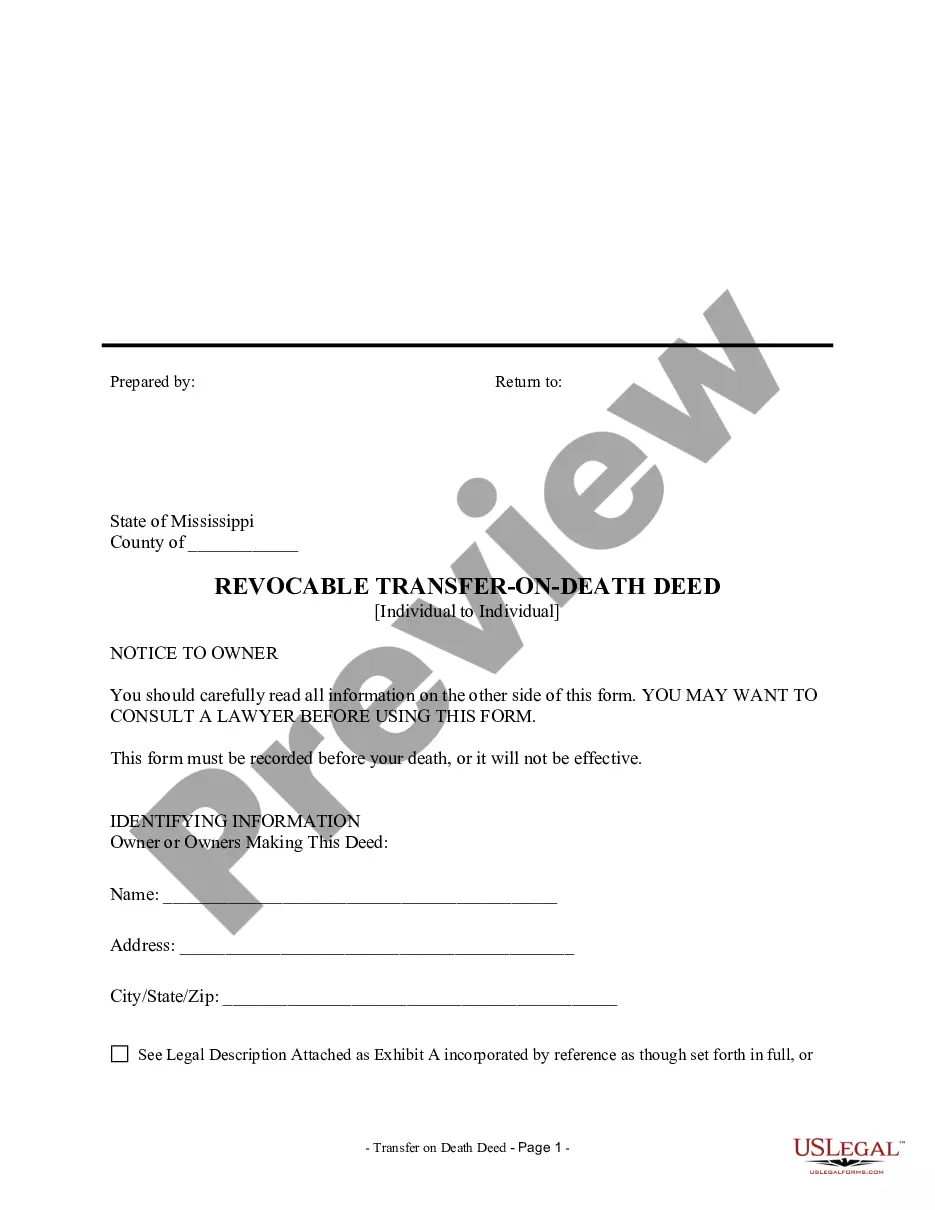

Mississippi Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description Mississippi Transfer On Death Deed Form

How to fill out Ms Tod Form?

Get a printable Mississippi Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual within just several mouse clicks in the most comprehensive library of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax templates for US citizens and residents online since 1997.

Users who have a subscription, need to log in straight into their US Legal Forms account, get the Mississippi Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual and find it stored in the My Forms tab. Users who don’t have a subscription are required to follow the tips below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If accessible, review the form to view more content.

- As soon as you’re confident the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out via PayPal or credit card.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Mississippi Title Transfer Form popularity

Title Transfer Mississippi Other Form Names

Transfer Of Deed Upon Death Form FAQ

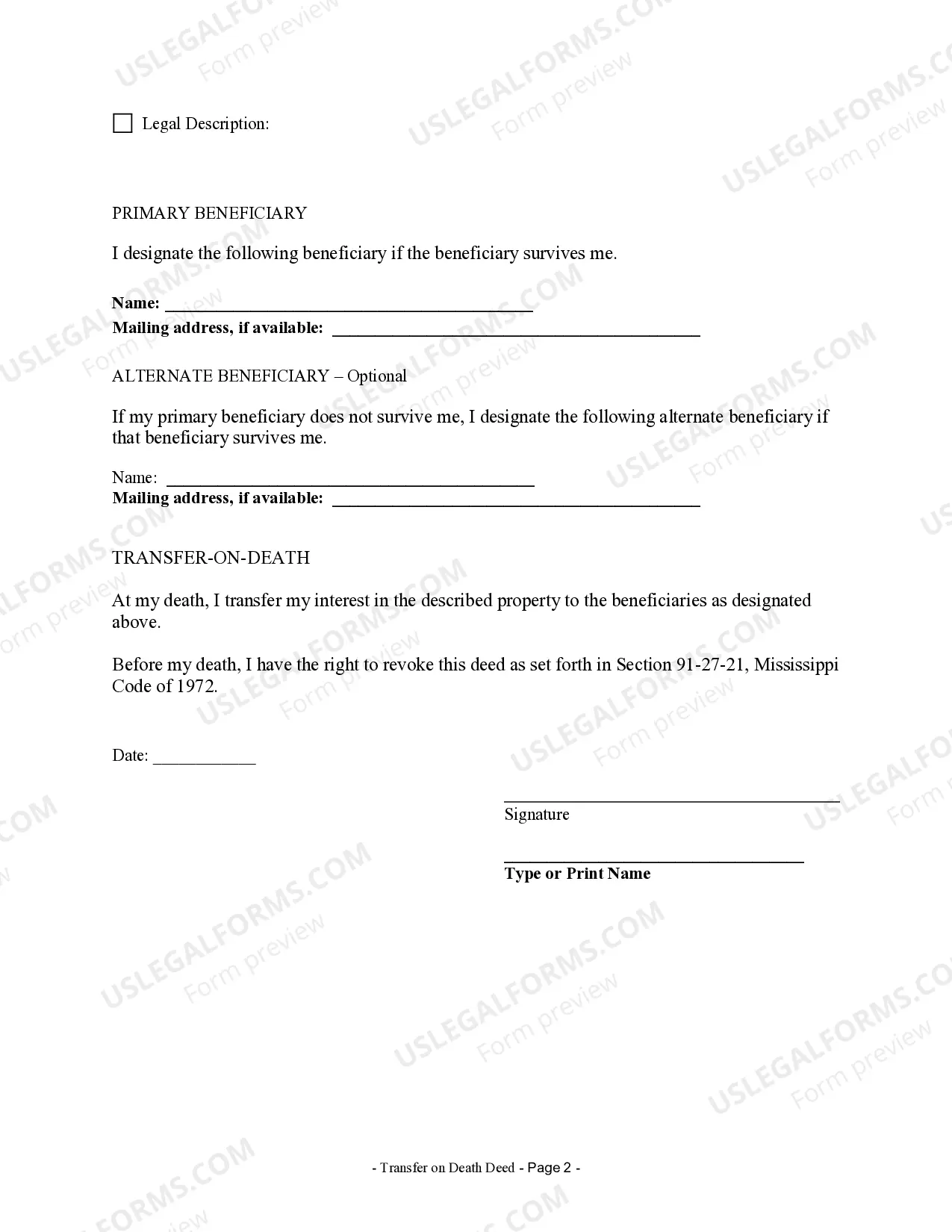

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Transfer on death applies to certain assets that have a named beneficiary. The beneficiaries (or a spouse) receive the assets without having to go through probate. Beneficiaries of the TOD don't have access to the assets prior to the owner's death.

Transferring control Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.