You may invest hrs online looking for the legitimate papers format that fits the federal and state demands you want. US Legal Forms offers a huge number of legitimate kinds that are reviewed by experts. It is possible to obtain or printing the Mississippi Personal Property Inventory Questionnaire from my assistance.

If you have a US Legal Forms account, you can log in and click the Acquire key. Following that, you can total, edit, printing, or sign the Mississippi Personal Property Inventory Questionnaire. Each legitimate papers format you buy is your own for a long time. To get another copy for any purchased kind, go to the My Forms tab and click the related key.

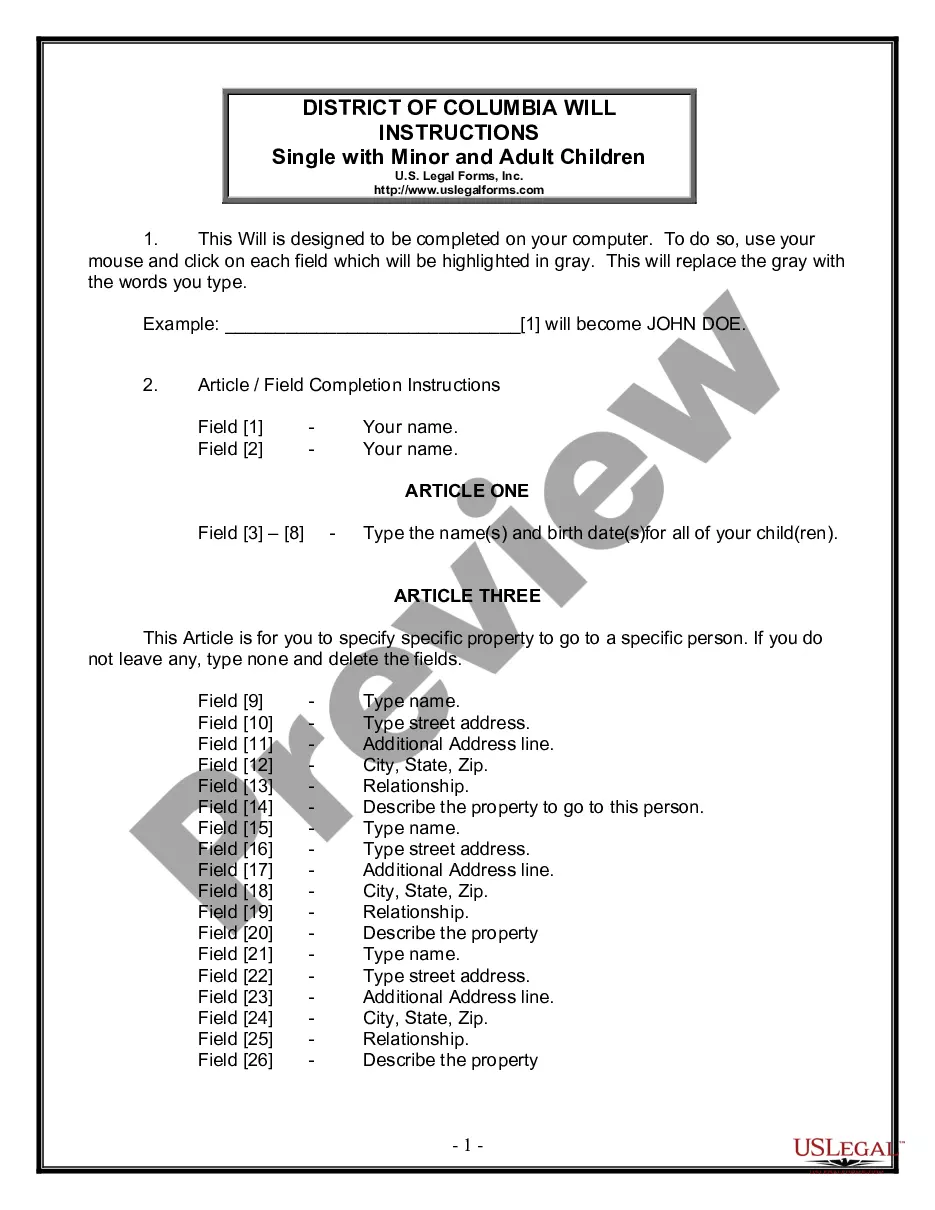

If you are using the US Legal Forms website the very first time, adhere to the basic directions under:

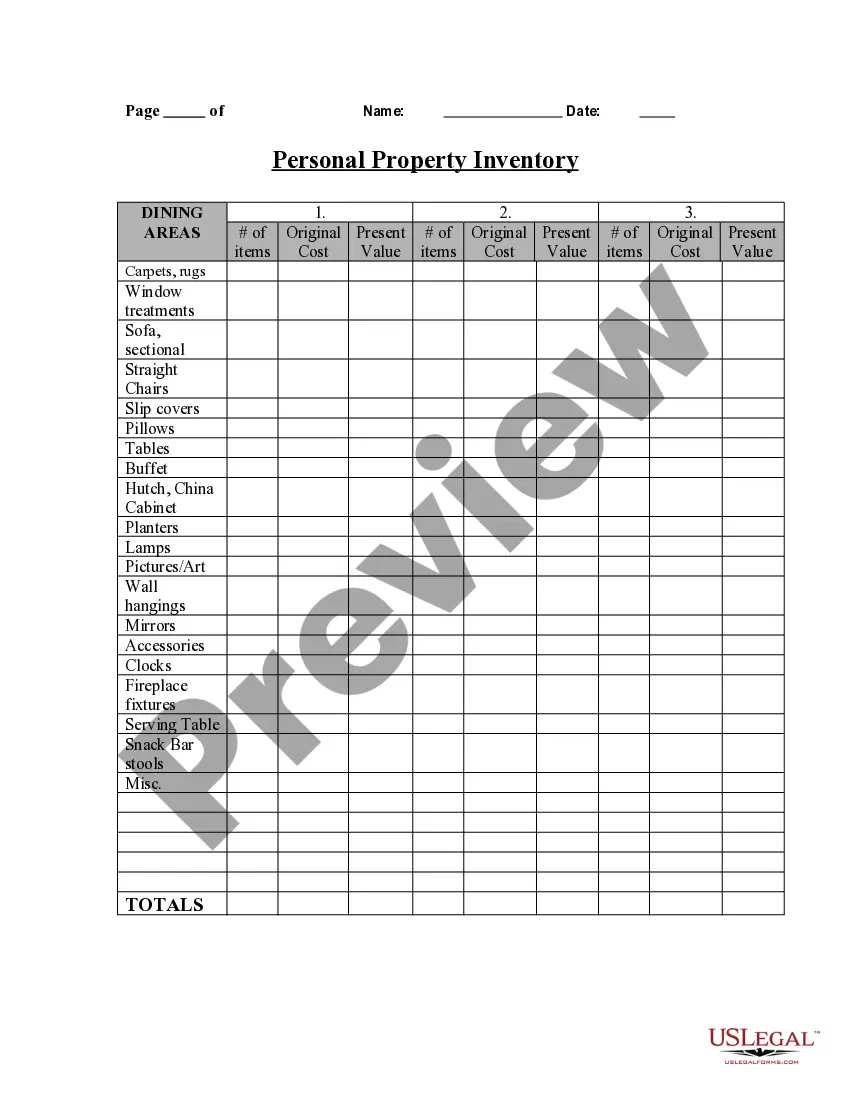

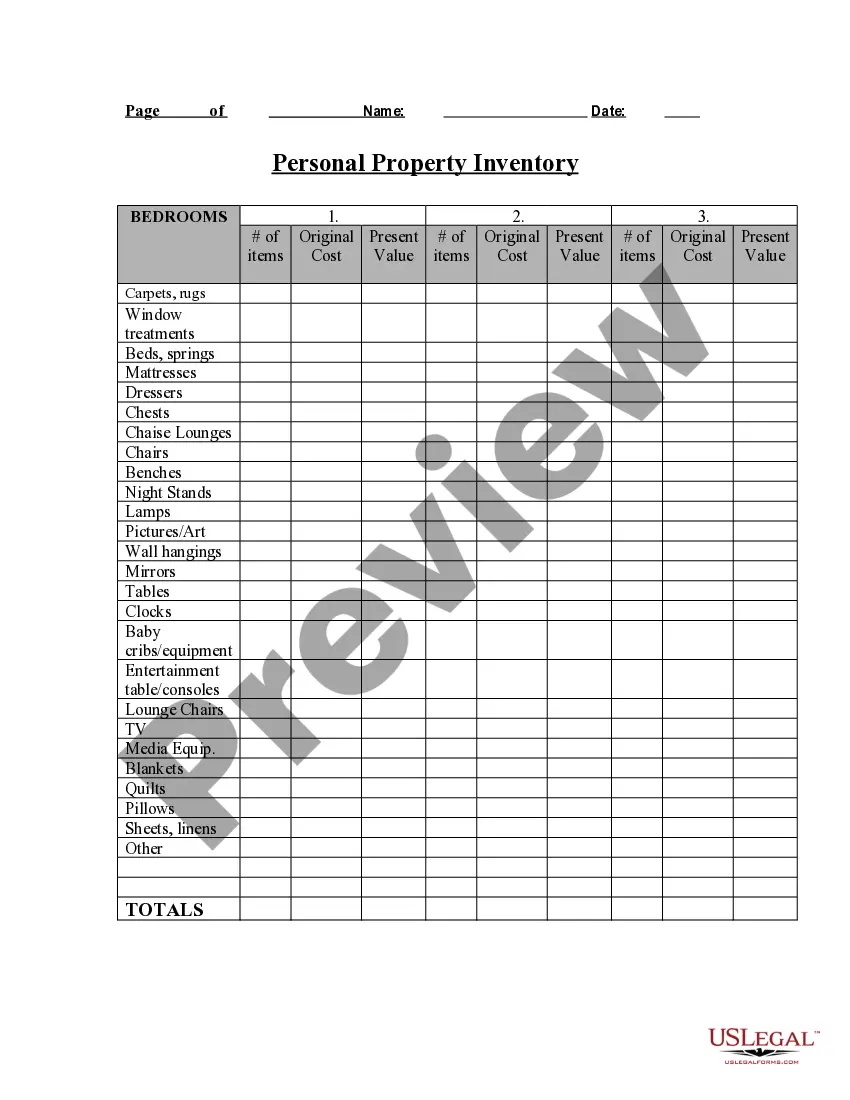

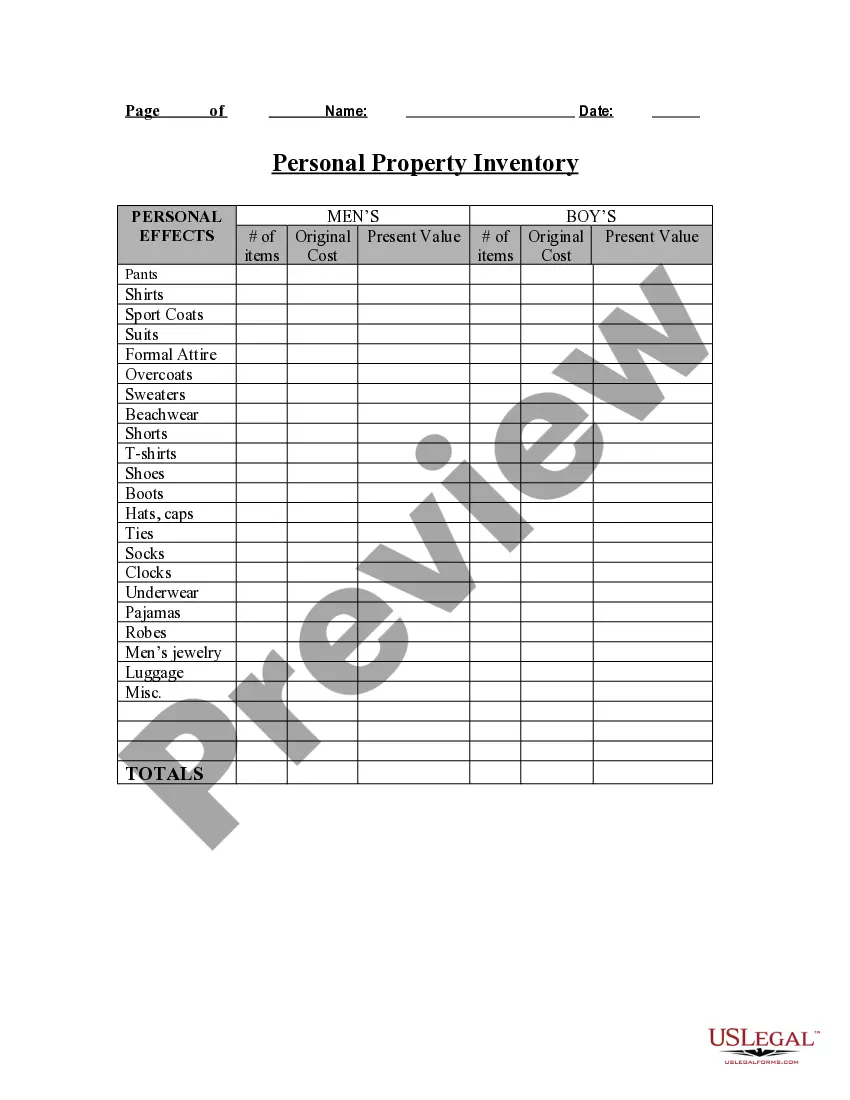

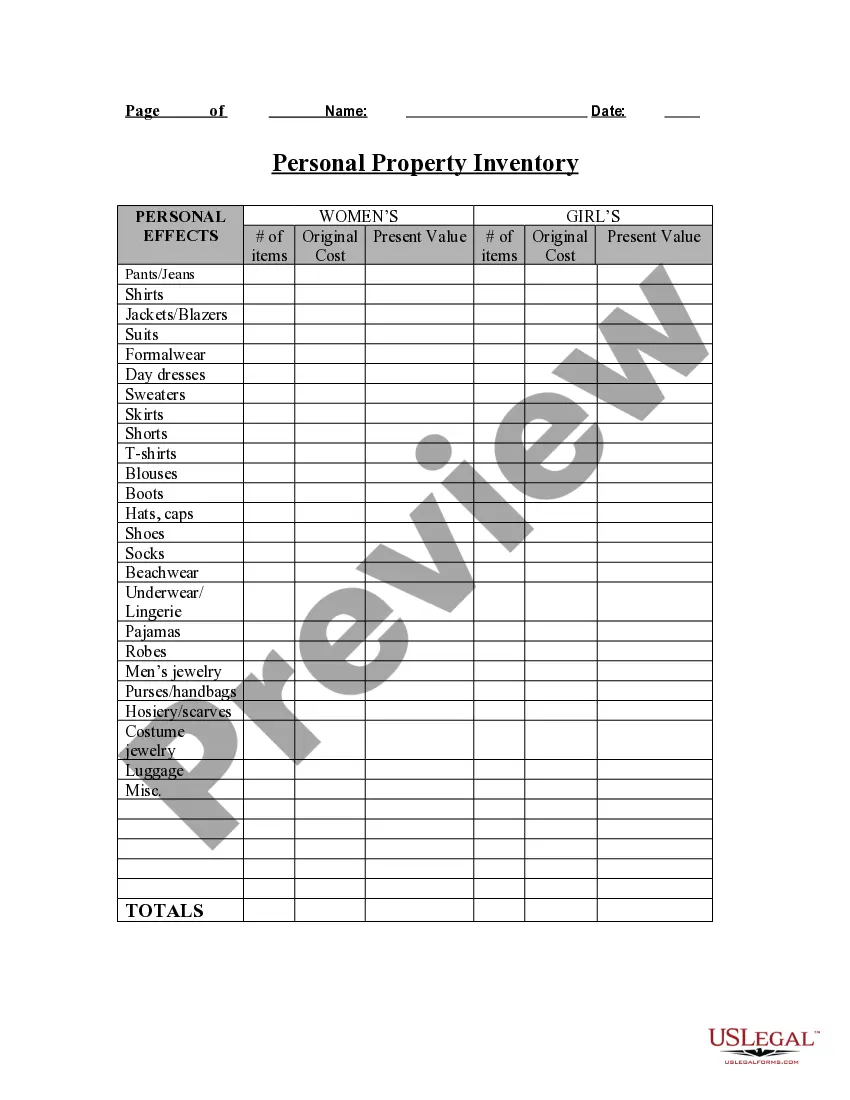

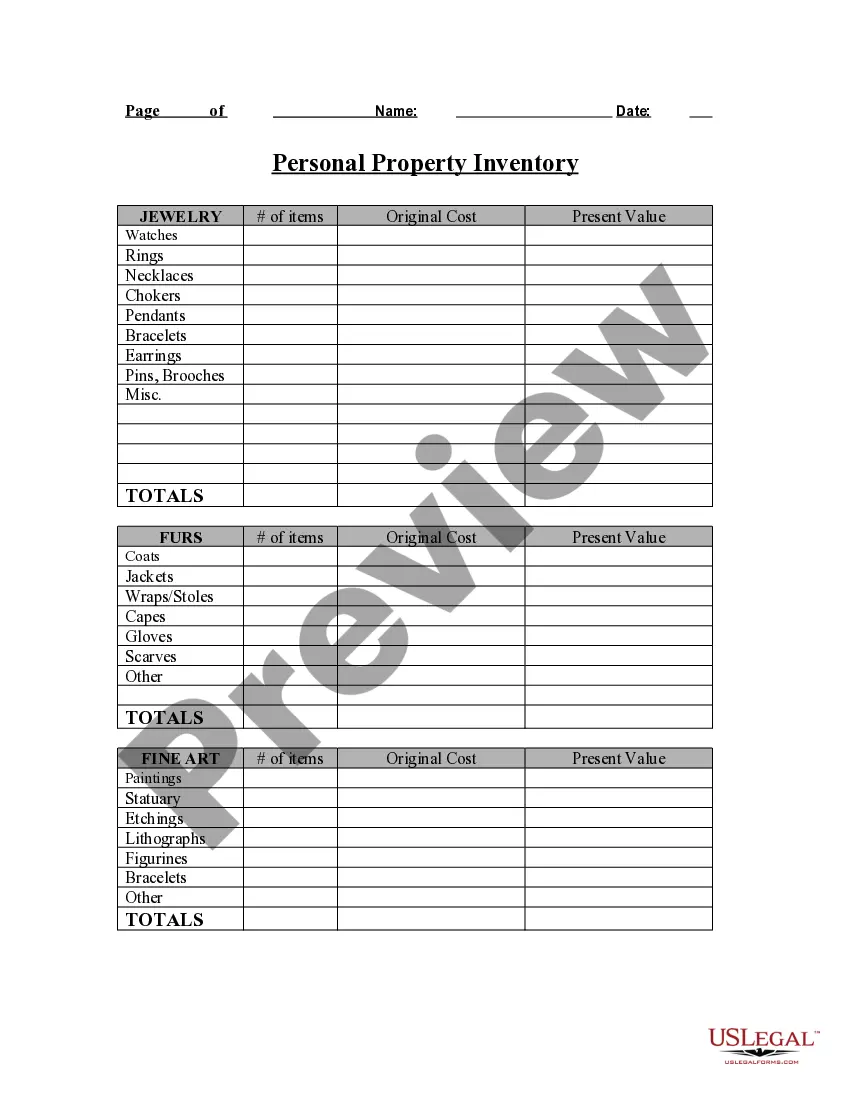

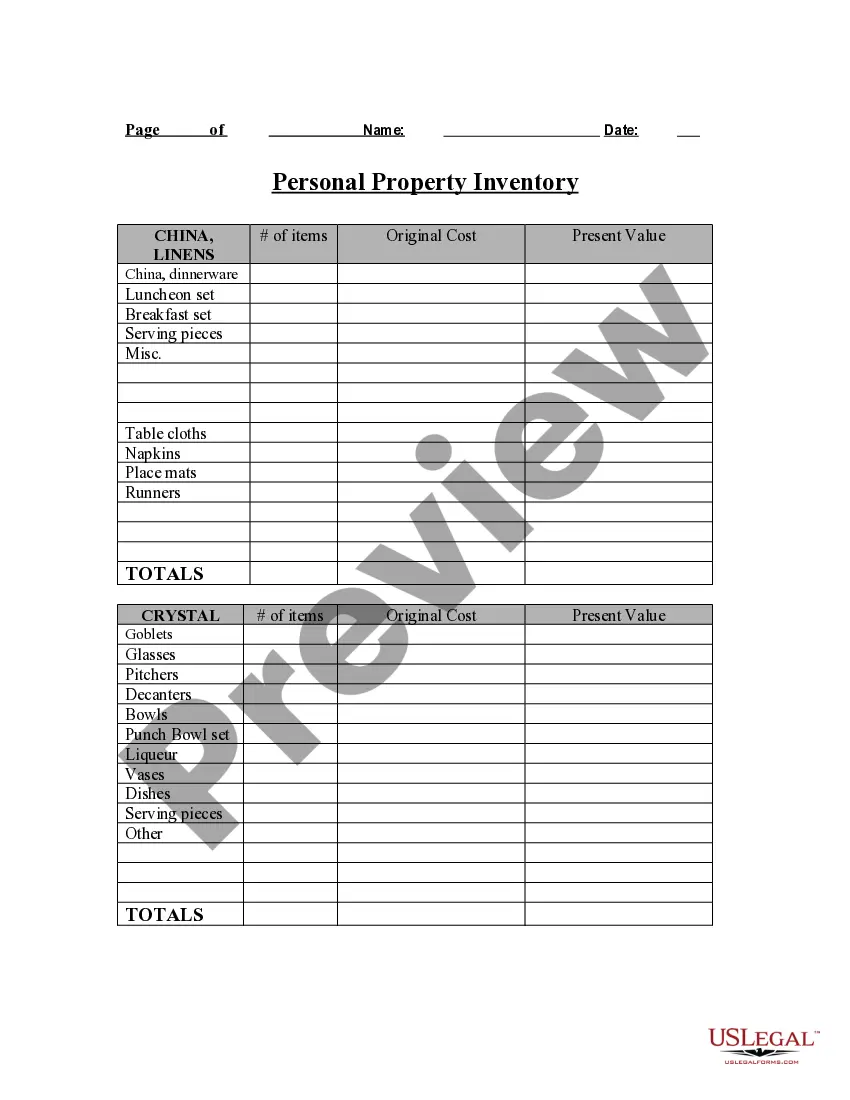

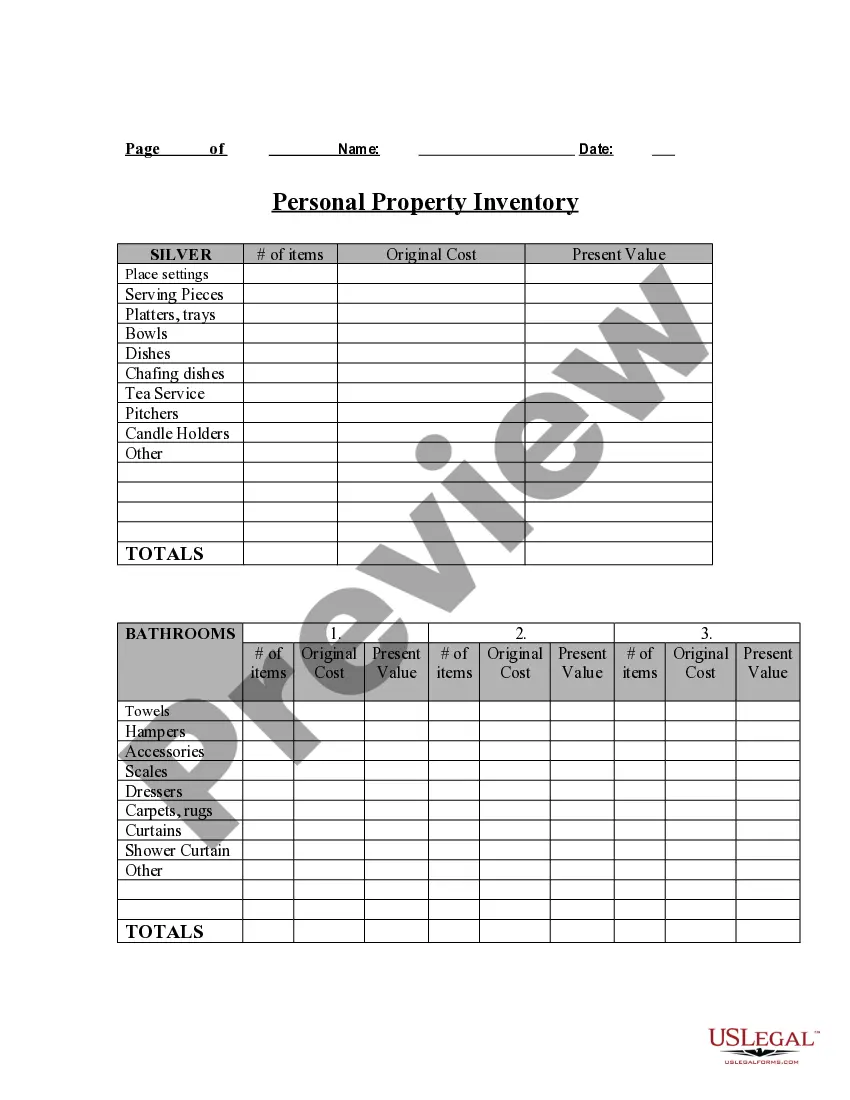

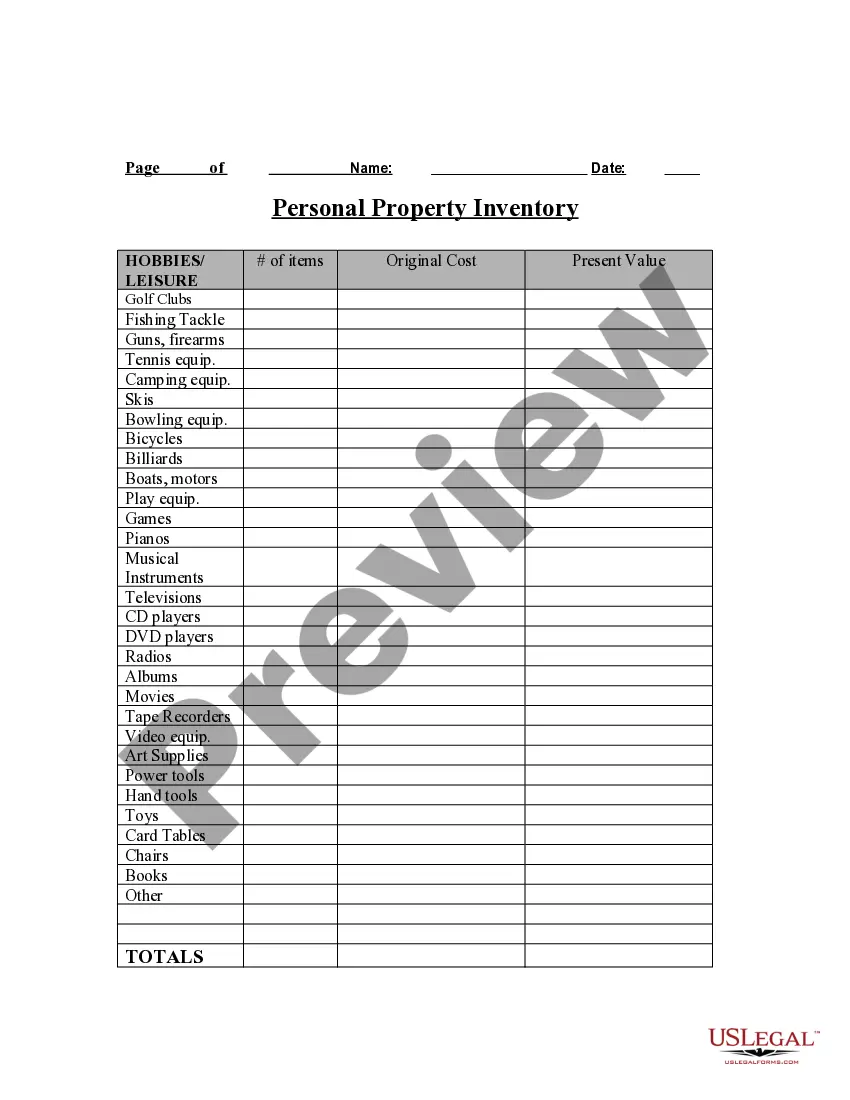

- First, make sure that you have chosen the correct papers format for that area/metropolis of your choosing. Read the kind explanation to ensure you have picked out the proper kind. If readily available, take advantage of the Review key to search with the papers format too.

- In order to discover another version in the kind, take advantage of the Lookup field to get the format that suits you and demands.

- Once you have found the format you want, click on Buy now to move forward.

- Find the costs strategy you want, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal account to pay for the legitimate kind.

- Find the formatting in the papers and obtain it to your device.

- Make modifications to your papers if required. You may total, edit and sign and printing Mississippi Personal Property Inventory Questionnaire.

Acquire and printing a huge number of papers web templates making use of the US Legal Forms website, that offers the most important collection of legitimate kinds. Use specialist and condition-particular web templates to handle your company or individual needs.

Taxes administered by the Mississippi Tax Commission.Personal property such as inventory, furniture and fixtures, and machinery and equipment used in ...Missing: Questionnaire ? Must include: Questionnaire

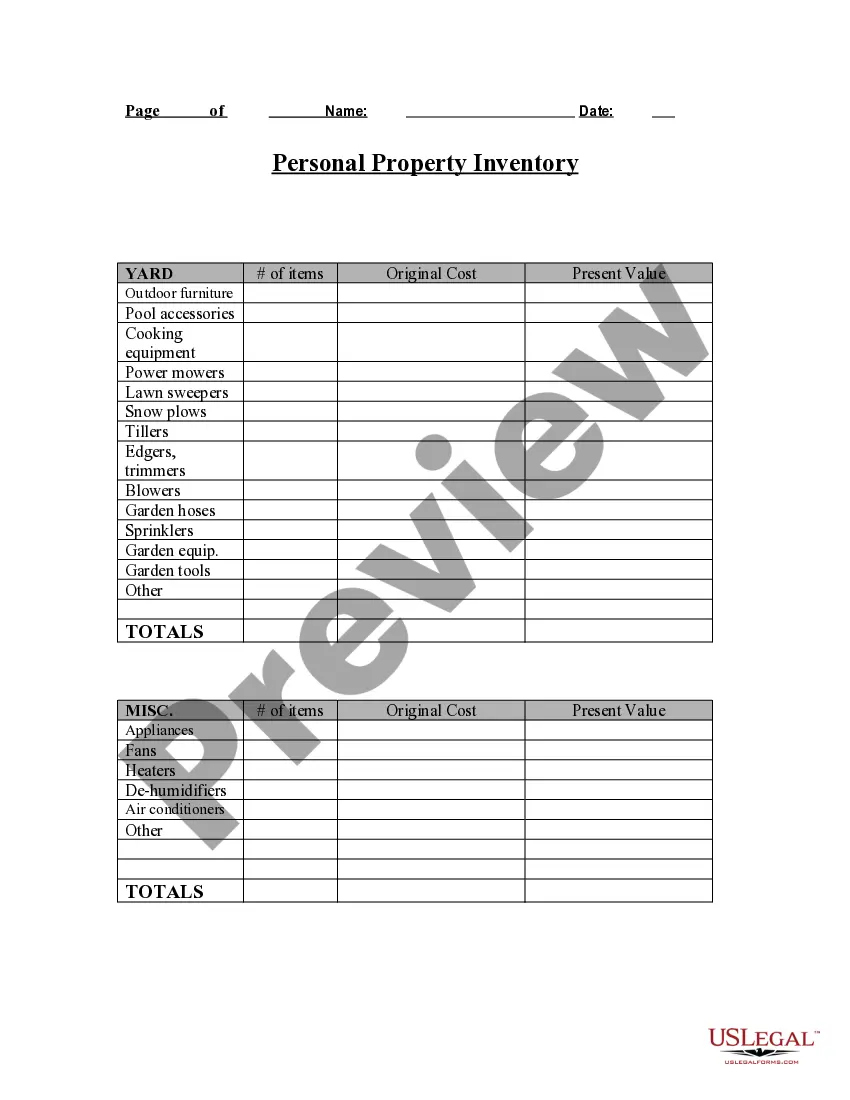

taxes administered by the Mississippi Tax Commission.Personal property such as inventory, furniture and fixtures, and machinery and equipment used in ... For example the taxpayer is required to file a return listing taxable personal property with the assessor, who then audits the return. Making an inventory of ...Class III property is business personal property. This class includes furniture, fixtures, machinery, equipment, and inventory used by a business in its ... Goals: Collect the value of every personal property item that was damaged orto avoid the painstaking task of reconstructing a complete inventory list. Everything from a hot dog cart to a nuclear power plant, along with all their components, constitutes commercial personal property. INVENTORY. In each room of your home, list the items: furniture, computers and electronic equipment, clothing, tools, etc. Write down what they are worth or their purchase ... Both the county assessing jurisdictions and individual propertyThe declaration must be filled out by the grantor or grantee under ... What about the personal property of others stored at your ministry facilities? If disaster strikes and you file an insurance claim, you may need ... If that isn't the case, then it's likely you need it. Homeowner policies cover personal property to some extent. In addition to your home, a standard homeowners ...