Mississippi Correction Assignment to Correct Amount of Interest: A Detailed Description In the state of Mississippi, a correction assignment is a legal mechanism used to rectify and adjust the amount of interest imposed on a particular transaction or debt. This process is undertaken when it is determined that an error was made in calculating the interest or when the interest rate needs to be revised due to changes in the market or other relevant factors. Keyword: Mississippi Correction Assignment The Mississippi Correction Assignment primarily aims to rectify any inaccuracies or omissions related to the interest calculation, ensuring fair and accurate assessments. This assignment involves the transfer of ownership or rights from the original creditor, also known as the assignor, to the designated correction assignee. This mechanism can be employed in various situations, including loans, mortgages, financial agreements, or any other financial instrument involving an interest rate. It enables the correction assignee to assume control over the debt and reevaluate the interest amount in line with the updated or corrected terms. Types of Mississippi Correction Assignments: 1. Loan Interest Correction Assignment: In cases where a borrower has been charged an incorrect or unfair interest rate on a loan, a loan interest correction assignment can be used. This ensures that both parties, the lender, and the borrower, reach an agreement on the revised interest rate, alleviating any financial burden caused by the incorrect calculation. 2. Mortgage Interest Correction Assignment: When there are errors detected in the interest calculation or discrepancies in the agreed-upon mortgage interest rate, a mortgage interest correction assignment can be executed. This allows for the correction assignee, typically a financial institution or credit agency, to rectify any inaccuracies and adjust the interest amounts accordingly. 3. Financial Agreement Interest Correction Assignment: In certain financial agreements or contracts, such as those involving installment payments or leases, mistakes in interest calculations can occur. In such cases, a financial agreement interest correction assignment is employed to rectify any errors and ensure a fair and accurate assessment of interest amounts owed. In conclusion, the Mississippi Correction Assignment to Correct Amount of Interest is a legal process used to rectify and adjust interest rates in various financial transactions. It involves the transfer of rights or ownership from the original creditor to a correction assignee, ensuring accuracy and fairness. Specific types of correction assignments include loan interest correction assignments, mortgage interest correction assignments, and financial agreement interest correction assignments.

Mississippi Correction Assignment to Correct Amount of Interest

Description

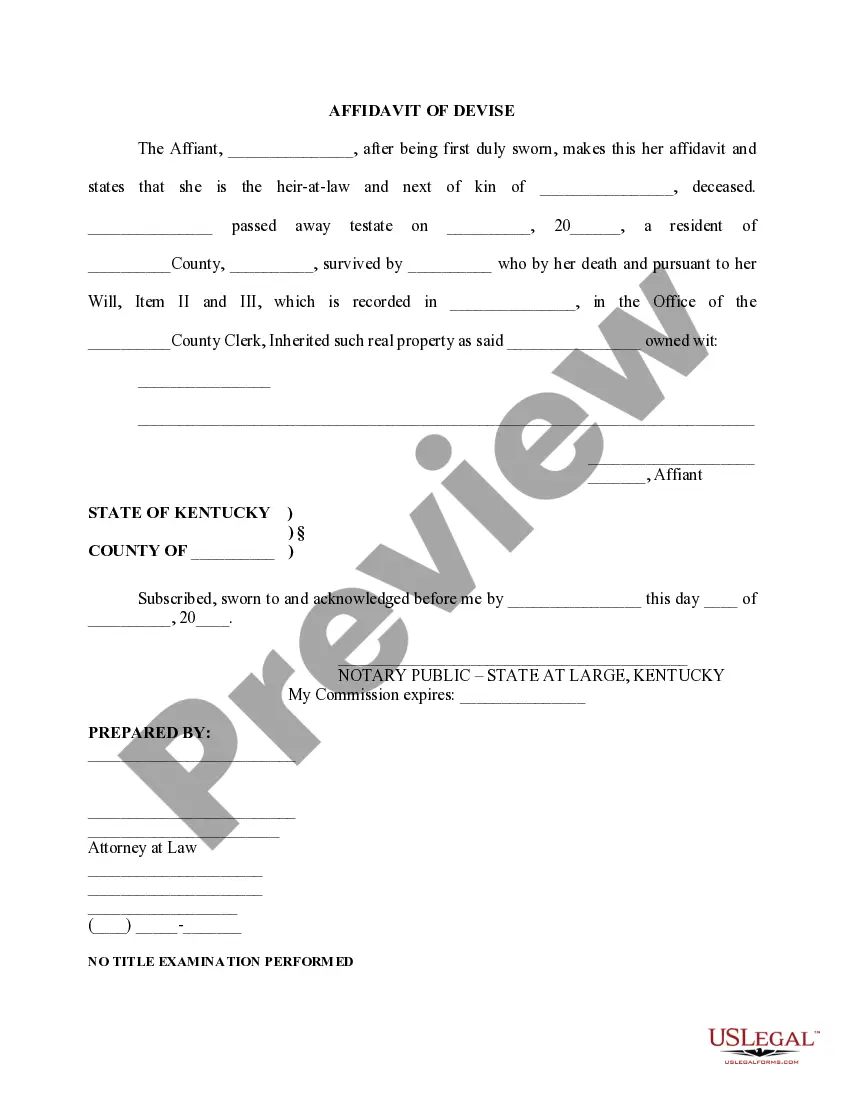

How to fill out Mississippi Correction Assignment To Correct Amount Of Interest?

If you need to comprehensive, obtain, or produce lawful file web templates, use US Legal Forms, the largest variety of lawful types, that can be found on-line. Make use of the site`s simple and easy handy search to find the documents you need. Different web templates for enterprise and specific uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to find the Mississippi Correction Assignment to Correct Amount of Interest in just a few clicks.

When you are currently a US Legal Forms consumer, log in to your accounts and click on the Obtain switch to get the Mississippi Correction Assignment to Correct Amount of Interest. You can also accessibility types you in the past acquired inside the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for the correct metropolis/nation.

- Step 2. Take advantage of the Preview solution to examine the form`s content material. Don`t forget to read through the information.

- Step 3. When you are not satisfied with the type, utilize the Lookup industry at the top of the display screen to get other types from the lawful type web template.

- Step 4. When you have located the form you need, click the Buy now switch. Opt for the costs program you choose and add your qualifications to sign up on an accounts.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Select the formatting from the lawful type and obtain it on your gadget.

- Step 7. Comprehensive, modify and produce or sign the Mississippi Correction Assignment to Correct Amount of Interest.

Every lawful file web template you acquire is yours eternally. You may have acces to every single type you acquired inside your acccount. Select the My Forms section and choose a type to produce or obtain once again.

Remain competitive and obtain, and produce the Mississippi Correction Assignment to Correct Amount of Interest with US Legal Forms. There are millions of skilled and condition-distinct types you can utilize to your enterprise or specific requirements.