Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction is a legal agreement that pertains to the transfer of a portion or percentage of overriding royalty interest from one party to another in Mississippi. This assignment is designed to distribute or allocate the rights to receive revenue or royalties from an oil, gas, or mineral lease in a fair and proportional manner. Keywords: Mississippi, Assignment, Overriding Royalty Interest, Proportionate Reduction, legal agreement, transfer, revenue, royalties, oil, gas, mineral lease. There are various types of Mississippi Assignments of Overriding Royalty Interest with Proportionate Reduction, including: 1. Full Assignment: This type of assignment involves the complete transfer of the overriding royalty interest from one party to another. The assignor relinquishes all rights and entitlements to the overriding royalty interest, while the assignee assumes full ownership and responsibility. 2. Partial Assignment: In this type of assignment, only a portion or percentage of the overriding royalty interest is transferred. The assignor retains a specific percentage or fraction of the interest, while the assignee gains ownership of the remaining portion. 3. Proportional Assignment: Proportional assignments divide the overriding royalty interest among multiple assignees based on an agreed-upon ratio or formula. This type of assignment ensures that each assignee receives royalties proportionate to their assigned interest. 4. Lump-Sum Assignment: A lump-sum assignment involves the transfer of a predetermined fixed amount of the overriding royalty interest, with no further adjustments or proportionate reductions. 5. Time-limited Assignment: This type of assignment grants the assignee the rights to the overriding royalty interest for a specific period, after which the interest reverts to the assignor. Time-limited assignments are often used when the assignee requires a temporary ownership of the interest. 6. Non-Operated Assignment: Non-operated assignments occur when an assignee assumes the ownership of an overriding royalty interest but does not have any involvement in the day-to-day operations of the lease or royalties extraction. The assignee receives their share of the royalties without taking on responsibilities related to the operations. Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction is an essential legal tool for transferring and distributing the rights of ownership or entitlements to royalties in the oil, gas, and mineral industry. These assignments ensure a fair and proportional distribution of the financial benefits associated with these resources while providing flexibility for assignors and assignees in structuring their royalty interests.

Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

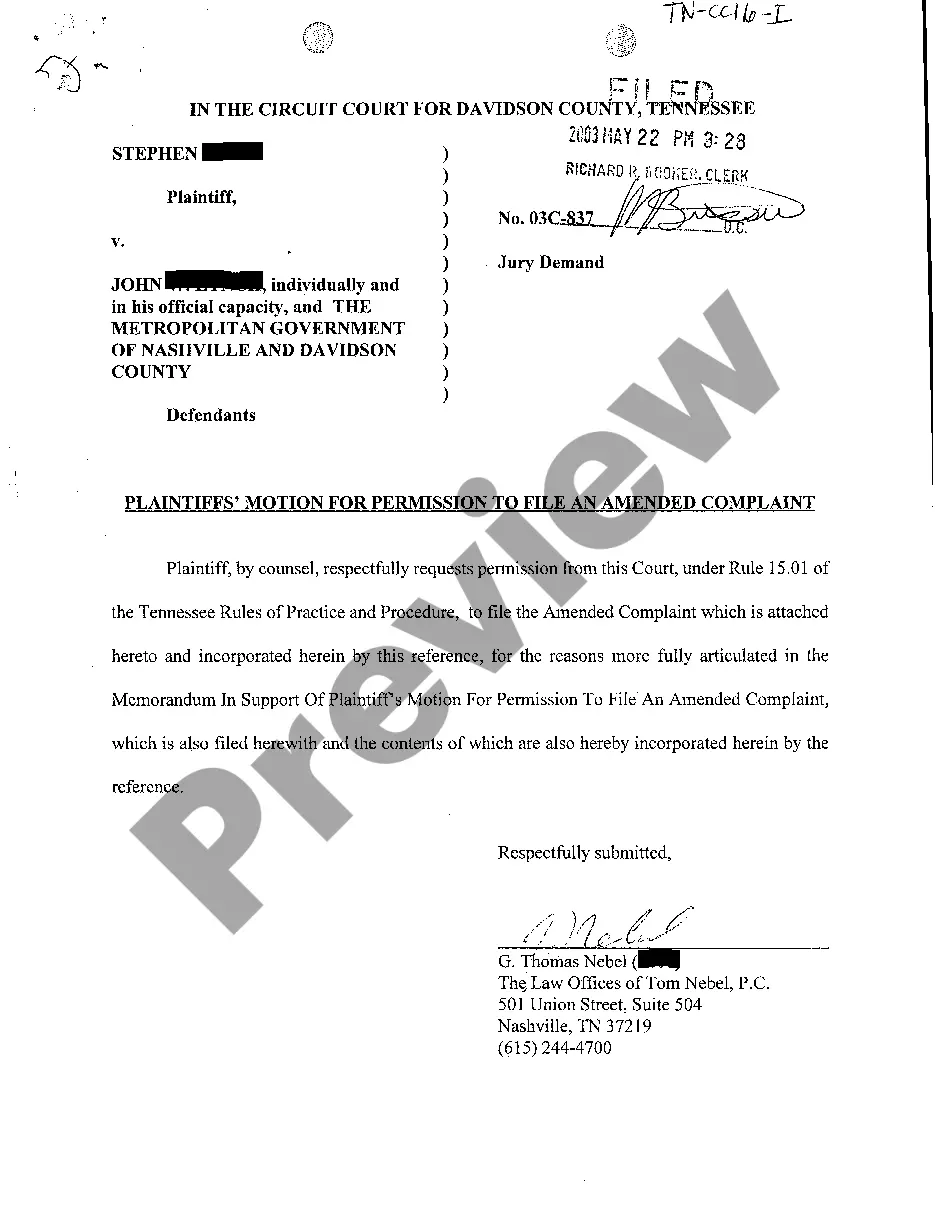

How to fill out Mississippi Assignment Of Overriding Royalty Interest With Proportionate Reduction?

US Legal Forms - one of the largest libraries of authorized varieties in the United States - delivers a wide range of authorized document themes it is possible to down load or produce. Utilizing the website, you may get a large number of varieties for company and specific functions, sorted by categories, states, or search phrases.You will find the latest variations of varieties like the Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction in seconds.

If you currently have a monthly subscription, log in and down load Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction through the US Legal Forms library. The Acquire switch will show up on each and every form you perspective. You have access to all earlier downloaded varieties in the My Forms tab of the profile.

If you want to use US Legal Forms the first time, here are simple directions to obtain started off:

- Be sure to have selected the proper form for your city/region. Click on the Preview switch to examine the form`s information. See the form description to ensure that you have selected the correct form.

- In the event the form doesn`t satisfy your needs, take advantage of the Lookup industry at the top of the monitor to get the one who does.

- When you are happy with the shape, affirm your choice by simply clicking the Purchase now switch. Then, opt for the pricing strategy you prefer and supply your accreditations to register on an profile.

- Approach the purchase. Use your bank card or PayPal profile to complete the purchase.

- Pick the file format and down load the shape in your gadget.

- Make changes. Fill up, edit and produce and indication the downloaded Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction.

Each template you put into your bank account does not have an expiration time and is also the one you have permanently. So, in order to down load or produce an additional backup, just go to the My Forms segment and click in the form you want.

Get access to the Mississippi Assignment of Overriding Royalty Interest with Proportionate Reduction with US Legal Forms, one of the most substantial library of authorized document themes. Use a large number of skilled and condition-specific themes that satisfy your business or specific requirements and needs.

Form popularity

FAQ

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.