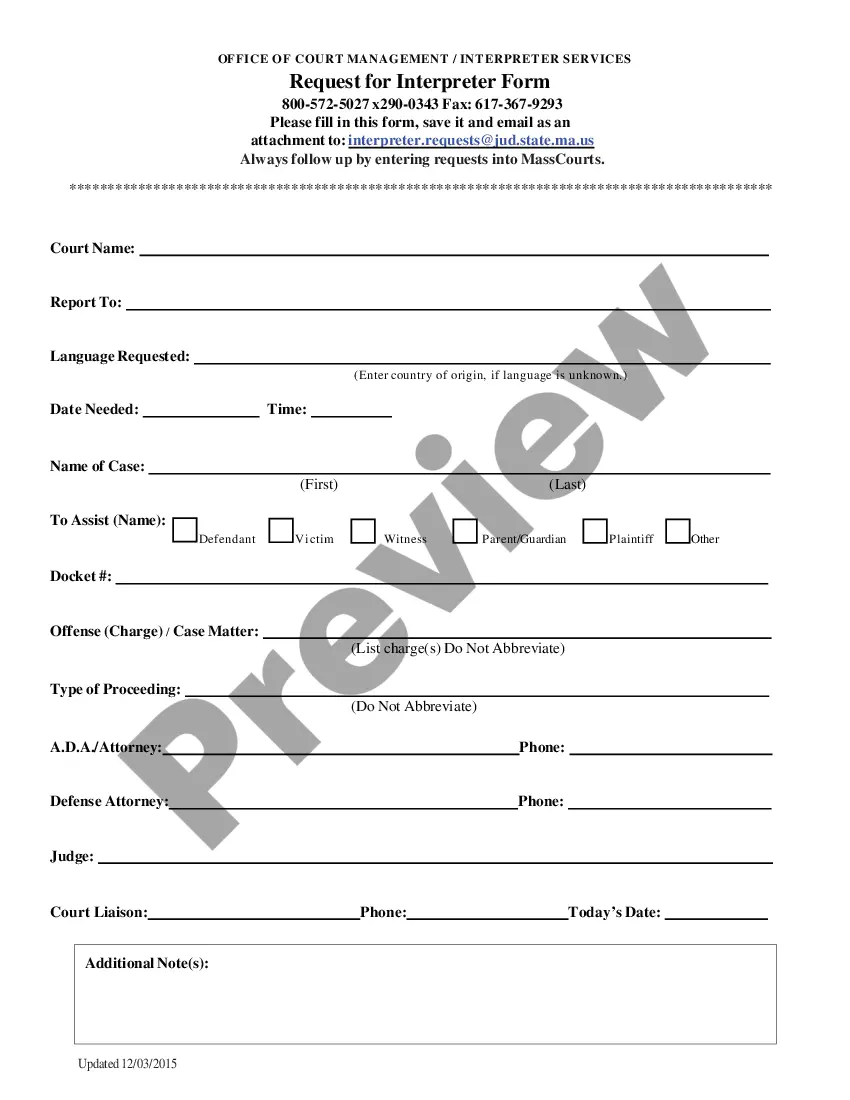

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Choosing the best legitimate papers web template could be a have difficulties. Of course, there are tons of templates available online, but how do you find the legitimate develop you want? Make use of the US Legal Forms website. The services gives thousands of templates, like the Mississippi Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, which can be used for enterprise and private requires. All the forms are checked out by professionals and meet federal and state needs.

Should you be already registered, log in to the profile and click on the Download option to get the Mississippi Notice Regarding Introduction of Restricted Share-Based Remuneration Plan. Make use of profile to search from the legitimate forms you possess purchased formerly. Go to the My Forms tab of the profile and obtain an additional backup of the papers you want.

Should you be a whole new end user of US Legal Forms, here are basic recommendations that you can follow:

- First, make certain you have chosen the proper develop for the metropolis/area. You may look over the shape utilizing the Preview option and read the shape explanation to guarantee it will be the best for you.

- In the event the develop does not meet your needs, take advantage of the Seach industry to get the right develop.

- Once you are positive that the shape would work, go through the Purchase now option to get the develop.

- Choose the rates strategy you want and enter the essential information. Design your profile and purchase the order with your PayPal profile or Visa or Mastercard.

- Opt for the document format and down load the legitimate papers web template to the system.

- Full, modify and print and signal the obtained Mississippi Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

US Legal Forms is definitely the biggest collection of legitimate forms in which you will find a variety of papers templates. Make use of the company to down load expertly-made files that follow express needs.

Form popularity

FAQ

How Restricted Stock Works. Restricted shares provide an employee with a stake in their company, but they have no tangible value before they vest. Vesting gives employees rights to employer-provided assets over time, giving the employees an incentive to perform well and remain with a company.

Restricted Stock. transfers share of stock to employees, subject to an agreement that the shares cannot be sold, transferred, or pledged until vesting occurs.

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.

Restricted Stock Units cannot be sold or transferred while they are subject to forfeiture. This means that the employee cannot sell or transfer the units until they are vested.

Restricted stocks are unregistered shares the holder cannot transfer until certain conditions are met. In contrast, unrestricted stocks are not subject to such restrictions for ownership transferability.

Here's an example. Say you've been granted 1,500 RSUs and the vesting schedule is 20% after one year of service, and then equal quarterly installments thereafter for the next three years. This would mean that after staying with your company for a year, 300 shares would vest and become yours.

Once the Restricted Stock Units vest, the employee receives shares of the company stock in a brokerage account. If the company is publicly traded, selling the shares can be as simple as placing a trade order. Note that blackout periods may apply.