Title: Mississippi First Meeting Minutes of Shareholders: A Detailed Description and Types Introduction: Mississippi First Meeting Minutes of Shareholders are formal documents that record the proceedings and decisions discussed during the initial gathering of shareholders of a company registered in the state of Mississippi, USA. These minutes are a crucial part of maintaining transparency and corporate governance, providing a legal record of the company's decision-making process. Here, we will delve into the importance, format, and different types of Mississippi First Meeting Minutes of Shareholders. Keywords: Mississippi, First Meeting Minutes, Shareholders, formal documents, proceedings, decisions, transparency, corporate governance, legal record. I. Importance of Mississippi First Meeting Minutes of Shareholders — Legal Requirement: Under Mississippi corporate law, it is mandatory for every corporation to maintain accurate records of their meetings, including the first shareholder meeting. — Compliance: Minutes ensure adherence to corporate bylaws and state regulations, demonstrating good governance practices. — Liability Protection: Detailed minutes provide protection against liability claims by maintaining evidence of responsible decision-making and due diligence. — Reference Documentation: Shareholders can refer to the minutes to accurately recall previous decisions, actions, and discussions held during the meeting. Keywords: legal requirement, compliance, corporate bylaws, state regulations, liability protection, decision-making, due diligence, reference documentation. II. Format and Content of Mississippi First Meeting Minutes of Shareholders — Heading: Include the name of the corporation, location, and date of the meeting for identification purposes. — Attendees: List the names and roles of shareholders, officers, directors, and legal counsel present at the meeting. — Call to Order: State who called the meeting to order and when it officially commenced. — Approval of Agenda: Document the approval of the meeting's agenda by the shareholders. — Minutes Approval: Record that the minutes from the previous meeting, if applicable, were reviewed, amended, and approved by the shareholders. — Business Transactions: Detail the actions taken, resolutions passed, and decisions made during the meeting, including voting results, if any. — Adjournment: Note the date and time when the meeting was adjourned. Keywords: format, content, heading, attendees, call to order, approval of agenda, minutes approval, business transactions, adjournment. III. Types of Mississippi First Meeting Minutes of Shareholders 1. Initial Organizational Meeting Minutes: Records the proceedings of the first shareholders' meeting held immediately after the incorporation of a company. Topics typically include the election of officers, adoption of bylaws, appointment of directors, and other crucial organizational matters. 2. Annual Shareholder Meeting Minutes: Document the discussions and decisions made during the yearly shareholders' meeting. These minutes address matters like financial reporting, director elections, dividend declarations, and other significant business updates. 3. Special Shareholder Meeting Minutes: These minutes pertain to a specific meeting called outside the regular annual meetings to address particular issues, such as mergers, acquisitions, amendments to bylaws, or other extraordinary matters. Keywords: initial organizational meeting, annual shareholder meeting, special shareholder meeting, incorporation, bylaws, financial reporting, director elections, extraordinary matters. Conclusion: Mississippi First Meeting Minutes of Shareholders play a vital role in maintaining compliance, legal requirements, and corporate transparency. By keeping an accurate record of the first shareholder meeting, corporations in Mississippi can ensure good governance, protect themselves from liability claims, and create a historical reference for future decision-making processes. Keywords: compliance, legal requirements, corporate transparency, good governance, liability claims, historical reference, decision-making processes.

Mississippi First Meeting Minutes of Shareholders

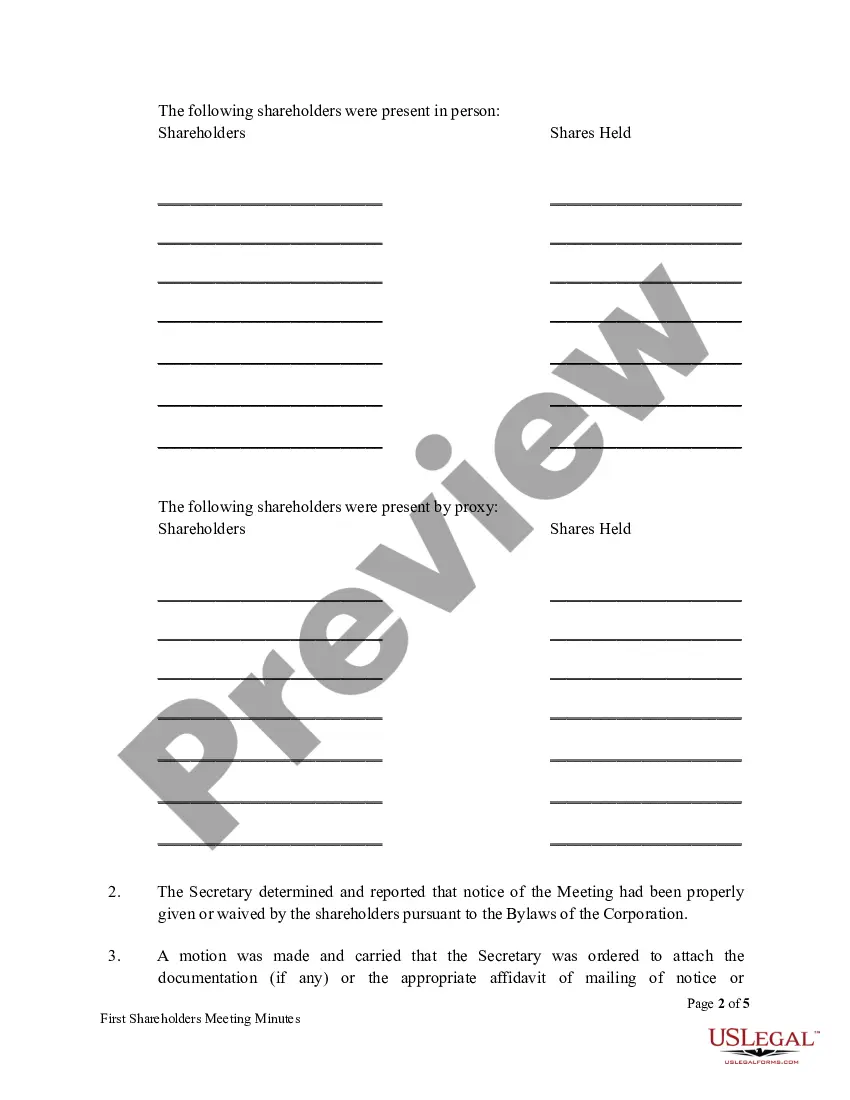

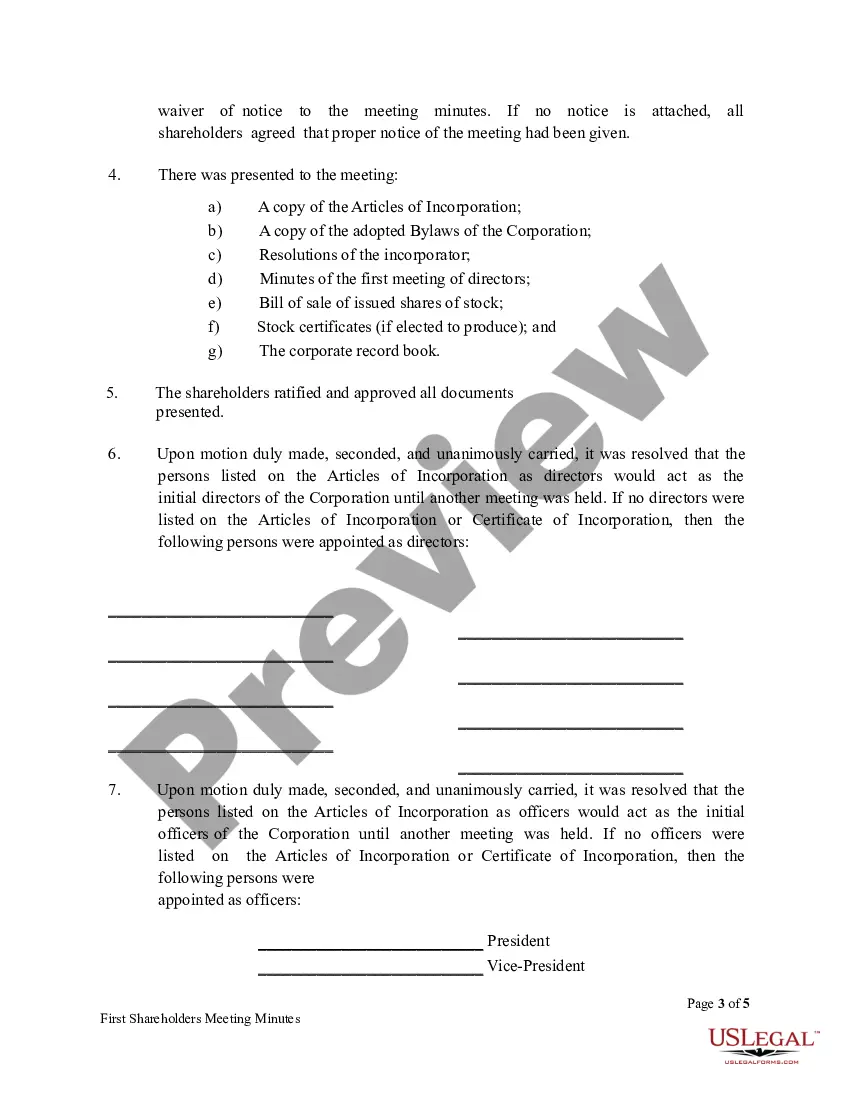

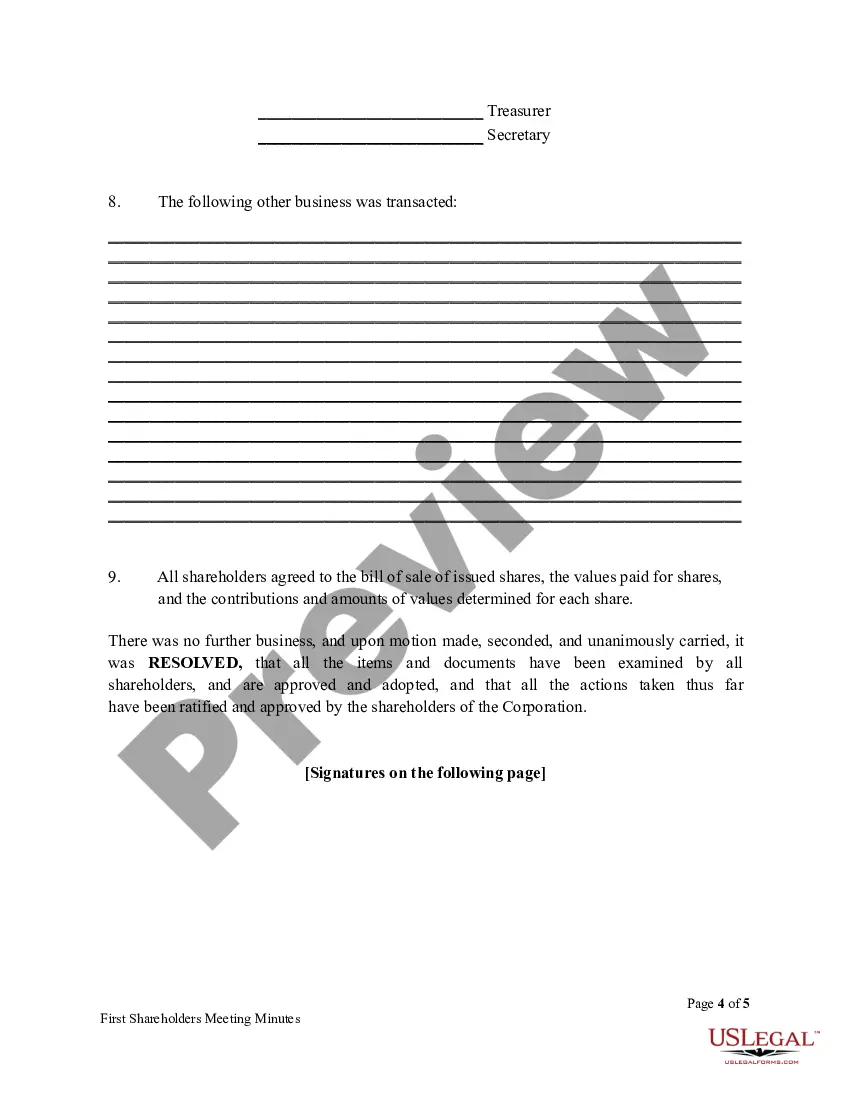

Description

How to fill out Mississippi First Meeting Minutes Of Shareholders?

If you have to total, acquire, or produce lawful document templates, use US Legal Forms, the largest assortment of lawful kinds, which can be found on the web. Use the site`s easy and handy search to get the paperwork you need. Different templates for organization and specific purposes are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the Mississippi First Meeting Minutes of Shareholders in a handful of clicks.

Should you be previously a US Legal Forms customer, log in to the profile and click on the Obtain key to get the Mississippi First Meeting Minutes of Shareholders. You may also accessibility kinds you in the past saved in the My Forms tab of your own profile.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for the right area/region.

- Step 2. Utilize the Review option to look through the form`s content material. Never forget about to read the information.

- Step 3. Should you be unsatisfied using the form, make use of the Lookup discipline at the top of the monitor to find other variations from the lawful form web template.

- Step 4. Upon having identified the form you need, select the Acquire now key. Opt for the costs plan you favor and put your accreditations to sign up for an profile.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal profile to finish the purchase.

- Step 6. Find the formatting from the lawful form and acquire it on your gadget.

- Step 7. Comprehensive, modify and produce or indication the Mississippi First Meeting Minutes of Shareholders.

Each and every lawful document web template you get is yours forever. You might have acces to each form you saved in your acccount. Go through the My Forms segment and pick a form to produce or acquire once again.

Remain competitive and acquire, and produce the Mississippi First Meeting Minutes of Shareholders with US Legal Forms. There are many skilled and status-certain kinds you may use for your personal organization or specific needs.