Mississippi Farm Hand Services Contract - Self-Employed

Description

How to fill out Mississippi Farm Hand Services Contract - Self-Employed?

Are you currently in a situation that you need paperwork for possibly organization or personal uses nearly every time? There are a variety of authorized document templates available online, but locating ones you can depend on isn`t simple. US Legal Forms provides a large number of type templates, such as the Mississippi Farm Hand Services Contract - Self-Employed, which are created to meet federal and state specifications.

Should you be currently knowledgeable about US Legal Forms web site and also have an account, basically log in. Following that, you are able to down load the Mississippi Farm Hand Services Contract - Self-Employed format.

If you do not provide an profile and need to start using US Legal Forms, abide by these steps:

- Discover the type you need and ensure it is for your appropriate area/area.

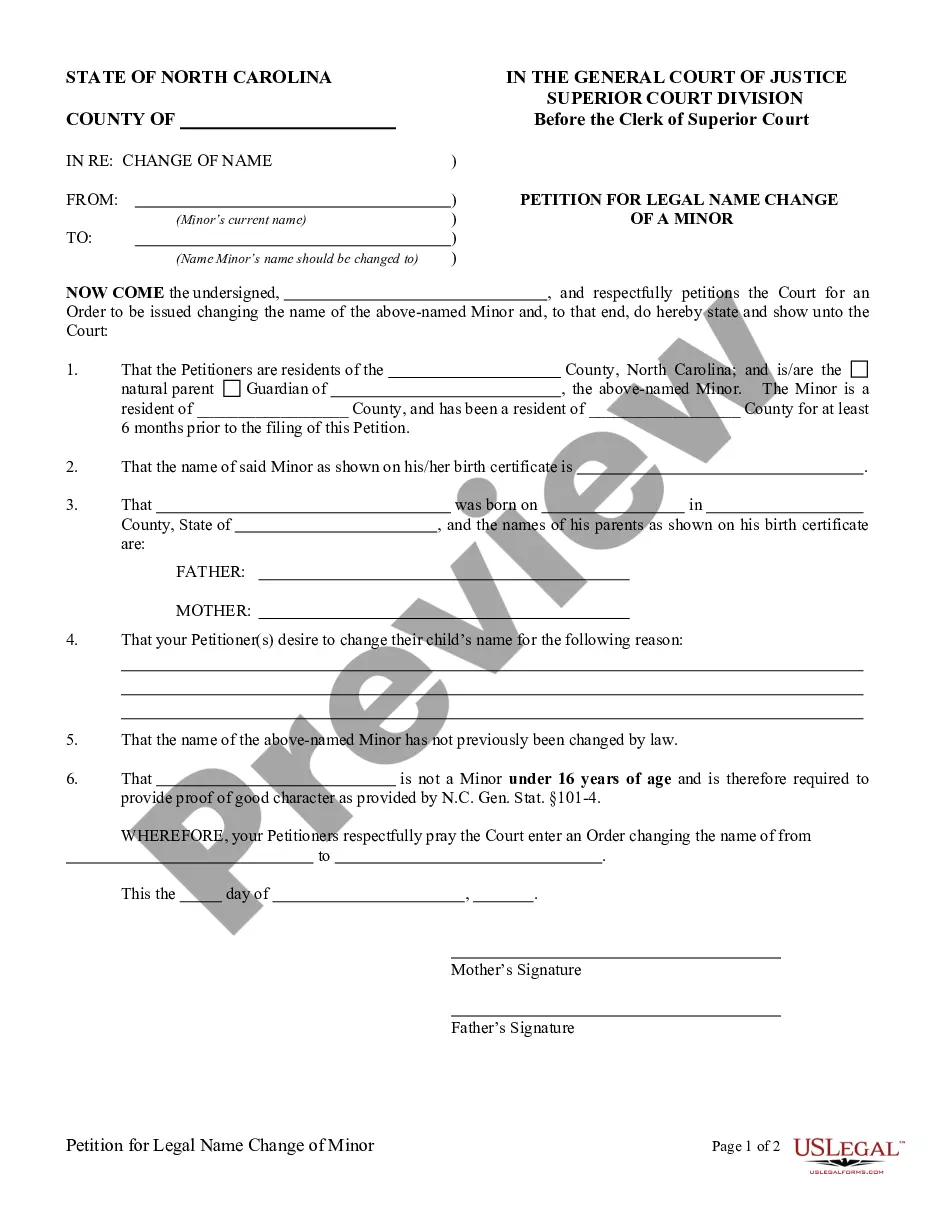

- Utilize the Review key to check the shape.

- Look at the information to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you`re seeking, utilize the Search discipline to find the type that meets your needs and specifications.

- Once you get the appropriate type, just click Purchase now.

- Opt for the prices prepare you need, fill out the desired details to generate your account, and pay for your order making use of your PayPal or credit card.

- Choose a practical file file format and down load your backup.

Get all the document templates you may have purchased in the My Forms menu. You can obtain a extra backup of Mississippi Farm Hand Services Contract - Self-Employed at any time, if needed. Just select the needed type to down load or print the document format.

Use US Legal Forms, one of the most comprehensive variety of authorized forms, to conserve some time and avoid blunders. The assistance provides professionally manufactured authorized document templates which you can use for a variety of uses. Create an account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

An independent contractor can be anyone to provides services to the general public and who does not operate within an employer-employee relationship....Some examples include:Doctors in a private practice.Lawyers, bookkeepers, accountants.IT, web designers, programmers.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.