Mississippi Foundation Contractor Agreement - Self-Employed

Description

How to fill out Mississippi Foundation Contractor Agreement - Self-Employed?

Are you presently in a placement that you need to have paperwork for either company or specific purposes virtually every day time? There are a lot of legitimate document web templates available online, but discovering versions you can depend on is not simple. US Legal Forms offers a large number of type web templates, like the Mississippi Foundation Contractor Agreement - Self-Employed, that happen to be created to satisfy federal and state requirements.

When you are presently knowledgeable about US Legal Forms site and get a merchant account, merely log in. Afterward, it is possible to obtain the Mississippi Foundation Contractor Agreement - Self-Employed web template.

Unless you provide an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the type you need and ensure it is for that appropriate city/state.

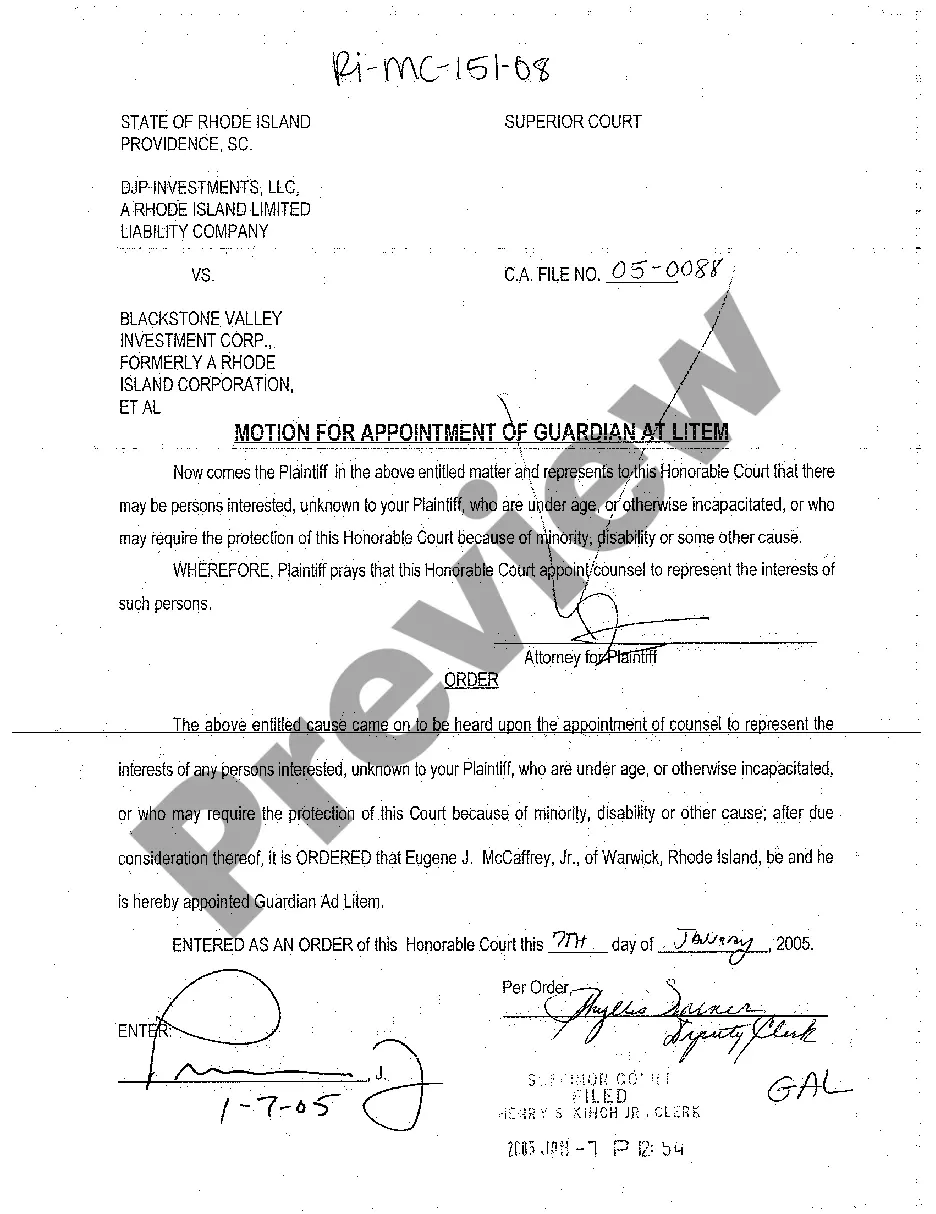

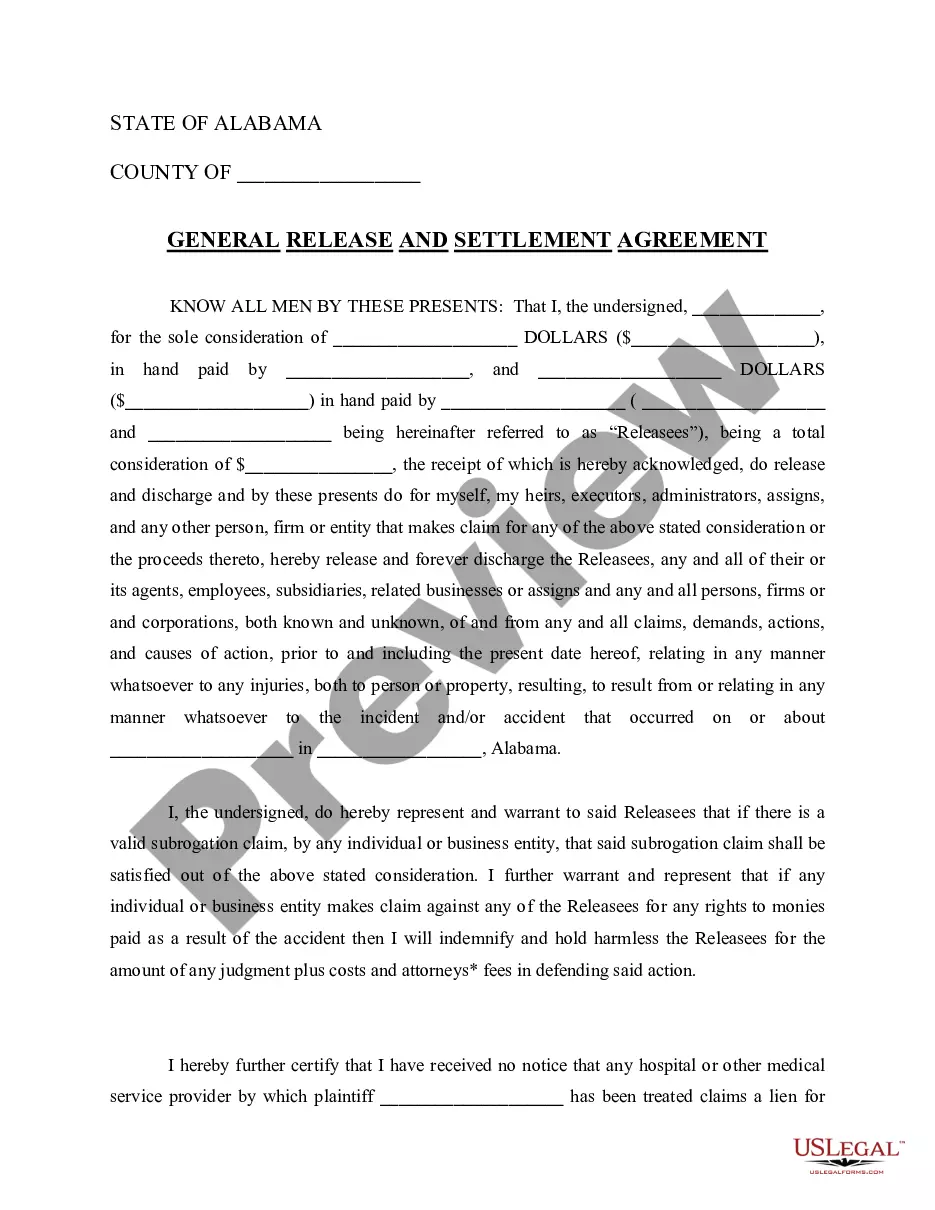

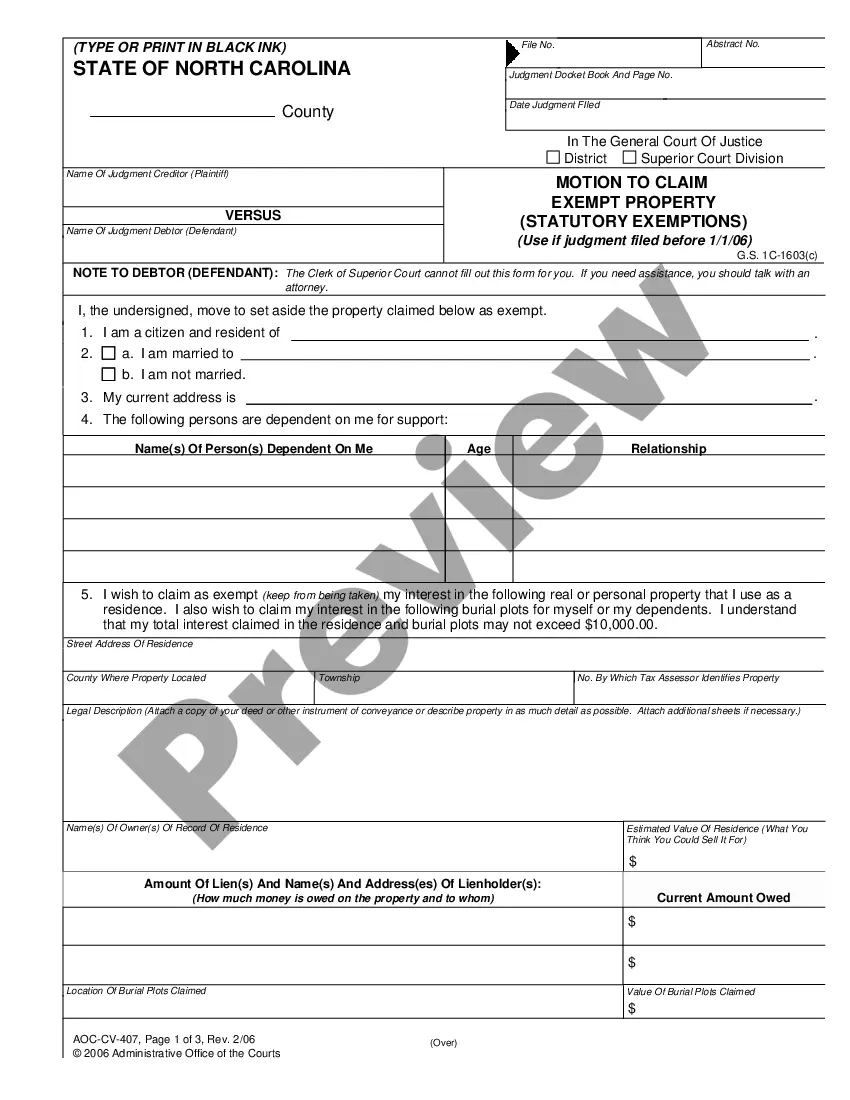

- Take advantage of the Preview key to analyze the form.

- Look at the outline to ensure that you have chosen the right type.

- In case the type is not what you are seeking, use the Search area to find the type that meets your needs and requirements.

- Once you discover the appropriate type, click on Get now.

- Select the costs plan you need, fill out the specified info to produce your account, and buy an order utilizing your PayPal or charge card.

- Select a practical data file file format and obtain your version.

Locate all the document web templates you have purchased in the My Forms menus. You can get a extra version of Mississippi Foundation Contractor Agreement - Self-Employed at any time, if needed. Just select the required type to obtain or produce the document web template.

Use US Legal Forms, by far the most substantial variety of legitimate kinds, to conserve time as well as steer clear of faults. The service offers appropriately produced legitimate document web templates which can be used for a range of purposes. Produce a merchant account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

Contract work provides greater independence, it can give you more predictable control of your work, and for many people, greater job security than traditional full-time employment. However, you are responsible for your own taxes, contracts, benefits and vacations.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.