Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the biggest libraries of legitimate forms in the States - offers a wide array of legitimate document templates you are able to acquire or print out. Utilizing the site, you will get thousands of forms for company and specific functions, sorted by classes, says, or keywords.You will find the newest variations of forms like the Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor in seconds.

If you already possess a registration, log in and acquire Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor in the US Legal Forms catalogue. The Acquire switch will show up on every form you view. You have accessibility to all previously saved forms from the My Forms tab of your account.

If you would like use US Legal Forms for the first time, listed here are basic guidelines to help you started off:

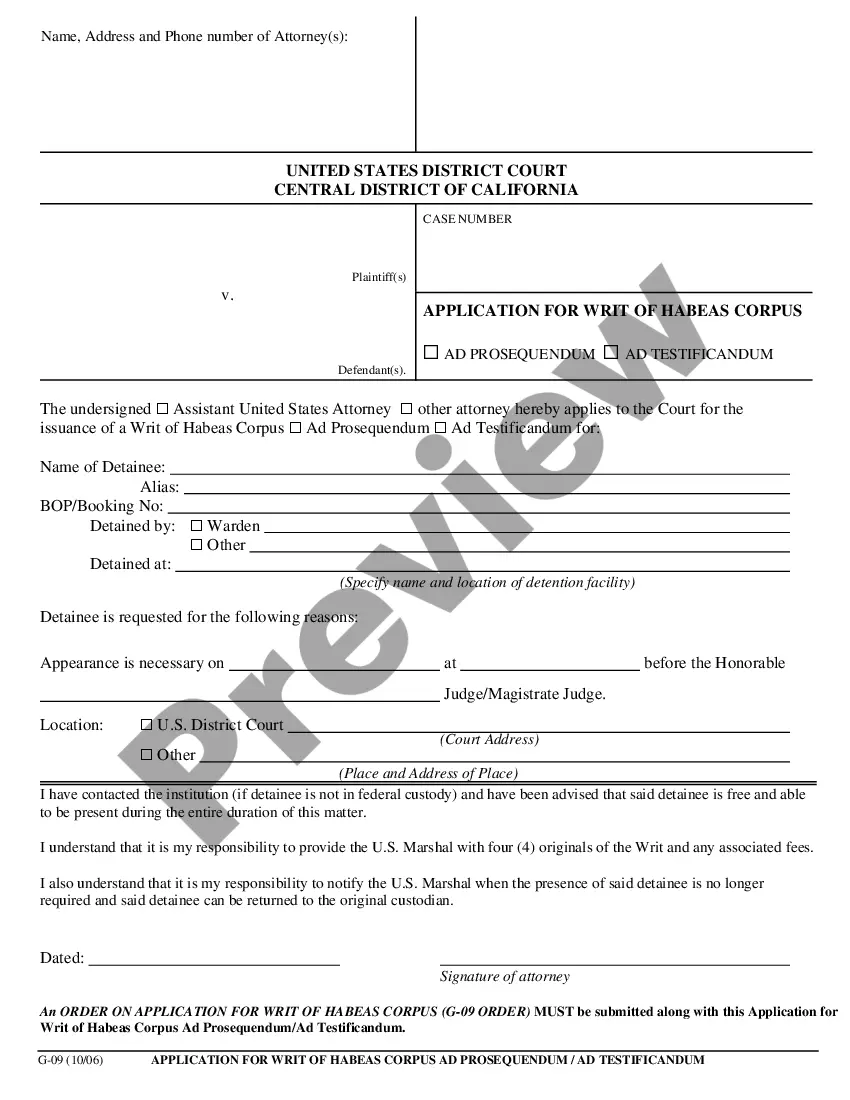

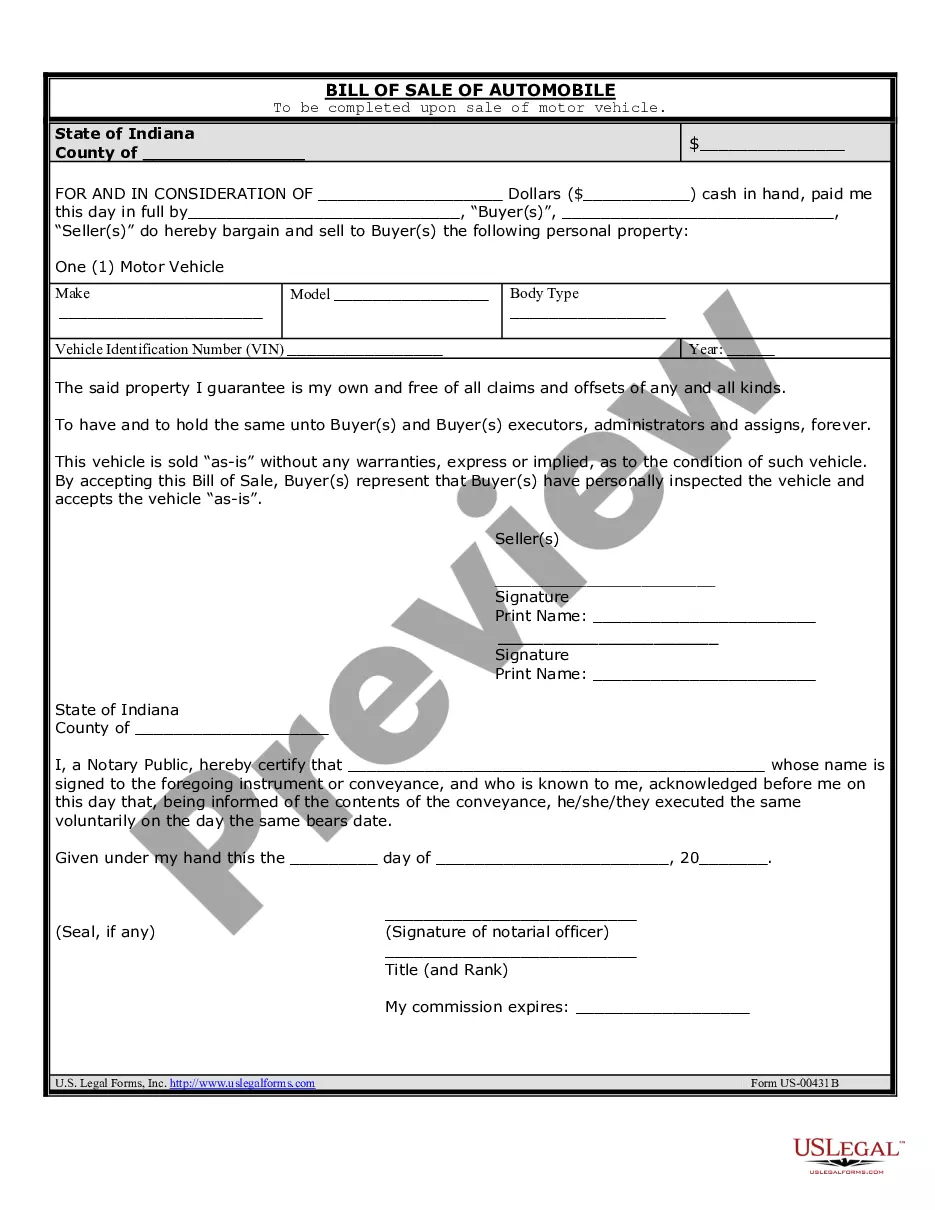

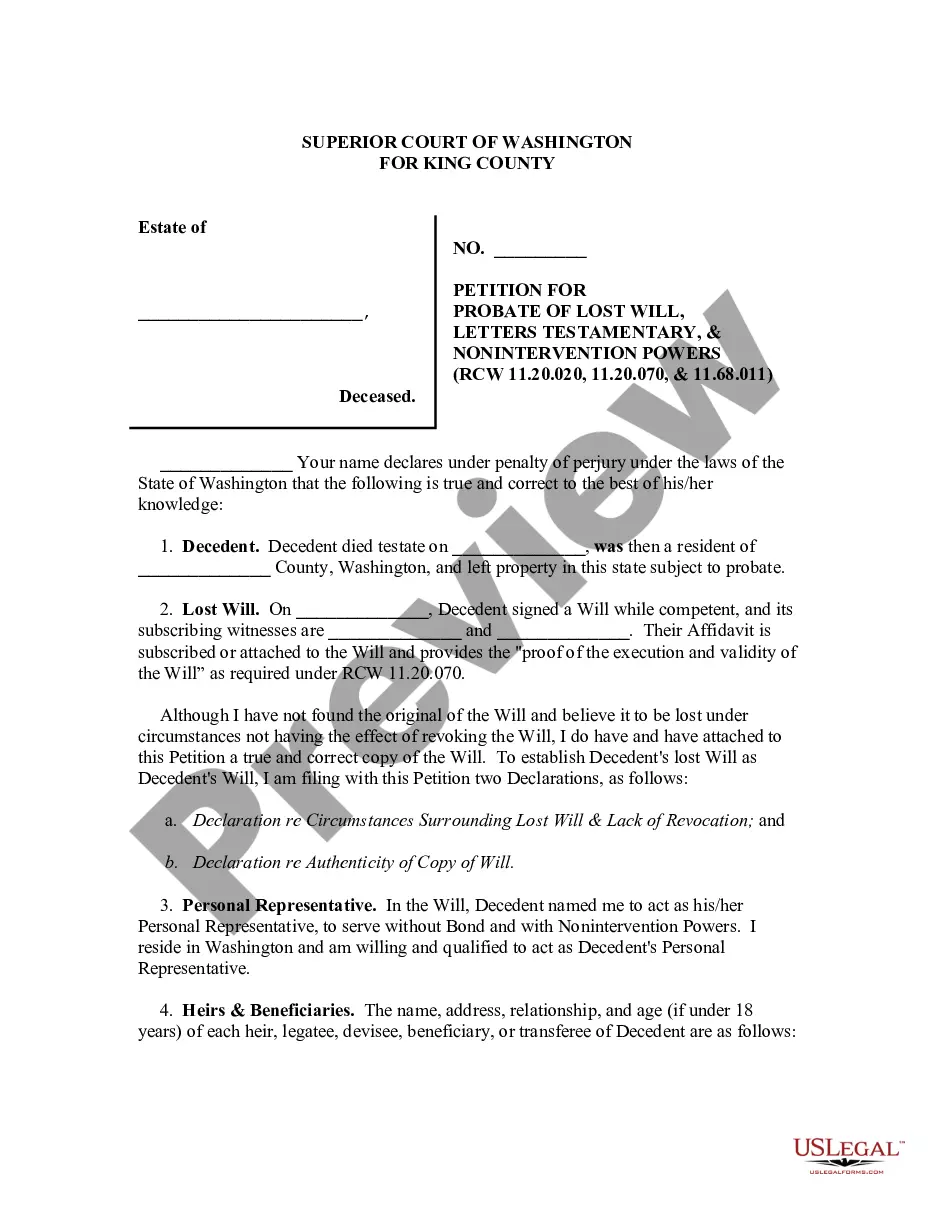

- Make sure you have selected the correct form for the area/state. Select the Preview switch to examine the form`s content. Read the form explanation to ensure that you have selected the appropriate form.

- If the form does not satisfy your demands, take advantage of the Look for discipline towards the top of the display to discover the the one that does.

- In case you are pleased with the form, verify your selection by simply clicking the Acquire now switch. Then, choose the rates plan you prefer and supply your qualifications to sign up for the account.

- Method the purchase. Make use of your bank card or PayPal account to complete the purchase.

- Select the format and acquire the form on your own gadget.

- Make alterations. Fill up, edit and print out and sign the saved Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor.

Every single format you added to your money does not have an expiry date and is also your own property forever. So, in order to acquire or print out yet another copy, just visit the My Forms portion and click on around the form you require.

Obtain access to the Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most substantial catalogue of legitimate document templates. Use thousands of professional and status-certain templates that meet your small business or specific requires and demands.

Form popularity

FAQ

Since they're not deemed employees, you don't pay them wages or a salary. Instead, you pay the 1099 worker according to the agreement you strike with them. In addition, you don't have to worry about withholding income taxes, withholding and paying Social Security and Medicare taxes, or paying unemployment taxes.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Every situation is different, but the general steps are as follows:Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.More items...

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.