Mississippi Receipt for Damages (Fiber Optic Communications System)

Description

How to fill out Receipt For Damages (Fiber Optic Communications System)?

Are you presently inside a situation the place you need paperwork for possibly company or individual reasons nearly every day time? There are a lot of legal papers layouts accessible on the Internet, but locating types you can trust is not easy. US Legal Forms provides a huge number of type layouts, like the Mississippi Receipt for Damages (Fiber Optic Communications System), which are composed to fulfill federal and state demands.

Should you be already knowledgeable about US Legal Forms website and also have a merchant account, basically log in. Following that, you may acquire the Mississippi Receipt for Damages (Fiber Optic Communications System) web template.

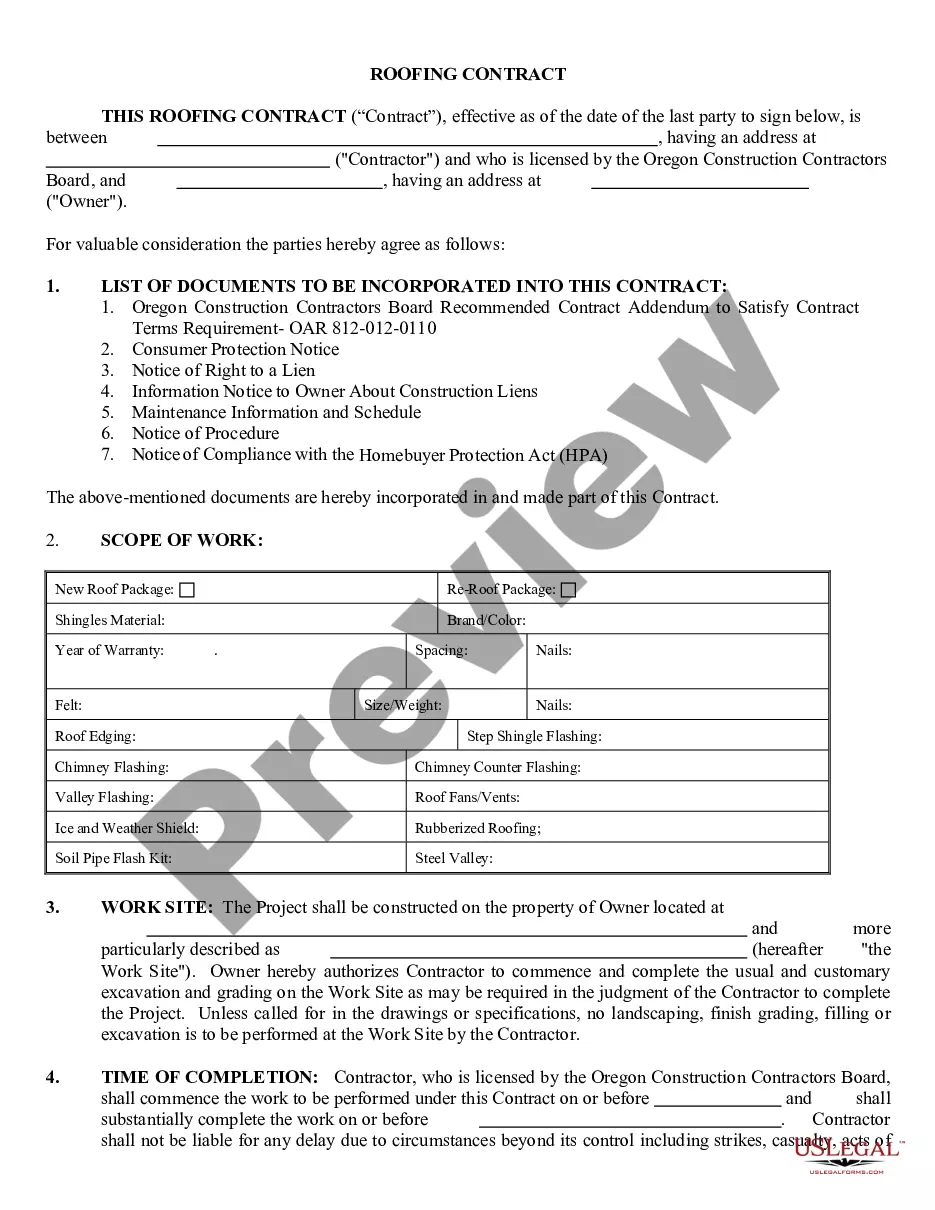

Should you not come with an account and need to start using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for your proper city/county.

- Take advantage of the Preview option to check the shape.

- See the explanation to ensure that you have selected the appropriate type.

- In the event the type is not what you`re seeking, utilize the Look for industry to discover the type that meets your needs and demands.

- If you find the proper type, just click Buy now.

- Opt for the pricing prepare you desire, submit the required details to make your account, and pay money for the order using your PayPal or bank card.

- Select a handy paper formatting and acquire your backup.

Locate all the papers layouts you may have bought in the My Forms food selection. You may get a additional backup of Mississippi Receipt for Damages (Fiber Optic Communications System) any time, if required. Just click on the required type to acquire or produce the papers web template.

Use US Legal Forms, by far the most comprehensive variety of legal types, in order to save some time and steer clear of blunders. The support provides skillfully made legal papers layouts that you can use for a selection of reasons. Generate a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

Grocery taxes do not exist in 37 states, but Mississippi has the highest in the U.S. at a rate of 7%. Twelve other states have grocery sales taxes ranging from 0.125% to 6%.

Some customers are exempt from paying sales tax under Mississippi law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

There is no overall exemption from sales tax in Mississippi that applies to churches; however, 501(c)(3) churches in Mississippi are exempt from sales tax on purchases of electricity, gases, other fuels and potable water used on property that is primarily used for religious or educational purposes.

Being tax-exempt means that some or all of a transaction, entity or person's income or business is free from federal, state or local tax. Tax-exempt organizations are typically charities or religious organizations recognized by the IRS. Internal Revenue Service.