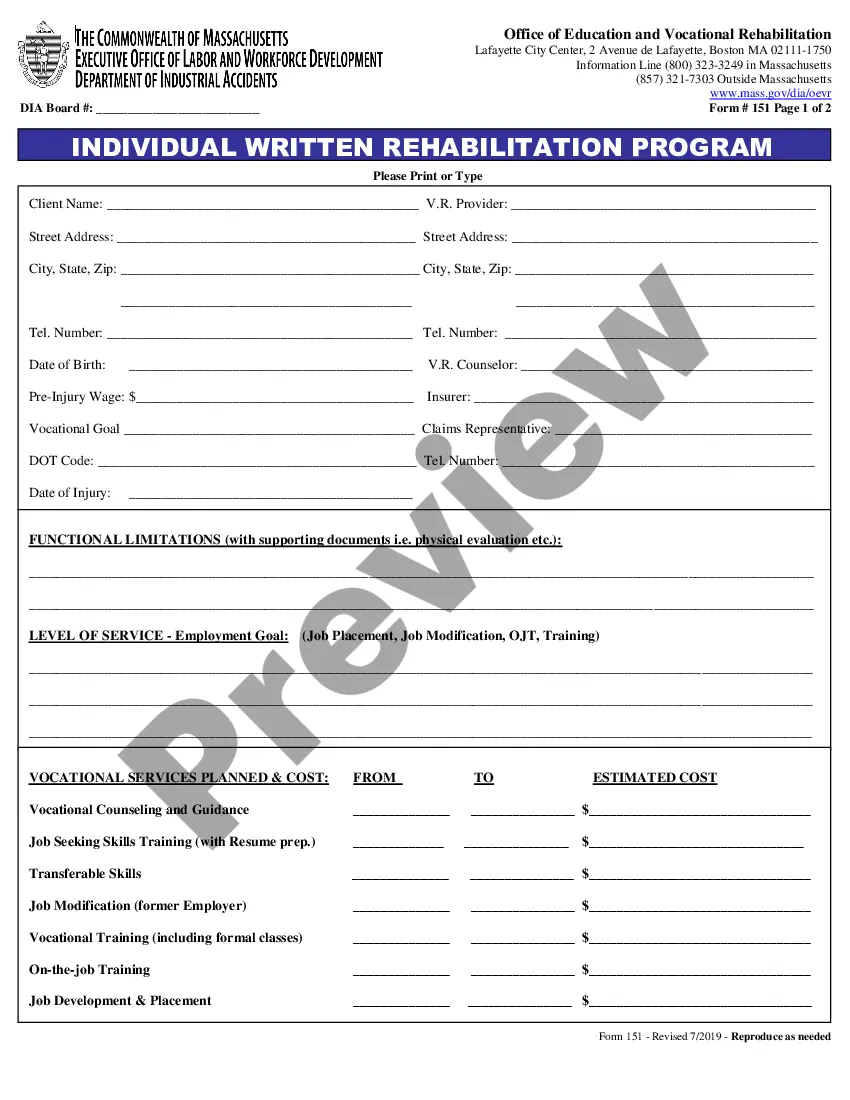

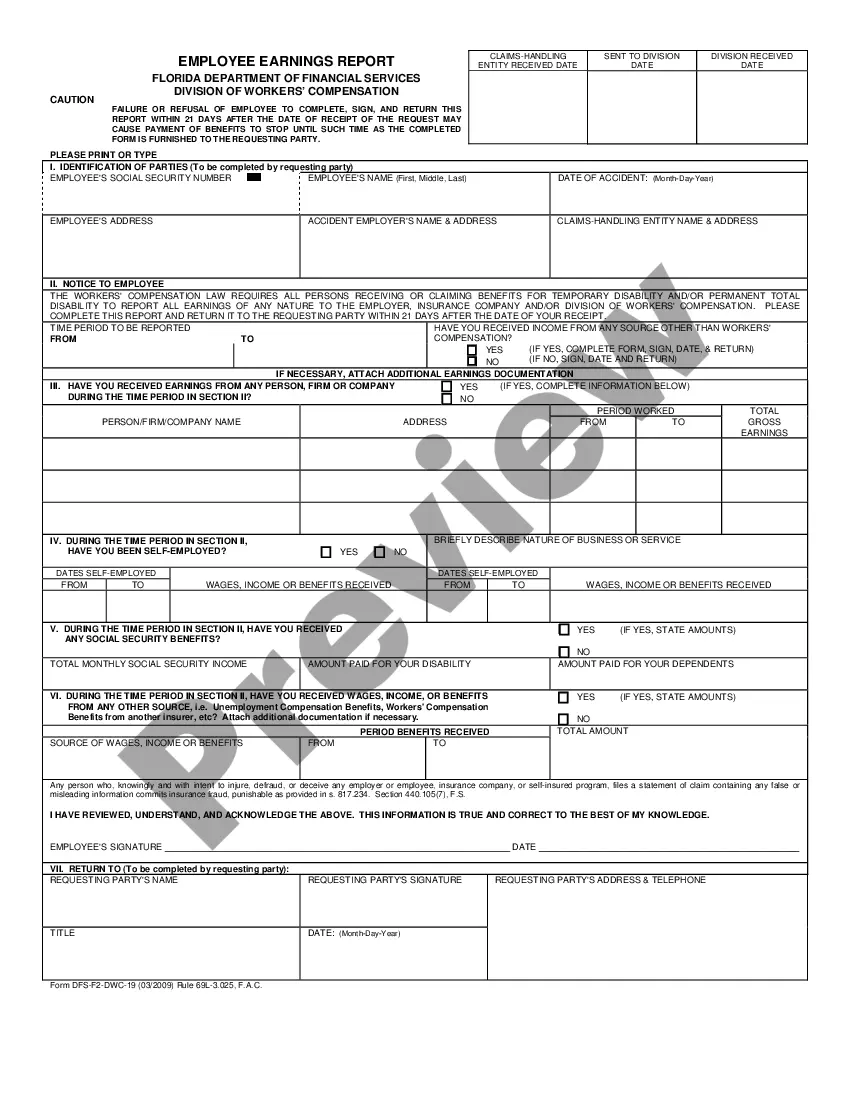

A Mississippi Quitclaim Deed All Granter C is essentially a legal document that allows the transfer of property ownership rights from the granter, known as Granter C, to another party, referred to as the grantee. This type of quitclaim deed is specific to the state of Mississippi and grants all the interest and rights held by Granter C in the property being transferred. Keywords: Mississippi, Quitclaim Deed, All Granter C, property ownership, transfer, legal document, granter, grantee, interest, rights. There are no specific types of Mississippi Quitclaim Deed All Granter C, as the term refers to a particular clause or provision included in a standard quitclaim deed for transferring property ownership. However, it is worth noting that quitclaim deeds can be used for various scenarios, such as transferring property between family members, spouses, or parties involved in divorce settlements, or for releasing any claims or interests in the property. In Mississippi, a Quitclaim Deed All Granter C is commonly used when the granter wishes to transfer their entire interest in the property to the grantee without providing any warranties or guarantees of title. This means that the granter does not guarantee that they have legal ownership of the property or that it is free from any liens or encumbrances. The grantee receives the property as-is, assuming any potential risks or issues associated with the title. To prepare a Mississippi Quitclaim Deed All Granter C, it is recommended to consult with a qualified real estate attorney or utilize online legal services specializing in deed preparation. The document should include the following essential information: 1. Heading: "Mississippi Quitclaim Deed All Granter C" or similar title. 2. Granter and Grantee details: Include the full legal names, addresses, and contact information of both parties involved. 3. Property description: Accurately describe the property being transferred, including the address, county, parcel number, and any other identifiers necessary for its identification. 4. Consideration: Specify any monetary consideration exchanged, which may be required for tax or recording purposes. 5. Granter's statement: A clear statement from Granter C declaring their intent to transfer all their rights, title, and interest in the property. 6. Signatures: Both Granter C and the grantee must sign the deed in the presence of a notary public. 7. Notary acknowledgment: The notary public should acknowledge the signatures and affix their seal and signature accordingly. 8. Recording: Once executed, the quitclaim deed must be recorded with the appropriate county clerk's office in Mississippi to provide public notice of the property transfer. It is crucial to understand that a Mississippi Quitclaim Deed All Granter C does not offer the same level of protection as a warranty deed. As such, it is advisable for both parties involved to seek legal advice to ensure they fully comprehend the implications and potential risks associated with this type of property transfer before proceeding.

Mississippi Quitclaim Deed All of Grantor C

Description

How to fill out Mississippi Quitclaim Deed All Of Grantor C?

US Legal Forms - one of several largest libraries of legal kinds in the United States - delivers a wide array of legal file web templates you may down load or produce. Using the website, you will get 1000s of kinds for enterprise and personal functions, categorized by types, says, or keywords.You can get the latest models of kinds just like the Mississippi Quitclaim Deed All of Grantor C within minutes.

If you already possess a monthly subscription, log in and down load Mississippi Quitclaim Deed All of Grantor C from the US Legal Forms collection. The Download key can look on every single form you see. You have accessibility to all previously delivered electronically kinds within the My Forms tab of the bank account.

If you would like use US Legal Forms initially, here are straightforward guidelines to help you started off:

- Make sure you have picked out the correct form for your metropolis/county. Select the Preview key to examine the form`s articles. Browse the form explanation to actually have selected the proper form.

- In the event the form does not match your requirements, make use of the Search field at the top of the screen to discover the the one that does.

- If you are pleased with the shape, validate your choice by simply clicking the Buy now key. Then, pick the rates strategy you favor and give your credentials to register on an bank account.

- Procedure the deal. Use your credit card or PayPal bank account to complete the deal.

- Select the formatting and down load the shape in your device.

- Make alterations. Complete, edit and produce and signal the delivered electronically Mississippi Quitclaim Deed All of Grantor C.

Every format you included in your bank account does not have an expiry particular date and is also yours permanently. So, in order to down load or produce yet another backup, just check out the My Forms area and click on around the form you require.

Obtain access to the Mississippi Quitclaim Deed All of Grantor C with US Legal Forms, probably the most considerable collection of legal file web templates. Use 1000s of skilled and status-particular web templates that satisfy your small business or personal demands and requirements.

Form popularity

FAQ

Also called a non-warranty deed, a quitclaim deed conveys whatever interest the grantor currently has in the property if any. The grantor only "remises, releases, and quitclaims" their interest in the property to the grantee.

Content Requirements for Mississippi Deeds Title. A document title?such as Quitclaim Deed or Warranty Deed?must identify the type of document being recorded. Parties' identifying information. ... Property description or indexing information. ... Prepared-by statement. ... Return address.

Mississippi deeds are recorded with the chancery clerk for the county where the property is located. The standard fee payable to the chancery clerk for recording a Mississippi deed is $25.00 for the initial five pages and $1.00 for each page over five. Some counties charge an extra $1.00 archiving fee.

How to Create a Mississippi Special Warranty Deed Identify the parties. Clearly identify the grantor (the person transferring the property) and the grantee (the person receiving the property). Include a legal description of the property. ... Specify the limited warranty. ... Consideration. ... Signing. ... Recording.

Laws. Recording ? The quit claim deed will need to be brought to the Clerk of the Chancery Clerk's Office along with the required filing fee. Signing (§ 89-3-7) ? An official seal from a notary public is required to be shown under the Grantor(s) signature(s).

How do I transfer a deed in Mississippi? A processed, signed, and notarized deed must be presented to the Recorder of the Deeds in the same county of the property. Once the deed is accepted and signed, the transfer is complete.

Before a quitclaim deed can be recorded with a county recorder in Mississippi, the grantor must sign and acknowledge it. The names, addresses, and telephone numbers of the grantors and grantees to the quit claim deed, along with a legal description of the real property should be provided on the first page (89-5-24).

There are two sides to a transaction. In real estate, a grantee is the recipient of the property, and the grantor is a person that transfers ownership rights of a property to another person.