Mississippi Direction For Payment of Royalty to Trustee by Royalty Owners

Description

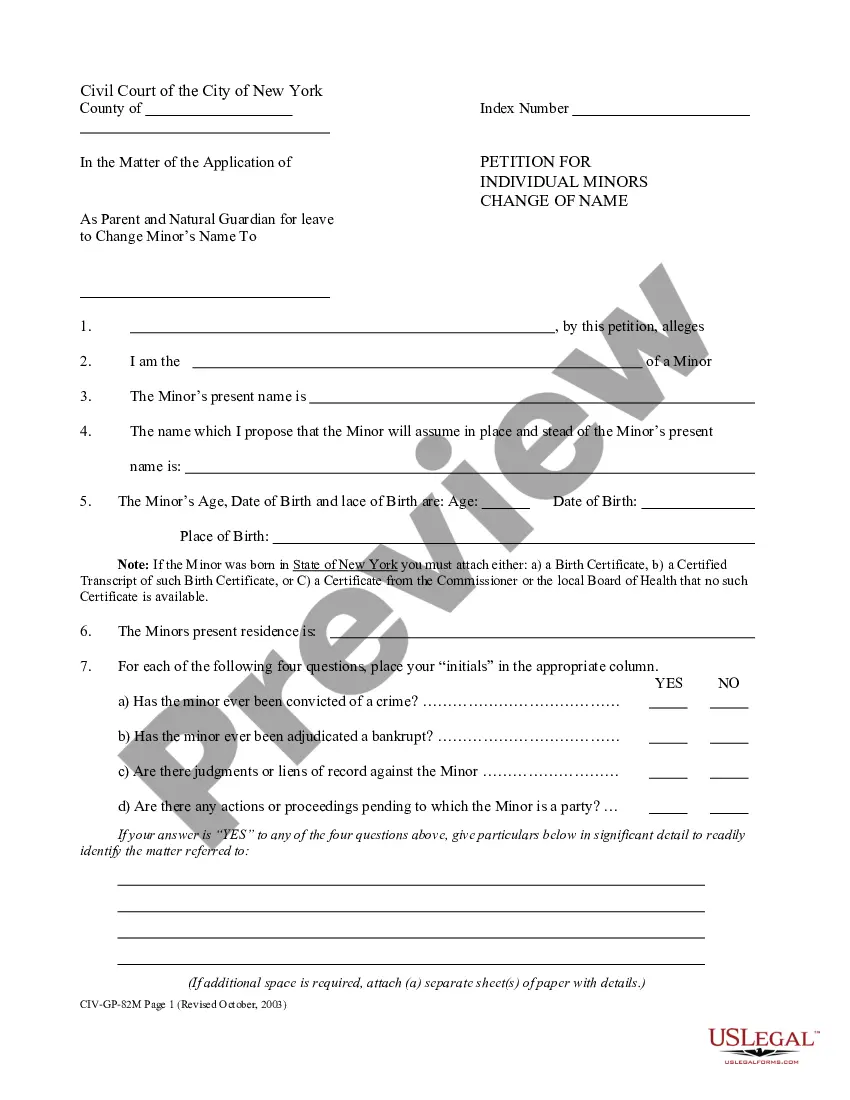

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Finding the right legitimate file template could be a battle. Of course, there are tons of web templates available online, but how will you discover the legitimate kind you want? Utilize the US Legal Forms website. The services gives a large number of web templates, like the Mississippi Direction For Payment of Royalty to Trustee by Royalty Owners, that you can use for company and personal requires. All of the types are inspected by professionals and satisfy state and federal demands.

In case you are previously authorized, log in for your bank account and click the Down load option to find the Mississippi Direction For Payment of Royalty to Trustee by Royalty Owners. Make use of bank account to appear with the legitimate types you might have bought earlier. Proceed to the My Forms tab of your respective bank account and get one more version of your file you want.

In case you are a brand new end user of US Legal Forms, allow me to share basic instructions so that you can follow:

- Very first, make certain you have chosen the proper kind to your area/state. You can check out the form using the Preview option and study the form information to make sure this is basically the right one for you.

- In case the kind is not going to satisfy your expectations, make use of the Seach field to discover the correct kind.

- When you are sure that the form is proper, go through the Buy now option to find the kind.

- Select the rates strategy you would like and enter in the necessary information and facts. Design your bank account and pay for your order with your PayPal bank account or bank card.

- Choose the file structure and acquire the legitimate file template for your gadget.

- Complete, change and produce and signal the received Mississippi Direction For Payment of Royalty to Trustee by Royalty Owners.

US Legal Forms is definitely the largest library of legitimate types in which you can see different file web templates. Utilize the company to acquire appropriately-made files that follow express demands.

Form popularity

FAQ

An extension of time to file a Federal Fiduciary Return will be accepted if no additional Mississippi tax is due.

Section 80QQB of income tax act 1961, states provisions related to Royalty or copyright Income. This section includes deductions for royalty income of authors. The income from the royalty is taxed under profit and gains of business or profession or other sources. Section 80QQB: Deductions for Royalty Income of Authors Tax2win ? ... ? Section 80 Deductions Tax2win ? ... ? Section 80 Deductions

This reward or compensation is called Royalty. While the Income tax department charges tax on this income under ?Profit and Gains of Business or Profession? or ?Other Sources? head of Income ,it also provides a deduction on the same that can be claimed by the authors to save tax.

Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. What is Taxable and Nontaxable Income? | Internal Revenue Service irs.gov ? small-businesses-self-employed irs.gov ? small-businesses-self-employed

Royalty income includes any payments you get from a patent, a copyright, or some natural resource that you own. Rental or royalty income - Glossary - HealthCare.gov healthcare.gov ? glossary ? rental-or-royalty... healthcare.gov ? glossary ? rental-or-royalty...

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments. What are Royalties & How do Royalty Payments Work? - Tipalti tipalti.com ? royalty-payments tipalti.com ? royalty-payments