Mississippi Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Mississippi Electronics Assembly Agreement - Self-Employed Independent Contractor?

Are you presently within a place that you will need files for sometimes business or personal reasons just about every working day? There are plenty of legal file themes available online, but getting versions you can rely isn`t simple. US Legal Forms provides a huge number of develop themes, such as the Mississippi Electronics Assembly Agreement - Self-Employed Independent Contractor, which can be created to meet federal and state demands.

When you are currently acquainted with US Legal Forms website and also have an account, merely log in. Following that, you can obtain the Mississippi Electronics Assembly Agreement - Self-Employed Independent Contractor format.

Should you not come with an profile and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you want and ensure it is for that right city/state.

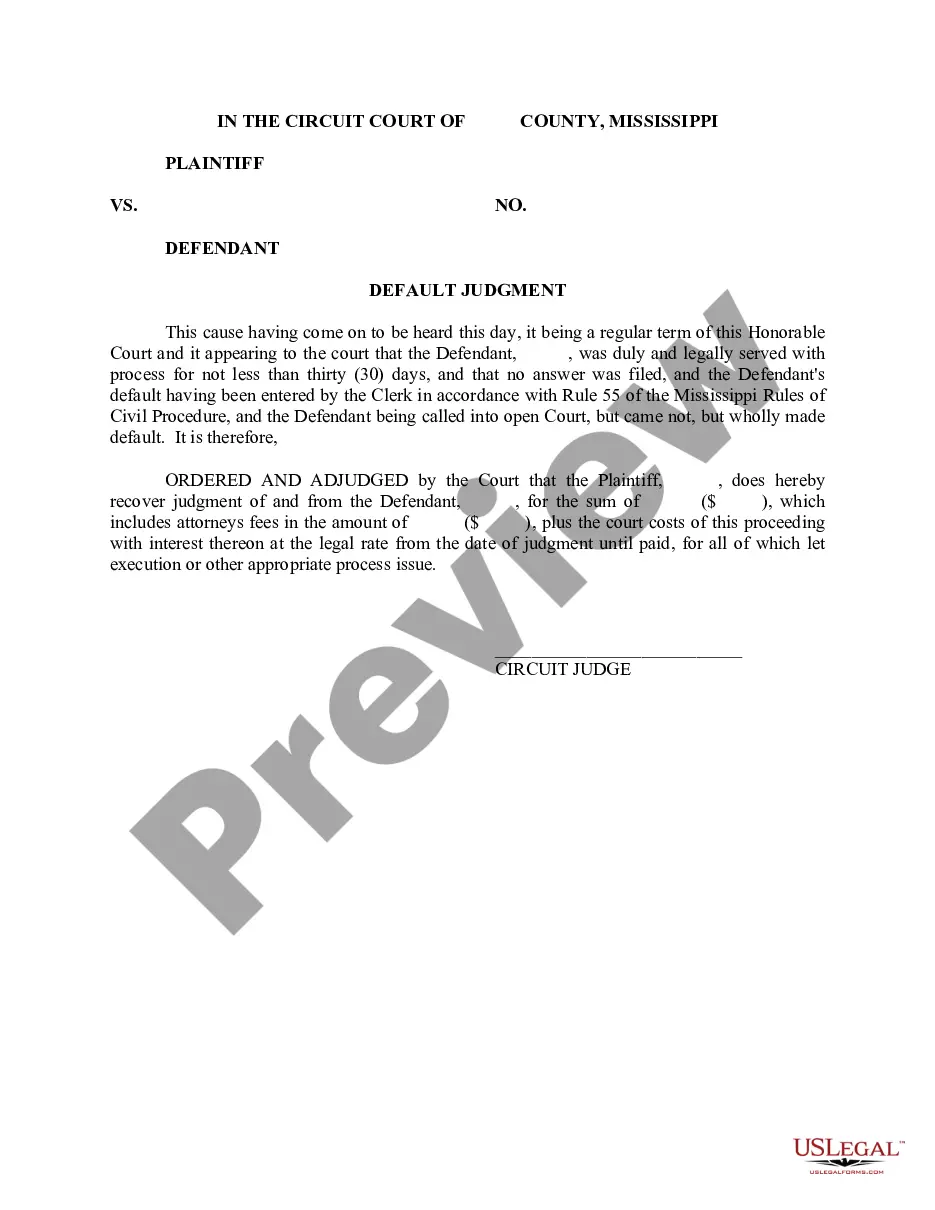

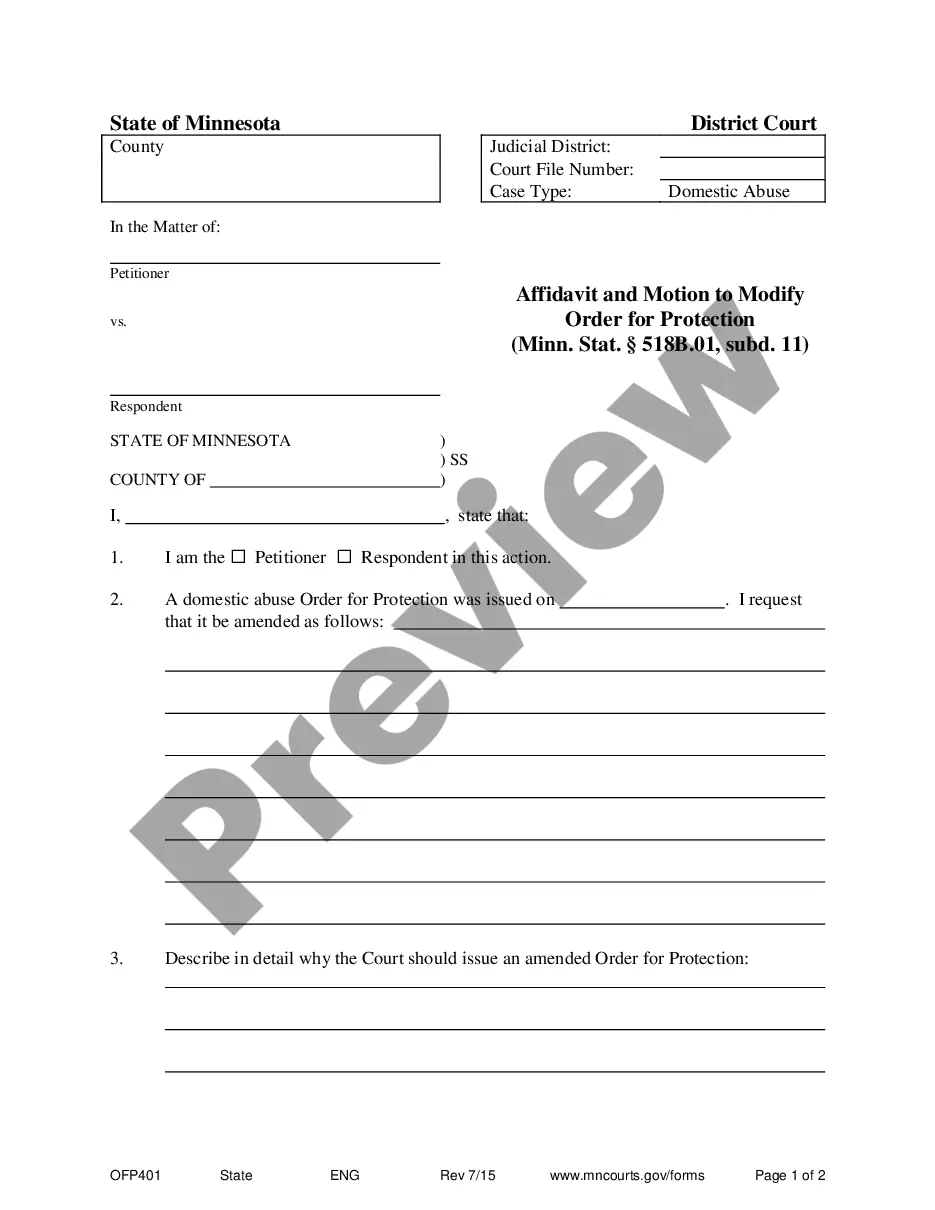

- Use the Review option to review the shape.

- Read the explanation to ensure that you have selected the right develop.

- If the develop isn`t what you are looking for, take advantage of the Look for area to discover the develop that fits your needs and demands.

- When you find the right develop, click on Acquire now.

- Select the costs prepare you need, complete the required info to produce your account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free file structure and obtain your version.

Get all of the file themes you have purchased in the My Forms food list. You can aquire a more version of Mississippi Electronics Assembly Agreement - Self-Employed Independent Contractor whenever, if possible. Just go through the necessary develop to obtain or print out the file format.

Use US Legal Forms, probably the most considerable assortment of legal forms, to save some time and avoid mistakes. The services provides expertly created legal file themes which you can use for a variety of reasons. Make an account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.