Mississippi Form — Term Sheet for Series C Preferred Stock is a legal document that outlines the terms and conditions related to the issuance of Series C preferred stock in the state of Mississippi. This form provides comprehensive information pertaining to the rights, preferences, and privileges associated with this class of stock. The purpose of the Mississippi Form — Term Sheet for Series C Preferred Stock is to establish the framework for investors and issuers when engaging in capital raising activities. It serves as an essential agreement that outlines the key provisions and terms which influence the relationship between the company and the preferred stockholders. The term sheet encompasses a variety of relevant details including the number of shares of Series C preferred stock to be issued, the price or consideration for each share, and the authorized capital of the company. It also specifies the dividend rate, dividend preferences, conversion rights, liquidation preferences, and voting rights that apply to the Series C preferred stock. Different types of Mississippi Form — Term Sheet for Series C Preferred Stock may exist, depending on the specific requirements and preferences of the issuing company. Some variations might include: 1. Participating Preferred Stock: This type of preferred stock allows holders to receive additional dividends in addition to their regular dividend amount, based on a predetermined formula or percentage. 2. Non-Participating Preferred Stock: In contrast to participating preferred stock, non-participating preferred stock does not entitle the holders to additional dividends beyond their regular dividend amount. The holders are limited to their stated dividend rate. 3. Cumulative Preferred Stock: Cumulative preferred stock includes a provision that allows any missed dividends to accumulate and be paid in future periods, before dividends are paid to common stockholders. 4. Convertible Preferred Stock: This type of preferred stock provides the option for the holders to convert their preferred shares into a predetermined number of common shares at a specified conversion price. 5. Redeemable Preferred Stock: Redeemable preferred stock allows the issuing company to buy back the preferred shares from the stockholders at a future date or under specific conditions, usually at a predetermined price. It is important to note that the specific terms and conditions outlined in the Mississippi Form — Term Sheet for Series C Preferred Stock may vary depending on the negotiations between the company and the investors.

Mississippi Form - Term Sheet for Series C Preferred Stock

Description

How to fill out Mississippi Form - Term Sheet For Series C Preferred Stock?

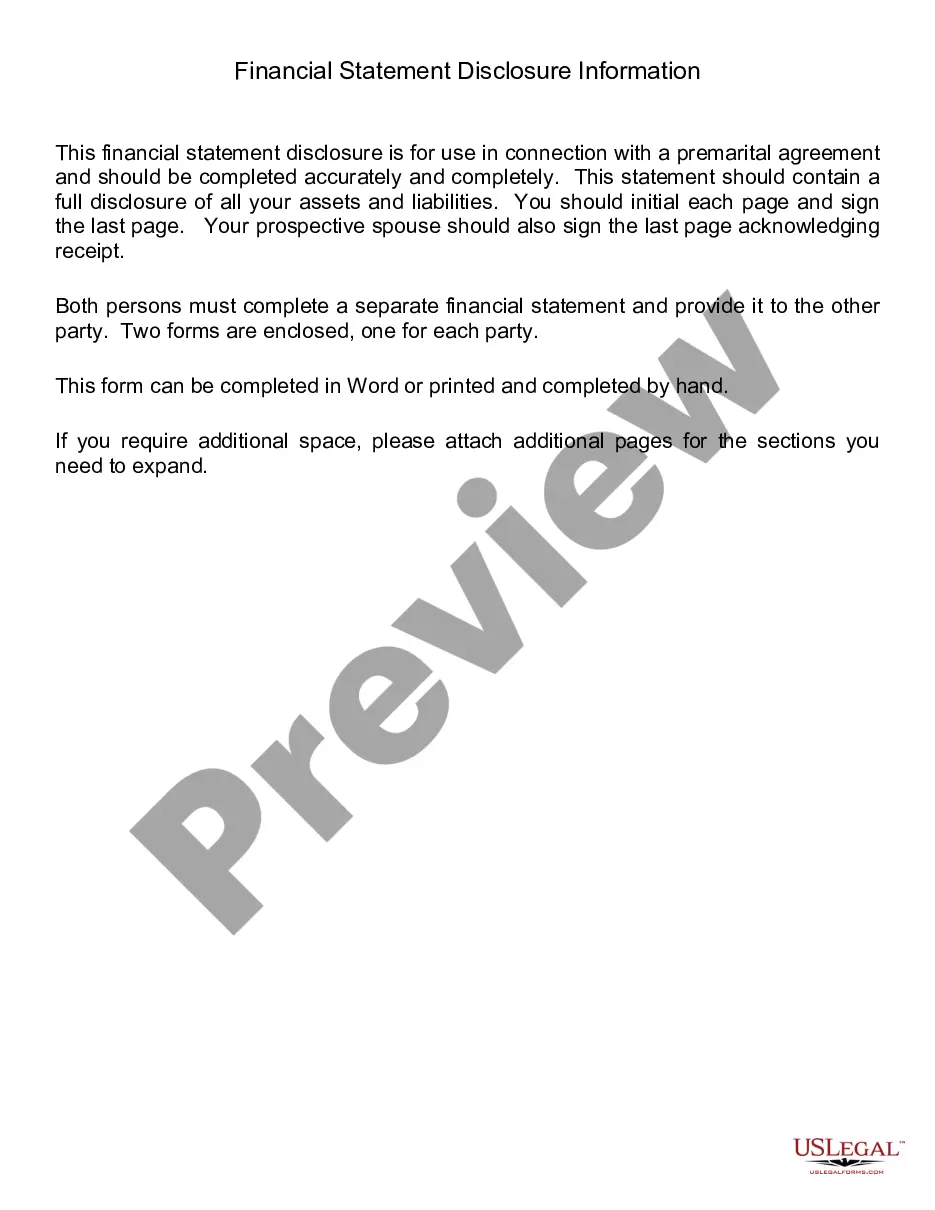

Are you currently in the place the place you require files for either organization or person reasons just about every working day? There are plenty of lawful file templates accessible on the Internet, but locating types you can rely on is not simple. US Legal Forms offers thousands of type templates, such as the Mississippi Form - Term Sheet for Series C Preferred Stock, that happen to be written in order to meet state and federal demands.

Should you be already knowledgeable about US Legal Forms website and possess a free account, just log in. Afterward, you can download the Mississippi Form - Term Sheet for Series C Preferred Stock web template.

If you do not have an account and wish to start using US Legal Forms, follow these steps:

- Find the type you will need and make sure it is for that right city/region.

- Make use of the Review button to review the form.

- Browse the outline to ensure that you have selected the correct type.

- If the type is not what you`re looking for, make use of the Research industry to obtain the type that fits your needs and demands.

- When you obtain the right type, click on Acquire now.

- Select the costs program you would like, fill out the desired details to generate your account, and buy your order using your PayPal or Visa or Mastercard.

- Pick a convenient document format and download your duplicate.

Get all of the file templates you have bought in the My Forms menus. You may get a additional duplicate of Mississippi Form - Term Sheet for Series C Preferred Stock any time, if needed. Just click the essential type to download or printing the file web template.

Use US Legal Forms, probably the most substantial assortment of lawful forms, to save some time and stay away from blunders. The assistance offers appropriately made lawful file templates which can be used for a range of reasons. Generate a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Similar to previous stages of financing, the series C round primarily relies on raising capital through the sale of preferred shares. The shares are likely to be convertible shares. They offer holders the right to exchange them for common stock in the company at some date in the future.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

What Is a Class C Share? Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Series C Bonds means the six and a half percent (6.5%) unsecured bonds of the Corporation having the terms and conditions described in Item 5.1 herein.

Traditionally, Series C has marked the exit phase of a startup's lifecycle. It's when you start down the path to profitability and begin to plan a potential IPO. For many, it will be the last round of funding they go through. Here's what to know about raising a Series C successfully.

In Series C rounds, investors inject capital into successful businesses in an effort to receive more than double that amount back. Series C funding focuses on scaling the company, growing as quickly and successfully as possible. One possible way to scale a company could be to acquire another company.